In the vast landscape of financial markets, investing in US fund stocks can be a lucrative venture for investors seeking long-term growth and stability. However, navigating this complex field requires a strategic approach. This article delves into the essentials of investing in US fund stocks, providing valuable insights and tips to help you make informed decisions.

Understanding US Fund Stocks

What are US Fund Stocks?

US fund stocks refer to shares of investment companies that pool funds from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, and other assets. These funds are managed by professional fund managers who aim to generate returns for investors while minimizing risk.

Types of US Fund Stocks

There are various types of US fund stocks, including:

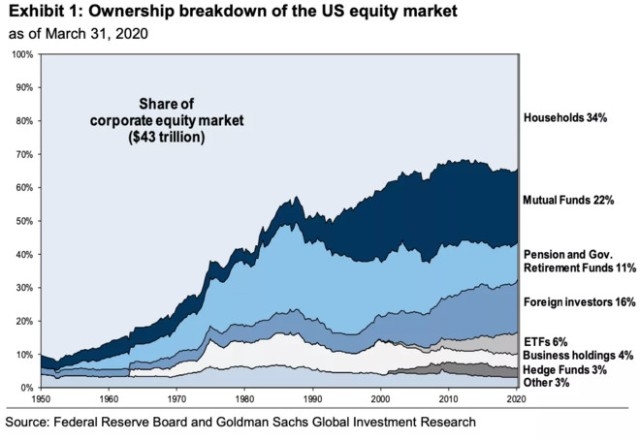

- Mutual Funds: These funds are open to the public and offer investors a wide range of investment options. They are managed by professional fund managers and can be actively or passively managed.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on exchanges like stocks. They offer investors a cost-effective and tax-efficient way to gain exposure to a specific market or asset class.

- Hedge Funds: These funds are typically available only to accredited investors and offer high-risk, high-reward opportunities. They employ various investment strategies, including leverage and short selling.

Benefits of Investing in US Fund Stocks

Investing in US fund stocks offers several benefits, including:

- Diversification: By investing in a fund, you gain exposure to a diversified portfolio of securities, reducing the risk associated with investing in a single stock.

- Professional Management: Fund managers are responsible for researching and selecting investments, which can save you time and effort.

- Accessibility: US fund stocks are accessible to investors of all levels, making them a popular choice for those just starting out in the investment world.

Strategic Approach to Investing in US Fund Stocks

To maximize your returns and minimize risk, it's crucial to adopt a strategic approach to investing in US fund stocks. Here are some key considerations:

1. Research and Due Diligence

Before investing in a US fund stock, thoroughly research the fund's history, performance, and management team. Look for funds with a strong track record and experienced fund managers.

2. Diversification

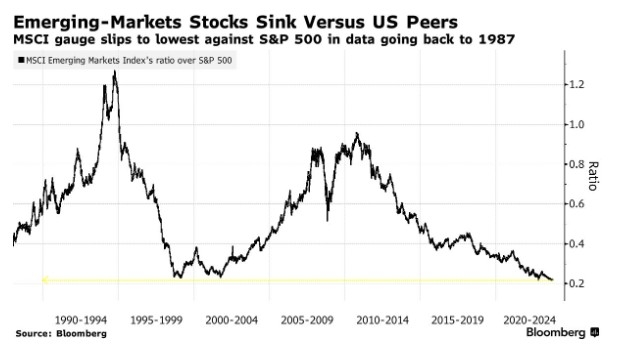

Diversify your portfolio by investing in funds that cover various asset classes, sectors, and geographic regions. This approach can help mitigate the impact of market fluctuations.

3. Understand Fees and Expenses

Be aware of the fees and expenses associated with US fund stocks. High fees can significantly impact your returns over time.

4. Set Realistic Expectations

Investing in US fund stocks is a long-term endeavor. Be patient and maintain a long-term perspective, as short-term market fluctuations are normal.

5. Stay Informed

Stay informed about market trends, economic indicators, and news that may impact your investments. This knowledge can help you make informed decisions and adjust your portfolio as needed.

Case Studies

To illustrate the potential of investing in US fund stocks, consider the following case study:

- Investor A: Invested

10,000 in a diversified mutual fund 10 years ago. Today, the investment is worth 20,000, thanks to the fund's strong performance and the investor's disciplined approach. - Investor B: Invested

10,000 in a high-risk hedge fund 10 years ago. Today, the investment is worth 5,000, as the hedge fund underperformed and the investor failed to diversify.

In conclusion, investing in US fund stocks can be a rewarding venture for investors who adopt a strategic approach. By understanding the types of funds, conducting thorough research, diversifying your portfolio, and staying informed, you can increase your chances of success.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....