In the ever-evolving landscape of the financial market, investors are constantly seeking opportunities to maximize their returns. One such avenue is through investing in stocks that offer dividends. The average US income stock dividend rate is a crucial metric that investors use to gauge the profitability of their investments. This article delves into what this rate signifies, its importance, and how it can impact your investment strategy.

What is the Average US Income Stock Dividend Rate?

The average US income stock dividend rate refers to the percentage of a company's earnings that it distributes to its shareholders as dividends. This rate is calculated by dividing the total dividends paid by the company by its total earnings. It is a critical indicator of a company's financial health and its commitment to returning value to investors.

Why is the Average US Income Stock Dividend Rate Important?

Income Generation: The primary reason investors are interested in the average US income stock dividend rate is to generate a steady stream of income. Dividends can provide a reliable source of cash flow, especially for those in retirement or looking to supplement their income.

Indication of Financial Health: A higher dividend rate often indicates that a company is financially stable and generating substantial profits. This can be a positive sign for investors looking for long-term investments.

Market Performance: Companies with higher dividend rates tend to outperform the market over the long term. This is because dividends can act as a cushion against market volatility and provide a consistent return.

Factors Influencing the Average US Income Stock Dividend Rate

Several factors influence the average US income stock dividend rate:

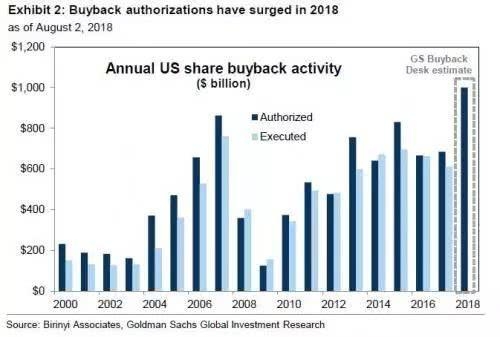

Company Earnings: A company's earnings directly impact its dividend rate. Companies with higher earnings are more likely to increase their dividend payments.

Industry Trends: Different industries have varying dividend rates. For instance, utility companies often have higher dividend rates compared to technology companies.

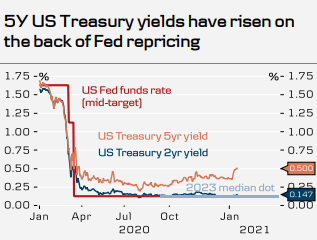

Market Conditions: Economic conditions, interest rates, and market sentiment can also influence dividend rates. During periods of economic growth, companies are more likely to increase their dividend payments.

Case Study: Microsoft Corporation

Let's take a look at Microsoft Corporation as a case study. Microsoft has a long history of increasing its dividend payments, making it a popular choice for income investors. As of the latest financial year, Microsoft's average US income stock dividend rate was around 1.8%. This indicates that for every dollar of earnings, Microsoft distributed $0.018 to its shareholders as dividends.

Conclusion

The average US income stock dividend rate is a vital metric for investors looking to generate income and assess the financial health of a company. By understanding this rate and its influencing factors, investors can make informed decisions about their investments. Remember, a higher dividend rate doesn't always guarantee a better investment. It's essential to consider other factors like the company's growth prospects and market conditions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....