In today's globalized financial market, cross-border investments have become increasingly common. One of the most sought-after destinations for Canadian investors is the United States, particularly when it comes to stocks. This article delves into the opportunities and considerations involved in Canadian investment in US stocks, providing a comprehensive guide for investors looking to diversify their portfolios.

Understanding the Market Dynamics

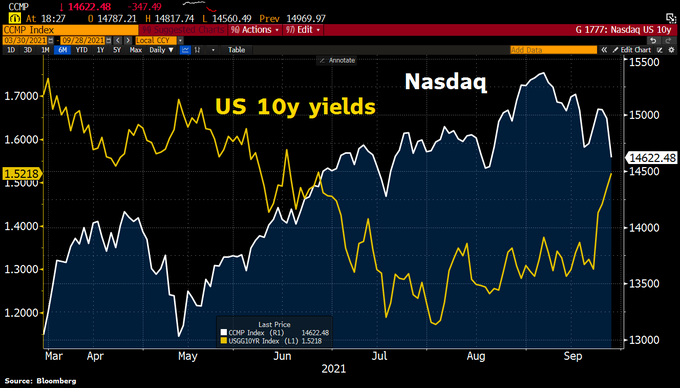

The US stock market is one of the largest and most liquid in the world, offering a wide array of investment opportunities. For Canadian investors, this means access to a vast pool of companies across various sectors, from technology and healthcare to energy and consumer goods. However, it's crucial to understand the market dynamics and the unique factors that influence it.

Opportunities in the US Stock Market

- Diversification: Investing in US stocks can help Canadian investors diversify their portfolios and reduce exposure to domestic market volatility.

- Access to Leading Companies: The US market is home to some of the world's largest and most innovative companies, offering exposure to cutting-edge technologies and industries.

- Strong Economic Growth: The US economy has been experiencing steady growth, which can translate into strong returns for investors.

Considerations for Canadian Investors

- Currency Fluctuations: The exchange rate between the Canadian dollar and the US dollar can significantly impact investment returns. Fluctuations in the exchange rate can either work in favor of or against investors.

- Tax Implications: Canadian investors must be aware of the tax implications of investing in US stocks. This includes potential capital gains tax and withholding taxes on dividends.

- Regulatory Differences: The regulatory framework for investing in the US stock market differs from that in Canada. Understanding these differences is crucial to avoid legal and financial risks.

Case Study: Canadian Investor Invests in US Tech Stocks

Consider the case of Sarah, a Canadian investor looking to diversify her portfolio. She decides to invest in a selection of US tech stocks, including Apple, Microsoft, and Google. Over the course of a year, her investments generate significant returns, despite fluctuations in the exchange rate and potential tax implications.

Sarah's success highlights the opportunities available in the US stock market for Canadian investors. However, it's important to note that investing in US stocks also involves risks, and careful consideration of the market dynamics and individual circumstances is essential.

Key Takeaways

- Diversification: Investing in US stocks can help Canadian investors diversify their portfolios and reduce exposure to domestic market volatility.

- Access to Leading Companies: The US market offers access to a wide array of leading companies across various sectors.

- Understanding Market Dynamics: It's crucial to understand the unique factors that influence the US stock market, including currency fluctuations and tax implications.

- Risk Management: Careful consideration of individual circumstances and risk tolerance is essential when investing in US stocks.

In conclusion, Canadian investment in US stocks can be a valuable addition to an investor's portfolio. By understanding the opportunities and considerations involved, investors can make informed decisions and maximize their returns.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....