In the world of online stock trading, Saxo Bank has established itself as a leading platform, offering a wide range of services including Saxo US stocks commission. This article delves into the details of Saxo Bank's US stock commission structure, its benefits, and how it compares to other brokers in the market.

Understanding Saxo US Stocks Commission

What is Saxo US Stocks Commission?

Saxo Bank's US stocks commission refers to the fees charged for executing trades on U.S. stocks through their platform. The commission structure is designed to be transparent and competitive, making it an attractive option for both beginner and experienced traders.

How Does Saxo's Commission Structure Work?

Saxo Bank offers a straightforward commission structure for U.S. stocks. The standard commission rate is

Benefits of Saxo US Stocks Commission

- Competitive Rates: Saxo Bank's US stocks commission is one of the most competitive in the market, making it an excellent choice for traders looking to minimize their trading costs.

- No Hidden Fees: Saxo Bank is known for its transparent pricing, with no hidden fees or surprises when it comes to executing trades.

- Advanced Trading Tools: Saxo Bank offers a suite of advanced trading tools and resources that can help traders make informed decisions and potentially improve their trading performance.

Comparison with Other Brokers

When comparing Saxo Bank's US stocks commission to other brokers, it's clear that Saxo offers one of the most competitive rates. Many brokers charge higher per-share rates or have additional fees for certain types of trades, which can add up over time.

Case Study: Trading U.S. Stocks with Saxo Bank

Let's consider a hypothetical scenario where a trader wants to execute a large trade on U.S. stocks. With Saxo Bank's US stocks commission structure, the trader would pay a minimum of

Additional Features and Services

In addition to competitive US stocks commission rates, Saxo Bank offers a range of additional features and services that can enhance the trading experience:

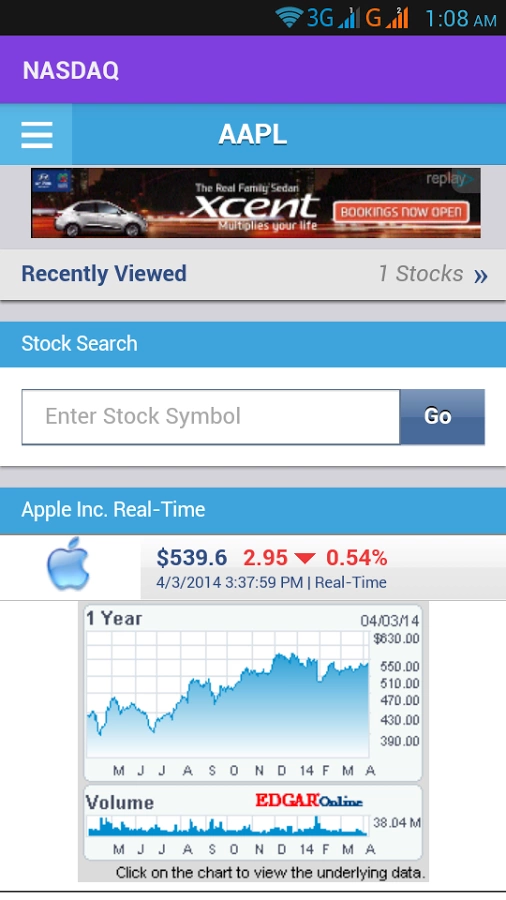

- Real-time Market Data: Access to real-time market data and analytics can help traders stay informed and make timely decisions.

- Customizable Trading Platform: Saxo Bank's trading platform is highly customizable, allowing traders to tailor their experience to their specific needs.

- Educational Resources: Saxo Bank provides a wealth of educational resources, including webinars, tutorials, and market analysis, to help traders improve their skills and knowledge.

In conclusion, Saxo Bank's US stocks commission offers a competitive, transparent, and cost-effective solution for traders looking to execute trades on U.S. stocks. With its advanced trading tools, educational resources, and competitive rates, Saxo Bank is a top choice for those serious about online stock trading.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....