The United States economy has long been considered the backbone of the global financial system. However, recent data from the US GDP has raised concerns about potential problems in the stock market. This article delves into the details of the US GDP and its implications for the stock market, providing insights into the current economic landscape.

Understanding the US GDP

The Gross Domestic Product (GDP) is a measure of the total value of all goods and services produced within a country over a specific period. It is a key indicator of economic health and is closely watched by investors and economists alike. The US GDP is released on a quarterly basis, and any significant changes can have a profound impact on the stock market.

Recent Trends in the US GDP

In the latest quarterly report, the US GDP growth rate was lower than expected, sparking concerns about the economy's trajectory. This has led to a cautious approach among investors, who are now weighing the risks and rewards of investing in the stock market.

Implications for the Stock Market

The stock market is highly sensitive to economic indicators, and the US GDP is no exception. A slowdown in GDP growth can lead to several negative consequences for the stock market:

Lower Corporate Profits: A decrease in GDP growth often translates into lower corporate profits. This is because companies generate less revenue when the overall economy is slowing down. As a result, investors may become more cautious about investing in stocks, leading to a potential downturn in the stock market.

Increased Borrowing Costs: When the economy is growing at a slower pace, central banks may raise interest rates to control inflation. Higher interest rates can make borrowing more expensive for companies, which can lead to lower stock prices.

Consumer Spending: A slower GDP growth rate can also lead to a decrease in consumer spending. This is because consumers may become more cautious about their finances, leading to lower demand for goods and services. As a result, companies may see a decline in revenue, which can negatively impact their stock prices.

Case Studies

To illustrate the relationship between the US GDP and the stock market, let's consider a few case studies:

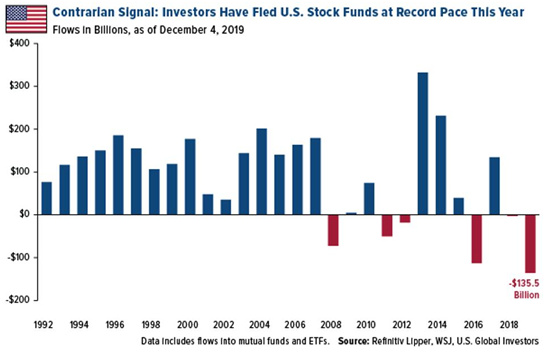

2008 Financial Crisis: In the lead-up to the 2008 financial crisis, the US GDP growth rate was slowing down. This was a major concern for investors, who began to pull out of the stock market. The crisis eventually led to a significant downturn in the stock market, with the S&P 500 falling by nearly 50% from its peak.

2019 US-China Trade War: In 2019, tensions between the US and China escalated, leading to a trade war. This had a negative impact on the US GDP, which grew at a slower pace than expected. The stock market responded by falling, with the S&P 500 dropping by more than 10% in the first half of the year.

Conclusion

The recent trends in the US GDP have raised concerns about potential problems in the stock market. While it is difficult to predict the exact outcome, it is clear that investors need to remain vigilant and cautious. By keeping a close eye on economic indicators like the US GDP, investors can better understand the risks and opportunities in the stock market.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....