Investing in stocks is a popular way to grow wealth over time. However, investors often face a crucial decision: should they invest in international or US stock funds? Both options offer unique opportunities and risks, making it essential to understand the differences between them. This article will delve into the key aspects of international and US stock funds, providing a comprehensive guide for investors to make informed decisions.

Understanding International Stock Funds

International stock funds are designed to invest in companies located outside of the United States. These funds can include investments in emerging markets, developed markets, or a combination of both. By investing in international stock funds, investors can gain exposure to different economies, industries, and currencies, which can potentially lead to higher returns.

Benefits of International Stock Funds

- Diversification: Investing in international stock funds allows investors to diversify their portfolios, reducing the risk associated with investing in a single market.

- Access to Global Opportunities: International stock funds provide access to companies and industries that may not be available in the US market, allowing investors to capitalize on global growth.

- Potential for Higher Returns: Historically, international stock funds have offered higher returns compared to US stock funds, particularly in emerging markets.

Understanding US Stock Funds

US stock funds, on the other hand, focus on investing in companies located within the United States. These funds can include investments in small-cap, mid-cap, or large-cap companies across various industries.

Benefits of US Stock Funds

- Political and Economic Stability: The US has a stable political and economic environment, which can be appealing to investors seeking a lower level of risk.

- Access to Diverse Industries: US stock funds provide access to a wide range of industries, allowing investors to find opportunities that align with their interests.

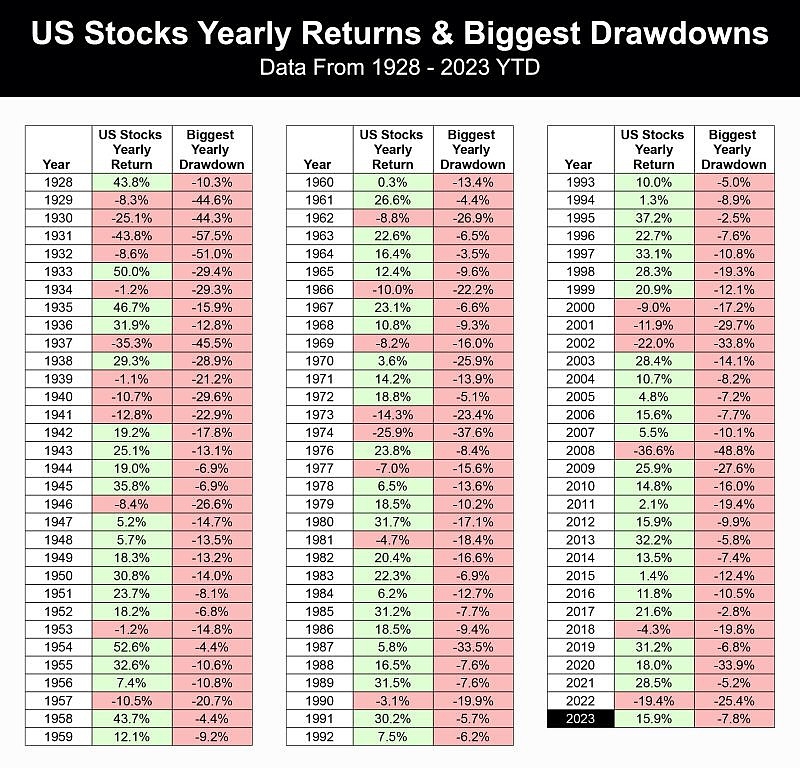

- Proven Track Record: US stock funds have a long history of performance, providing investors with a sense of familiarity and comfort.

Comparing Risks and Returns

While both international and US stock funds offer potential for growth, they also come with unique risks:

- Currency Risk: International stock funds are exposed to currency fluctuations, which can impact returns. For example, if the US dollar strengthens against a foreign currency, it could reduce the returns of an international stock fund.

- Political Risk: Investing in emerging markets may expose investors to political instability and regulatory changes, which can impact returns.

Case Studies

To illustrate the differences between international and US stock funds, let's consider two case studies:

- International Stock Fund: An investor invested in an emerging market international stock fund, which grew by 15% over a one-year period. However, due to currency fluctuations, the investor's returns were reduced to 10% when converted back to US dollars.

- US Stock Fund: Another investor invested in a large-cap US stock fund, which grew by 12% over the same one-year period. The investor's returns remained at 12%, as the US dollar did not experience significant fluctuations.

Conclusion

In conclusion, both international and US stock funds offer unique opportunities and risks. Investors should carefully consider their investment goals, risk tolerance, and market exposure when deciding between the two. By understanding the key differences and potential benefits, investors can make informed decisions that align with their financial objectives.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....