In the ever-evolving landscape of the global financial market, US domestic stocks have emerged as a significant area of interest for investors. These stocks represent the equity shares of companies listed on US exchanges, offering a glimpse into the robust and dynamic nature of the American economy. This article delves into the intricacies of US domestic stocks, their key characteristics, and the factors that influence their performance.

The Allure of US Domestic Stocks

The allure of US domestic stocks lies in their diversity, stability, and growth potential. With the largest stock market in the world, the US offers a vast array of investment opportunities across various sectors, including technology, healthcare, finance, and consumer goods. Diverse sectors provide investors with the flexibility to tailor their portfolios to their investment goals and risk tolerance.

Understanding Market Capitalization

One of the key aspects of US domestic stocks is their market capitalization. Market capitalization, or market cap, is the total value of a company's outstanding shares. It is calculated by multiplying the number of shares by the stock's price. Market cap is an essential metric for investors as it helps them gauge the size and stability of a company.

Large Cap, Mid Cap, and Small Cap Stocks

US domestic stocks are typically categorized into three groups based on their market cap: large cap, mid cap, and small cap.

Large cap stocks are those of companies with a market cap of over $10 billion. These companies are often well-established and have a strong track record of profitability and stability. Examples include Apple, Microsoft, and Johnson & Johnson.

Mid cap stocks have a market cap between

2 billion and 10 billion. These companies are generally in the growth phase and offer a balance between stability and potential for capital appreciation. Examples include Visa and Home Depot.Small cap stocks represent companies with a market cap of less than $2 billion. These companies are typically in the early stages of development and offer high growth potential but come with higher risk. Examples include Netflix and PayPal.

Factors Influencing US Domestic Stock Performance

Several factors influence the performance of US domestic stocks:

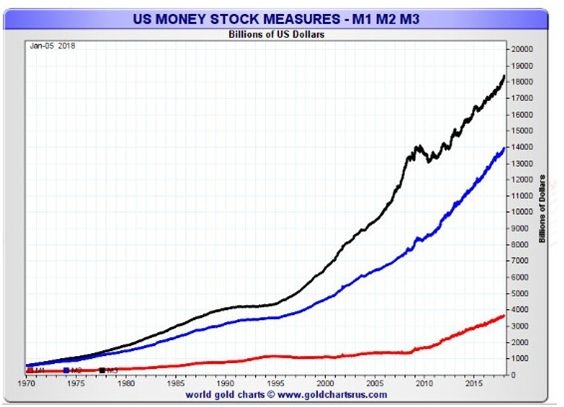

Economic indicators: Economic data such as GDP growth, unemployment rates, and inflation can significantly impact stock prices. For instance, strong economic indicators can boost investor confidence and lead to increased stock prices.

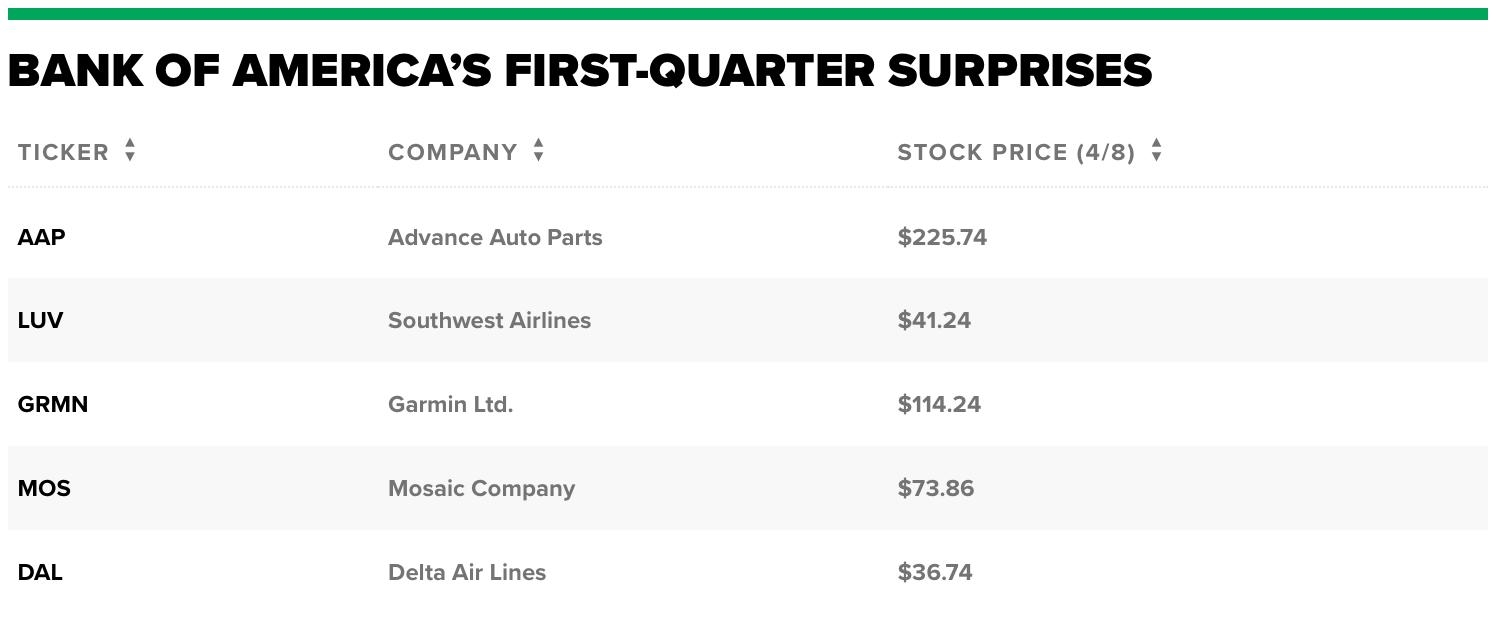

Corporate earnings: Companies' financial performance, including earnings and revenue, play a crucial role in determining stock prices. Positive earnings reports can lead to increased investor confidence and higher stock prices.

Political and regulatory environment: Changes in government policies and regulations can impact the performance of certain sectors. For instance, healthcare stocks may be affected by changes in healthcare policies.

Technological advancements: Technological advancements can disrupt entire industries, leading to significant changes in stock prices. For example, the rise of e-commerce has impacted traditional brick-and-mortar retailers.

Case Studies

To illustrate the impact of these factors, let's consider a few case studies:

Apple: Over the past decade, Apple's stock price has skyrocketed due to its strong financial performance, innovative products, and global market dominance. However, the company's stock price has also been affected by economic uncertainties and changes in consumer preferences.

Tesla: Tesla's stock has seen significant volatility due to its growth potential and the high-risk nature of the electric vehicle market. The company's stock price has been influenced by its earnings reports, production capacity, and competition from other electric vehicle manufacturers.

Amazon: Amazon's stock has experienced remarkable growth over the past few years, driven by its strong e-commerce platform and expanding cloud services. However, the company has also faced regulatory scrutiny and concerns about its market power.

In conclusion, US domestic stocks offer a diverse range of investment opportunities across various sectors and market caps. Understanding the factors that influence stock performance and staying informed about the market can help investors make informed decisions and achieve their investment goals.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....