The stock market has always been a rollercoaster ride, and the recent years have been no exception. With the global pandemic throwing the economy into disarray, many investors are left wondering: is the stock market still crashing in the US? In this article, we delve into the current state of the US stock market, analyze recent trends, and provide insights into what the future may hold.

Understanding the Current State of the Stock Market

The stock market crash of 2020 was a result of the unprecedented disruption caused by the COVID-19 pandemic. Many companies were forced to shut down, leading to a significant decline in their stock prices. However, as the economy started to recover, the stock market began to stabilize.

Recent Trends and Market Performance

Despite the initial downturn, the US stock market has made a remarkable comeback. The S&P 500, a widely followed benchmark index, has seen significant gains over the past year. The tech sector, in particular, has been a major driver of this recovery, with companies like Apple, Amazon, and Google leading the charge.

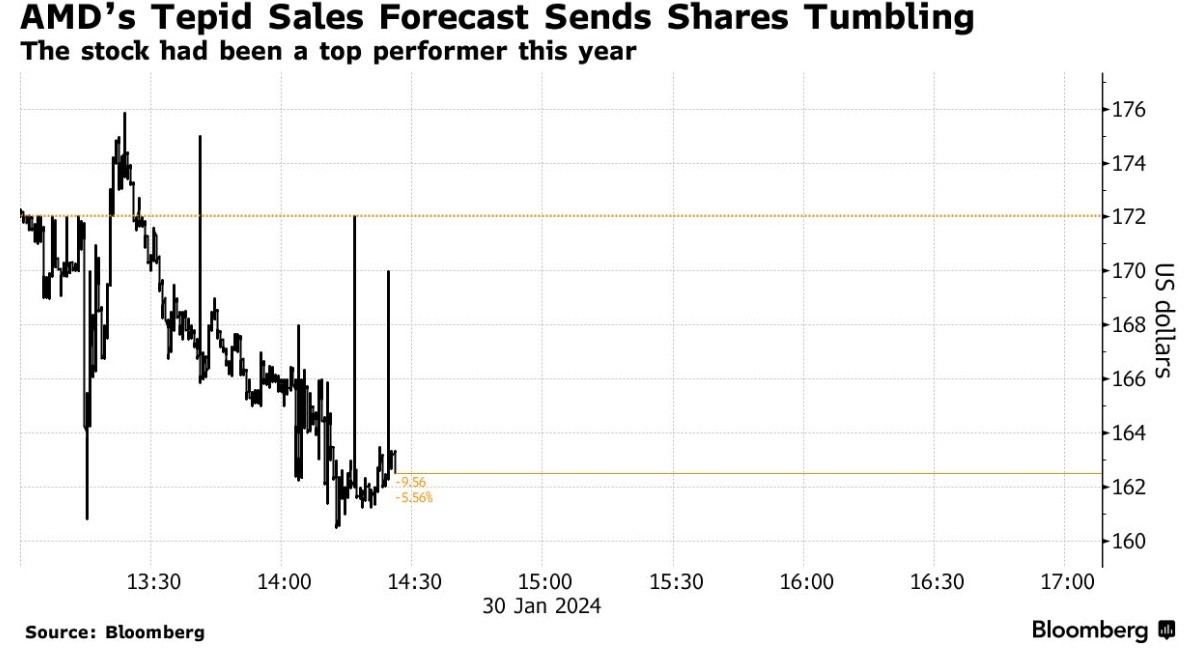

However, the market has not been without its challenges. The recent rise in inflation and concerns about rising interest rates have caused some volatility. Additionally, the ongoing geopolitical tensions and supply chain disruptions have also contributed to market uncertainty.

What Does the Future Hold?

The future of the stock market remains uncertain. While there are signs of recovery, there are also potential risks that could lead to another downturn. Here are some key factors to consider:

- Economic Recovery: The pace of economic recovery will play a crucial role in determining the direction of the stock market. If the recovery is strong and sustainable, the market is likely to continue its upward trend.

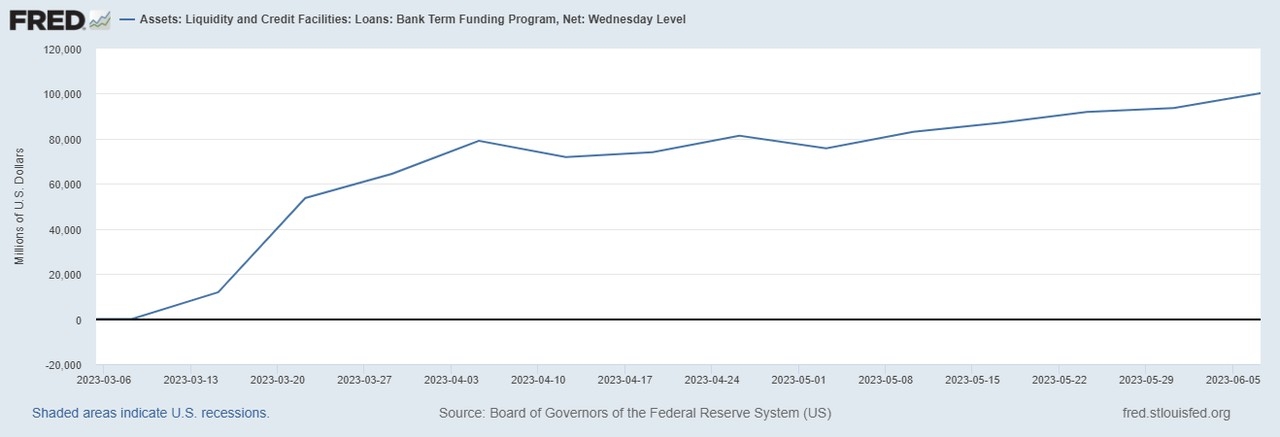

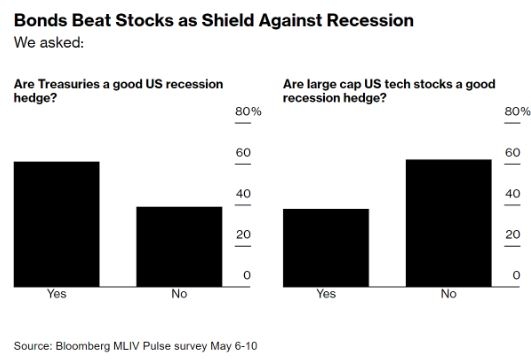

- Inflation and Interest Rates: The Federal Reserve's policies on inflation and interest rates will also have a significant impact. If inflation remains high and the Fed raises interest rates too quickly, it could lead to a slowdown in economic growth and a potential market downturn.

- Geopolitical Tensions: The ongoing tensions between major economies, such as the US and China, could lead to trade wars and other disruptions that could impact the stock market.

Case Studies

To illustrate the volatility of the stock market, let's look at a few case studies:

- Tesla: Tesla's stock has seen massive volatility over the past few years. While the company has seen significant growth, its stock has also experienced dramatic declines during periods of market uncertainty.

- NVIDIA: The tech giant has seen strong growth, with its stock price soaring. However, the company has also faced challenges, such as supply chain disruptions, which have impacted its performance.

- Amazon: The e-commerce giant has been a major driver of the stock market's recovery. However, the company has also faced criticism over its labor practices and environmental impact.

Conclusion

In conclusion, while the stock market has made a remarkable comeback from the 2020 crash, it remains a volatile and unpredictable environment. Investors should be cautious and stay informed about the latest market trends and economic indicators. While there are potential risks, there are also opportunities for growth. By staying informed and making informed decisions, investors can navigate the complexities of the stock market and achieve their financial goals.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....