In the ever-evolving tobacco industry, smokeless tobacco has emerged as a significant segment, attracting investors and consumers alike. The US Smokeless Tobacco Company, a leading player in this niche, has captured the attention of many. This article delves into the US Smokeless Tobacco Company stock, exploring its potential, risks, and factors that could impact its performance.

Understanding the US Smokeless Tobacco Company

The US Smokeless Tobacco Company is a well-established manufacturer and distributor of smokeless tobacco products. Their product range includes chew, snuff, and dissolvable tobacco, catering to a diverse consumer base. The company has a strong presence in the United States and has been a key player in the smokeless tobacco market for over a century.

Factors Influencing US Smokeless Tobacco Company Stock

Several factors can influence the performance of the US Smokeless Tobacco Company stock. Here are some of the key factors to consider:

- Market Trends: The smokeless tobacco market has been experiencing steady growth over the years, driven by changing consumer preferences and health concerns associated with smoking. As more people turn to smokeless tobacco products, the demand for these products is likely to increase, positively impacting the company's stock.

- Regulatory Environment: The regulatory landscape for tobacco products is constantly evolving. Changes in regulations, such as increased taxes or stricter advertising restrictions, can have a significant impact on the company's profitability. Investors should stay informed about any regulatory developments that could affect the industry.

- Product Innovation: The US Smokeless Tobacco Company has been actively investing in research and development to innovate its product offerings. New products and improved formulations can attract new customers and retain existing ones, potentially driving stock prices higher.

- Competitive Landscape: The smokeless tobacco market is highly competitive, with several other companies vying for market share. The company's ability to differentiate its products and maintain a competitive edge will be crucial in driving stock performance.

Case Studies

To illustrate the potential of the US Smokeless Tobacco Company stock, let's consider a few case studies:

- Company A: This company has been investing heavily in marketing and product innovation. As a result, their market share has increased significantly, leading to a surge in their stock price.

- Company B: This company faced regulatory challenges, which resulted in a decline in their stock price. However, they managed to navigate these challenges and stabilize their operations, eventually recovering their stock value.

Conclusion

Investing in the US Smokeless Tobacco Company stock can be a lucrative opportunity for investors looking to capitalize on the growing smokeless tobacco market. However, it is crucial to conduct thorough research and stay informed about the various factors that can impact the company's performance. By understanding the market trends, regulatory environment, and competitive landscape, investors can make informed decisions and potentially reap the rewards of investing in this niche industry.

new york stock exchange

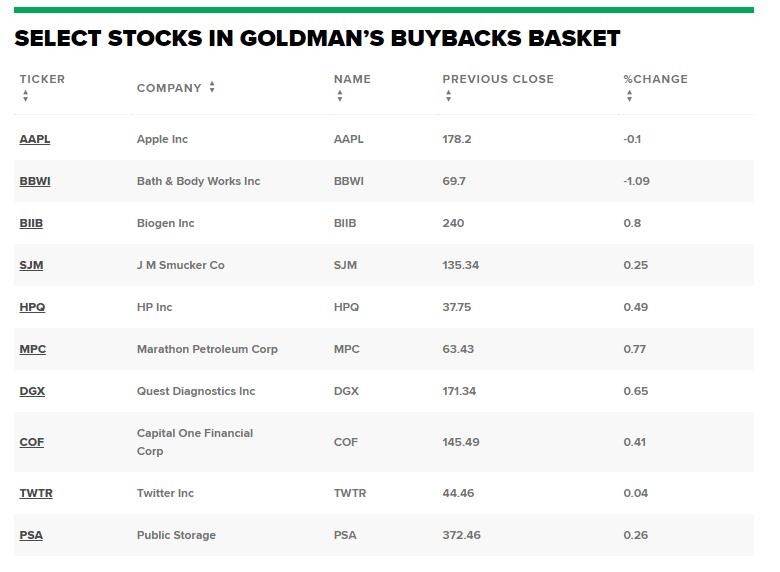

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....