In today's fast-paced digital world, computer chips are the backbone of the technology industry. They power everything from smartphones to servers, and their importance cannot be overstated. As such, the US computer chip stocks have become a key area of interest for investors and tech enthusiasts alike. In this article, we will delve into the world of US computer chip stocks, exploring their significance, performance, and future prospects.

Understanding the Role of Computer Chips

Computer chips, also known as integrated circuits, are small electronic devices that contain thousands or millions of transistors. These transistors allow chips to perform calculations and process data, making them the core of all electronic devices. Without chips, modern technology would not exist as we know it.

The Importance of US Computer Chip Stocks

The United States has a significant presence in the global computer chip industry. American companies like Intel, AMD, and NVIDIA are leading the way in innovation and development. Investing in US computer chip stocks can be a smart move for several reasons:

- Innovation Leadership: The US has a long-standing history of technological innovation, particularly in the chip sector. Companies based in the US often introduce cutting-edge technologies and products.

- Strong Market Position: US chip manufacturers hold a significant market share, which makes them a stable and profitable investment.

- Global Supply Chain: The US computer chip industry is deeply integrated into the global supply chain, making it a critical component of the global economy.

Performance of US Computer Chip Stocks

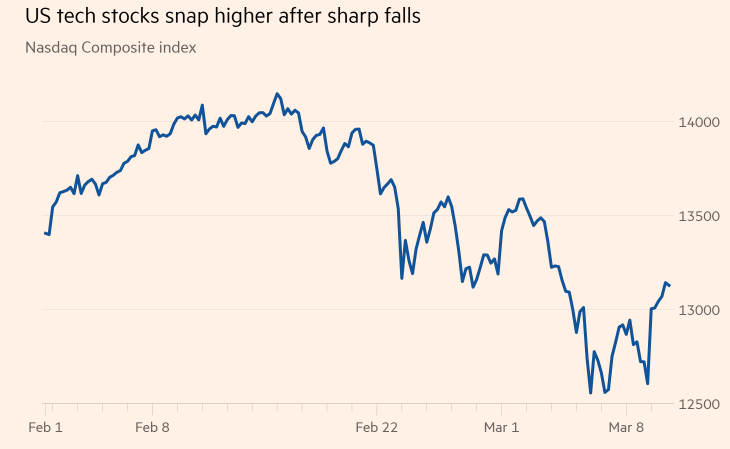

The performance of US computer chip stocks can be volatile, as it is influenced by various factors such as market demand, technological advancements, and geopolitical events. However, in recent years, the industry has shown strong growth, driven by the increasing demand for smartphones, tablets, and other electronic devices.

- Intel: As one of the largest and most influential chip manufacturers, Intel has a strong market position and a history of innovation. The company's stock has seen significant growth over the past few years, driven by its transition to 10nm and 7nm process technologies.

- AMD: AMD has emerged as a major competitor to Intel, gaining market share in the data center and gaming sectors. The company's stock has experienced strong growth, with a particularly impressive performance in the last year.

- NVIDIA: Known for its graphics processing units (GPUs), NVIDIA has expanded its presence in the data center and automotive markets. The company's stock has seen significant growth, driven by strong demand for its products.

Future Prospects for US Computer Chip Stocks

The future of US computer chip stocks looks promising, as the demand for advanced computing power continues to grow. Here are a few key trends that could impact the industry:

- 5G Technology: The rollout of 5G networks will require more advanced and powerful chips, driving demand for US chip manufacturers.

- Artificial Intelligence (AI): AI is rapidly evolving, and advanced chips are needed to support the growing demand for AI applications.

- Geopolitical Factors: The global trade tensions and supply chain disruptions could impact the industry, but they may also create opportunities for US chip manufacturers.

In conclusion, US computer chip stocks are a crucial area of investment for those looking to capitalize on the rapidly evolving technology industry. With the increasing demand for advanced computing power and the leadership of companies like Intel, AMD, and NVIDIA, the future looks bright for US computer chip stocks.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....