In recent years, the global financial market has been witnessing a significant shift in investment trends. One of the most intriguing questions that have popped up is whether the Swiss National Bank (SNB) is buying US stocks. This article delves into the background of the SNB, its investment strategy, and the potential implications of its investment in US stocks.

Understanding the Swiss National Bank

The Swiss National Bank is the central bank of Switzerland and is responsible for maintaining financial stability and ensuring the country's monetary policy. It is one of the world's most powerful central banks and plays a crucial role in managing the Swiss franc.

The SNB's Investment Strategy

The SNB's investment strategy is quite unique compared to other central banks. Traditionally, central banks invest their foreign exchange reserves in safe-haven assets like government bonds. However, the SNB has adopted a more diversified approach, including investments in stocks and other financial instruments.

Is the SNB Buying US Stocks?

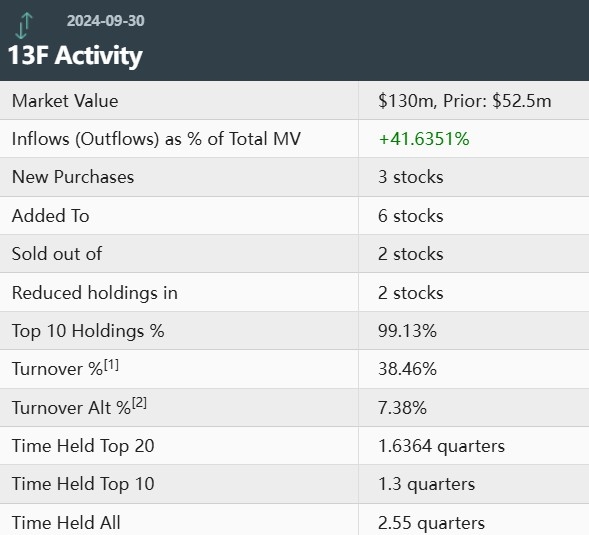

Yes, the Swiss National Bank has been investing in US stocks. The SNB's investment in US stocks is part of its strategy to diversify its foreign exchange reserves. The SNB has been increasing its exposure to US stocks in recent years, especially after the global financial crisis.

Why US Stocks?

There are several reasons why the SNB has chosen to invest in US stocks:

- Economic Stability: The US economy is considered one of the most stable in the world. Investing in US stocks provides the SNB with a reliable source of returns.

- Market Size: The US stock market is the largest in the world, offering a wide range of investment opportunities.

- Diversification: Investing in US stocks helps the SNB to diversify its foreign exchange reserves, reducing the risk of currency fluctuations.

Implications of the SNB's Investment in US Stocks

The SNB's investment in US stocks has several implications:

- Potential Returns: Investing in US stocks could potentially generate higher returns for the SNB's foreign exchange reserves.

- Market Influence: The SNB's investment in US stocks could also influence the US stock market, especially during times of market volatility.

- Economic Impact: The SNB's investment strategy could also have an indirect impact on the global economy.

Case Study: SNB's Investment in Apple Inc.

One of the notable investments made by the SNB is in Apple Inc., one of the world's largest technology companies. The SNB's investment in Apple Inc. highlights its strategy to invest in high-quality companies with strong growth potential.

Conclusion

The Swiss National Bank's investment in US stocks is a testament to the bank's commitment to diversifying its foreign exchange reserves. While the investment strategy has its risks, it also presents opportunities for potential returns. As the global financial landscape continues to evolve, it will be interesting to see how the SNB's investment strategy impacts the US stock market and the global economy.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....