In the ever-fluctuating world of finance, the stock market remains a cornerstone for investors and financial experts alike. As we delve into the events of August 4, 2025, let's explore the key highlights and analysis of the US stock market.

Market Overview: A Mixed Bag

The day's trading on August 4, 2025, was marked by a mixed bag of results. The S&P 500 index closed slightly lower, while the NASDAQ composite ended the day with a modest gain. The Dow Jones Industrial Average also experienced a marginal decline. While the market's overall performance was mixed, there were several significant stories that shaped the day's trading.

Key Highlights

1. Tech Stocks Lead the Way Tech stocks once again took center stage on August 4, 2025. Companies like Apple (AAPL) and Microsoft (MSFT) saw substantial gains, driven by strong earnings reports and positive outlooks for future growth. The tech sector's resilience was a beacon of hope amidst a choppy market.

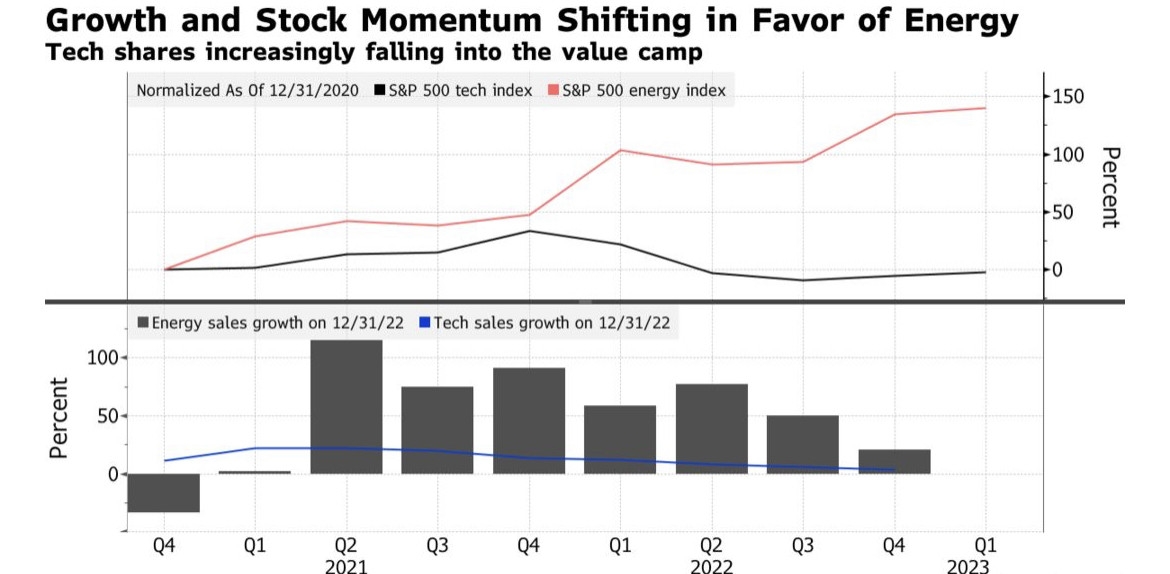

2. Energy Stocks Face Pressure In contrast, energy stocks were under pressure as the price of oil continued to decline. Fears of a global economic slowdown and rising supply concerns contributed to the downward trend. Major oil companies like ExxonMobil (XOM) and Chevron (CVX) experienced notable losses on the day.

3. Biotech Sector Shines Bright The biotech sector, however, shone brightly. Companies like Amgen (AMGN) and Gilead Sciences (GILD) saw significant gains, driven by promising drug trials and positive investor sentiment. The sector's robust performance was a welcome contrast to the energy sector's struggles.

4. Consumer Discretionary Stocks Decline Consumer discretionary stocks, including retailers and luxury brands, experienced a decline. This was partly due to concerns about rising inflation and consumer spending habits. Companies like Walmart (WMT) and Tiffany & Co. (TIF) saw modest losses on the day.

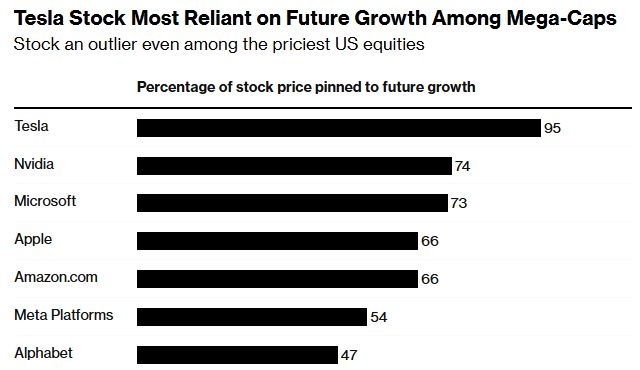

Case Study: Tesla's Earnings Report One of the standout stories of the day was Tesla's (TSLA) earnings report. The electric vehicle manufacturer reported a strong quarter, with significant growth in both vehicle sales and revenue. The report sent Tesla's stock soaring, demonstrating the company's resilience and potential for continued growth.

Analysis: What Does It Mean for Investors?

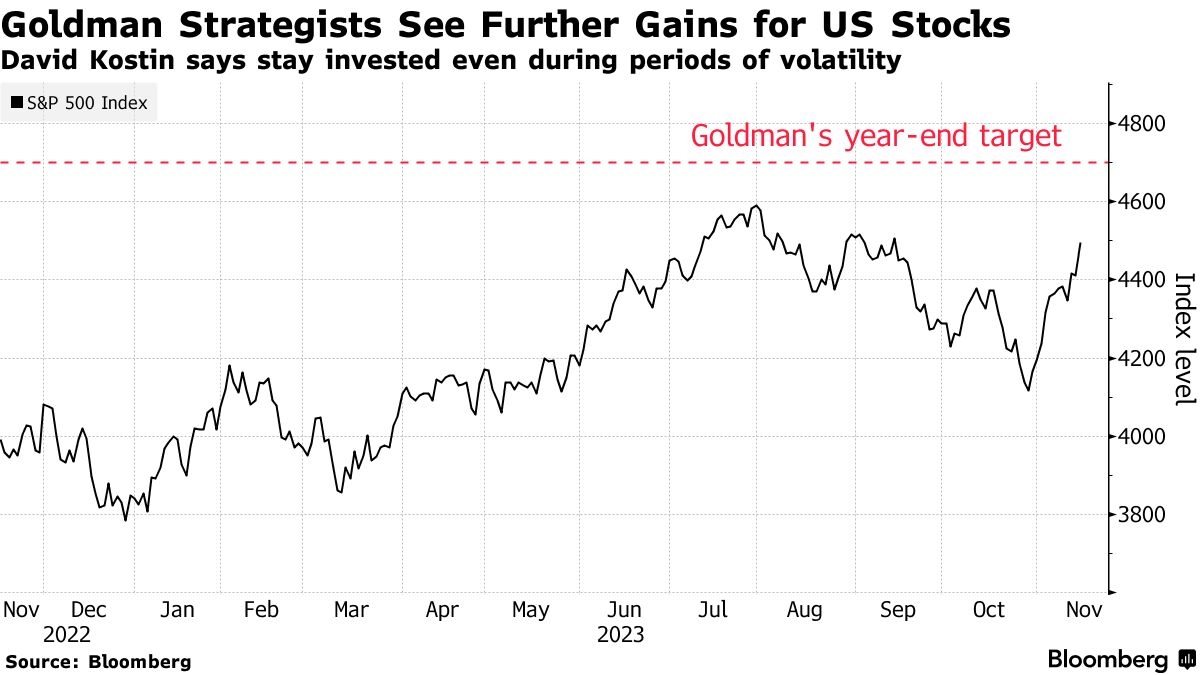

The mixed bag of results on August 4, 2025, highlights the importance of diversification in an investment portfolio. While tech stocks provided a glimmer of hope, the struggling energy and consumer discretionary sectors serve as a reminder of the market's volatility.

Investors should focus on companies with strong fundamentals and potential for long-term growth, rather than getting caught up in short-term market fluctuations. As always, it's crucial to conduct thorough research and consult with financial advisors before making investment decisions.

In conclusion, the US stock market on August 4, 2025, presented a mixed picture, with tech stocks leading the way while energy and consumer discretionary sectors struggled. As investors navigate the choppy waters of the stock market, they should remain vigilant, diversified, and focused on long-term growth potential.

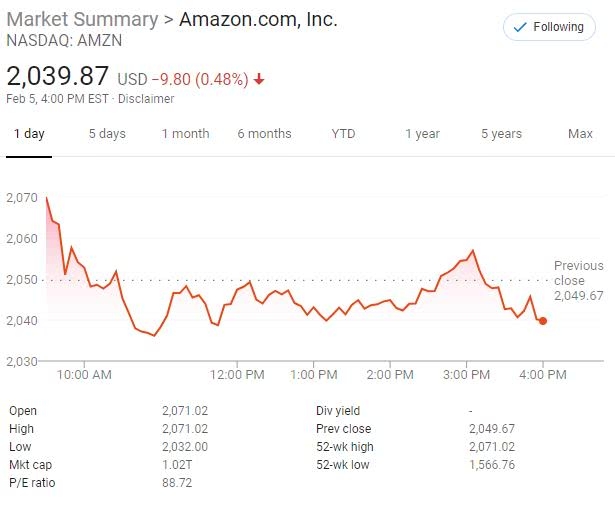

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....