In the ever-evolving world of technology, HCL Technologies has emerged as a major player. This Indian multinational company has been making significant strides in the United States, and investors are closely watching its stock price. In this article, we will delve into the factors influencing the HCL US stock price, provide a historical overview, and analyze future prospects.

Historical Overview

HCL Technologies was listed on the New York Stock Exchange (NYSE) in 2016, with its stock symbol being US:HCLT. Since then, the stock has seen both highs and lows, reflecting the company’s performance and market conditions. As of the latest data, the stock has a market capitalization of approximately $22.5 billion.

Factors Influencing the HCL US Stock Price

Financial Performance: HCL Technologies’ financial results play a crucial role in determining its stock price. Strong revenue growth, increased profitability, and robust earnings per share have historically driven the stock higher.

Market Sentiment: The overall sentiment in the technology sector can significantly impact HCL’s stock price. Positive news, such as new contracts or partnerships, tends to boost investor confidence and drive up the stock price.

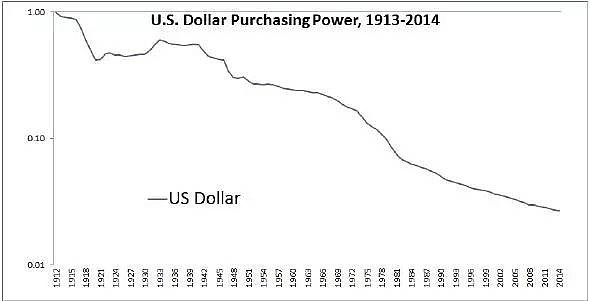

Economic Conditions: Economic factors, such as GDP growth, inflation rates, and currency exchange rates, can affect the company’s revenue streams and, consequently, its stock price.

Regulatory Environment: Changes in regulations, particularly in the technology industry, can impact the company’s operations and profitability, thereby influencing its stock price.

Case Studies

HCL’s Acquisition of Cognizant: In 2020, HCL Technologies announced its plan to acquire Cognizant, a significant player in the IT services industry. The news initially sent the stock price soaring, but the deal faced regulatory hurdles, leading to uncertainty and a subsequent drop in the stock price.

COVID-19 Pandemic: The COVID-19 pandemic disrupted global business operations and led to a shift towards remote work. HCL Technologies, with its expertise in digital transformation and cloud services, benefited from this trend, driving its stock price higher.

Future Prospects

Looking ahead, HCL Technologies has several growth drivers:

Digital Transformation: As businesses continue to digitalize their operations, HCL’s expertise in cloud computing, AI, and data analytics will be in high demand.

Global Expansion: HCL is actively expanding its footprint in the United States and other key markets, which could contribute to its revenue growth.

Strategic Partnerships: The company has been forming strategic partnerships with leading technology firms, which could further enhance its capabilities and market position.

Conclusion

The HCL US stock price is influenced by a variety of factors, including financial performance, market sentiment, and economic conditions. While there are risks and uncertainties, the company’s strong growth prospects make it an attractive investment for long-term investors. As the technology sector continues to evolve, HCL Technologies is well-positioned to capitalize on the opportunities ahead.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....