In today's fast-paced financial world, investors activity is a critical component for market analysis and investment strategies. Understanding how investors behave, what drives their decisions, and how they impact the market can be the difference between successful investments and missed opportunities. This article delves into the nuances of investor activity, providing insights that are essential for any investor looking to navigate the complex landscape of the financial markets.

The Dynamics of Investors Activity

Investors activity encompasses a wide range of behaviors, including buying, selling, and holding assets. The drivers behind these actions can be both quantitative and qualitative. Quantitative factors include market trends, economic indicators, and company fundamentals. Qualitative factors, on the other hand, involve investor sentiment, news events, and market psychology.

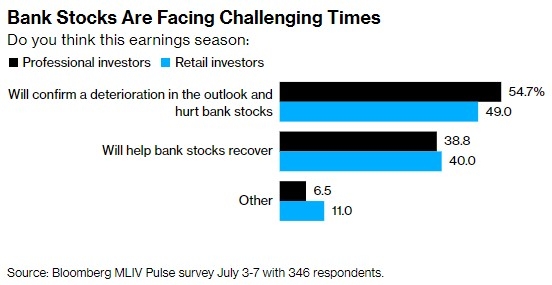

One of the most influential qualitative factors is market sentiment. This refers to the overall mood or outlook of investors towards the market. It can be optimistic, pessimistic, or neutral, and it significantly impacts investors activity. For instance, during periods of high optimism, investors may be more willing to take on risk, leading to a bull market. Conversely, during periods of pessimism, investors may sell off assets, leading to a bear market.

Market Trends and Economic Indicators

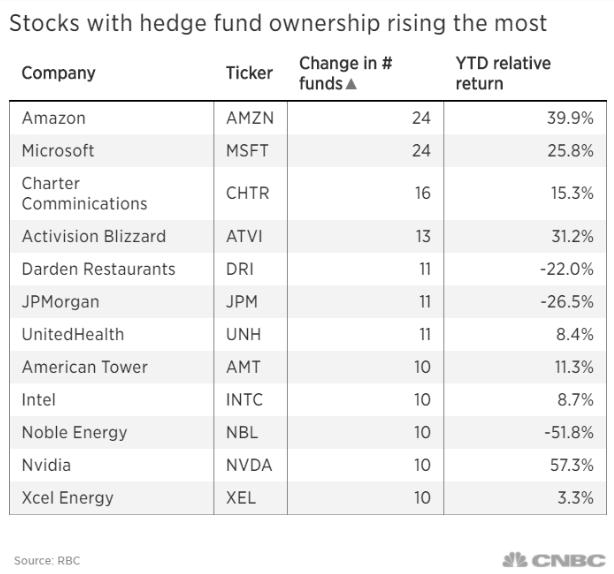

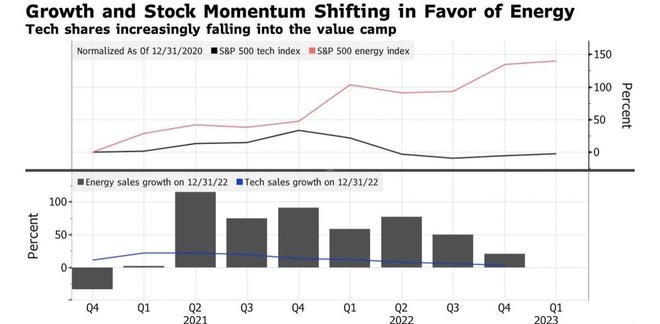

Quantitative factors, such as market trends and economic indicators, also play a crucial role in shaping investors activity. For example, a strong GDP growth rate may indicate a robust economy, leading to increased investor confidence and higher asset prices. Similarly, a declining unemployment rate may suggest a healthy labor market, further boosting investor sentiment.

However, it's important to note that economic indicators are just one piece of the puzzle. Market trends, such as long-term bull or bear markets, can also significantly influence investors activity. For instance, during a bull market, investors may be more inclined to invest in stocks, while during a bear market, they may prefer bonds or other conservative assets.

The Impact of News Events and Market Psychology

News events can also have a profound impact on investors activity. Positive news, such as a company announcing a breakthrough product or a country reaching a trade deal, can lead to increased investor optimism and higher asset prices. Conversely, negative news, such as a company facing a major lawsuit or a country experiencing political turmoil, can lead to investor pessimism and lower asset prices.

Market psychology also plays a significant role in investors activity. This includes investor biases, such as overconfidence or fear of missing out (FOMO), which can lead to irrational decision-making. Understanding these biases is crucial for investors looking to make informed decisions and avoid costly mistakes.

Case Studies

To illustrate the impact of investors activity, let's consider a few case studies:

The Tech Bubble of 2000: This period was marked by excessive optimism and speculation in the tech sector. Many investors piled into tech stocks, leading to a significant bubble. When the bubble burst, investors lost billions, illustrating the dangers of unchecked optimism.

The Financial Crisis of 2008: This crisis was driven by a combination of excessive risk-taking, poor regulatory oversight, and negative news events. Many investors lost their savings as the market crashed, highlighting the importance of diversification and risk management.

Conclusion

Understanding investors activity is crucial for any investor looking to navigate the complex financial markets. By considering both quantitative and qualitative factors, investors can make more informed decisions and avoid costly mistakes. Whether you're a seasoned investor or just starting out, this guide provides a valuable framework for understanding the dynamics of investors activity.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....