In the ever-evolving world of finance, predicting the future of the stock market is a task that both investors and analysts eagerly undertake. As we approach 2025, the market outlook for US stocks is a topic that continues to captivate the financial community. This article delves into the potential trends, opportunities, and challenges that may shape the US stock market landscape by 2025.

The Resilience of US Stocks

Historically, US stocks have proven to be a resilient investment vehicle, often weathering economic downturns and emerging stronger. The market's ability to recover from the 2008 financial crisis is a testament to its resilience. As we look ahead to 2025, several factors suggest that this trend may continue.

1. Economic Growth and Stability

One of the primary drivers of the US stock market's potential growth is the country's robust economic outlook. The United States has experienced steady economic growth over the past decade, and this trend is expected to continue into the 2020s. Low unemployment rates, a strong dollar, and favorable trade agreements are all contributing factors.

2. Technological Advancements

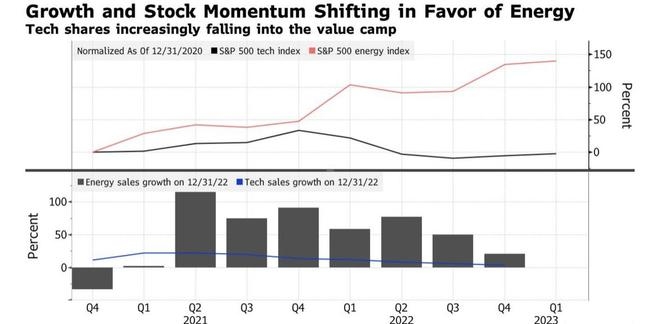

Technology is a key driver of economic growth and has been a significant contributor to the rise of US stocks. Companies like Apple, Microsoft, and Amazon have become household names and have significantly influenced the market. As we approach 2025, emerging technologies such as artificial intelligence, blockchain, and quantum computing could continue to fuel growth in the tech sector.

3. Diversification

Another factor that could benefit the US stock market is the increased diversification of the market. Historically, the market has been heavily reliant on a few large-cap companies. However, in recent years, there has been a rise in small and mid-cap stocks, providing investors with a wider range of opportunities.

Potential Challenges

While there are several positive indicators for the US stock market, there are also potential challenges that could impact its performance.

1. Geopolitical Risks

Geopolitical tensions, such as trade disputes and political instability, can create uncertainty in the market. As we approach 2025, the potential for these risks to escalate remains a concern.

2. Inflation and Interest Rates

The Federal Reserve's monetary policy, particularly in terms of inflation and interest rates, can have a significant impact on the stock market. As the economy continues to grow, there is a possibility that inflation could rise, leading to higher interest rates. This could potentially dampen investor confidence and affect stock prices.

3. Market Valuations

Another concern is the current valuations of many stocks. With the market at or near record highs, some investors worry that stocks may be overvalued, increasing the risk of a market correction.

Case Studies

To better understand the potential market outlook for US stocks, let's examine a few case studies.

1. Apple Inc.

Apple has been a standout performer in the tech sector, with its stock price reaching all-time highs. As the company continues to innovate and expand into new markets, such as services and wearables, it remains a key player in the US stock market.

2. Tesla Inc.

Tesla has seen rapid growth over the past few years, driven by its leadership in the electric vehicle market. As the company continues to expand its production capacity and enter new markets, it could become an even more significant player in the stock market.

Conclusion

The market outlook for US stocks in 2025 is complex, with a mix of potential opportunities and challenges. While economic growth, technological advancements, and diversification offer positive indicators, geopolitical risks, inflation, and market valuations remain concerns. As always, investors should conduct thorough research and consider their risk tolerance before making investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....