Are you an investor looking to diversify your portfolio? Are you intrigued by the potential of investing in US stocks from the UK? If so, you're not alone. The allure of investing in the world's largest economy is undeniable. But what do you need to know before diving into the US stock market from the UK? This comprehensive guide will walk you through everything you need to know about trading US stocks from the UK.

Understanding the Basics

Before you start trading US stocks from the UK, it's essential to understand the basics. The US stock market is one of the most significant and influential markets in the world. It's home to some of the world's most iconic companies, including Apple, Google, and Microsoft.

Opening a Brokerage Account

The first step in trading US stocks from the UK is to open a brokerage account. A brokerage account is an account with a financial institution that allows you to buy and sell stocks. There are many brokerage firms that cater to UK investors looking to trade US stocks. Some of the most popular include Fidelity, TD Ameritrade, and E*TRADE.

Understanding the Risks

It's crucial to understand the risks involved in trading US stocks from the UK. The US market operates on a different schedule than the UK market, and currency exchange rates can fluctuate. Additionally, trading in a different market can be challenging due to different regulations and reporting requirements.

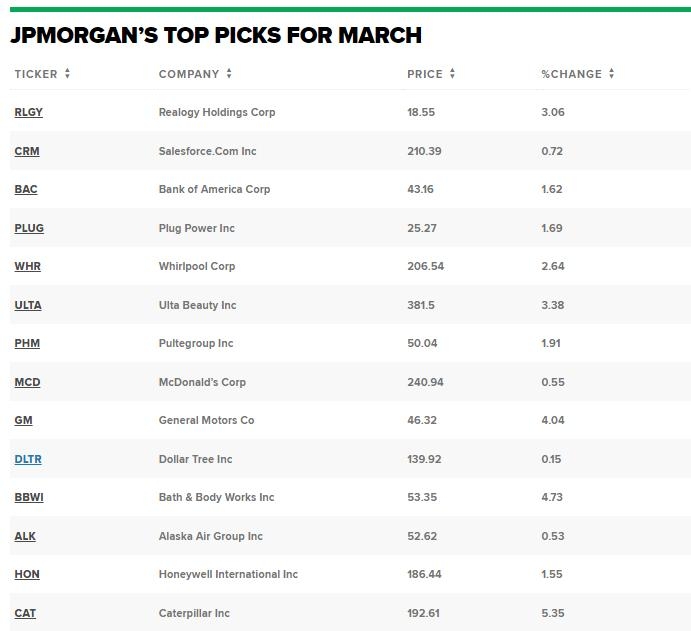

Choosing the Right Stocks

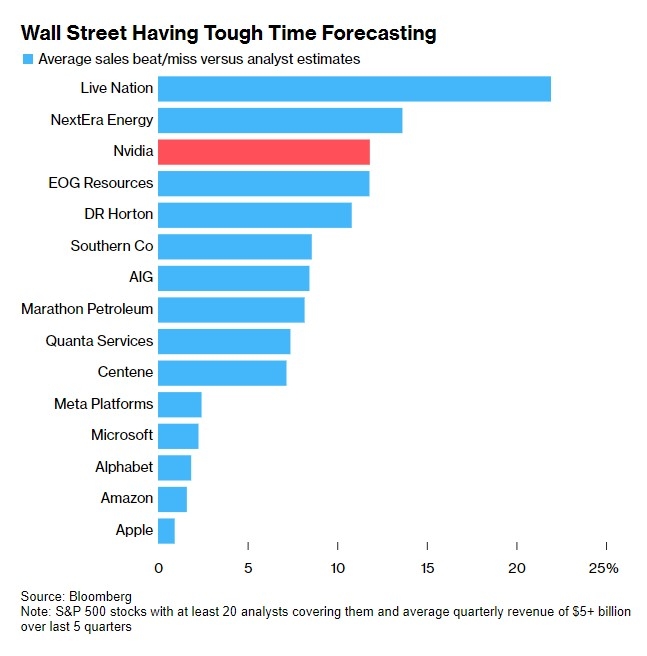

When selecting stocks to trade, it's essential to do thorough research. Look for companies with strong fundamentals, such as a high return on equity and a solid track record of profitability. Additionally, consider the sector and industry in which the company operates. Some of the most popular sectors for UK investors include technology, healthcare, and consumer goods.

Using a Stop-Loss Order

A stop-loss order is an essential tool for managing risk. It allows you to set a price at which your stock will be sold if the price falls below that level. This can help you minimize potential losses if the market takes an unexpected turn.

Diversifying Your Portfolio

Diversifying your portfolio is crucial to managing risk. By investing in a variety of sectors and industries, you can reduce the impact of any single stock's performance on your overall portfolio. Consider using ETFs (exchange-traded funds) to gain exposure to a broad range of US stocks without having to buy individual stocks.

Case Studies

To illustrate the potential of trading US stocks from the UK, let's look at a couple of case studies.

Case Study 1: Apple Inc.

Apple Inc. (AAPL) is one of the most popular US stocks among UK investors. Over the past decade, Apple has delivered strong returns, making it an attractive investment for many. However, it's essential to understand the risks involved, as the stock can be volatile.

Case Study 2: Tesla Inc.

Tesla Inc. (TSLA) is another popular US stock among UK investors. The electric vehicle company has seen significant growth in recent years, driven by increased demand for electric vehicles and advancements in technology. However, Tesla is a volatile stock, and investors need to be prepared for potential fluctuations in its price.

Conclusion

Trading US stocks from the UK can be a rewarding investment opportunity. By understanding the basics, managing risks, and conducting thorough research, you can build a diversified portfolio of US stocks that can potentially deliver strong returns. Remember to stay informed and keep an eye on market trends and economic indicators to make informed investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....