Embarking on a journey to the United States as an international student can be an exciting and transformative experience. Alongside the pursuit of academic excellence, many students explore opportunities to invest in the US stock market. But how exactly do US stocks work, and what are the benefits for international students? Let's delve into this fascinating topic.

Understanding the US Stock Market

The US stock market is one of the largest and most dynamic in the world. It provides a platform for companies to raise capital by selling shares to investors. These shares represent ownership in the company and are bought and sold on stock exchanges like the New York Stock Exchange (NYSE) and the NASDAQ.

Key components of the US stock market include:

- Stock Exchanges: These are the venues where shares are bought and sold. They facilitate liquidity and price discovery.

- Brokers: Individuals and companies need brokers to execute trades on their behalf.

- Trading Hours: The primary trading sessions for the NYSE and NASDAQ are from 9:30 AM to 4:00 PM Eastern Time, Monday to Friday.

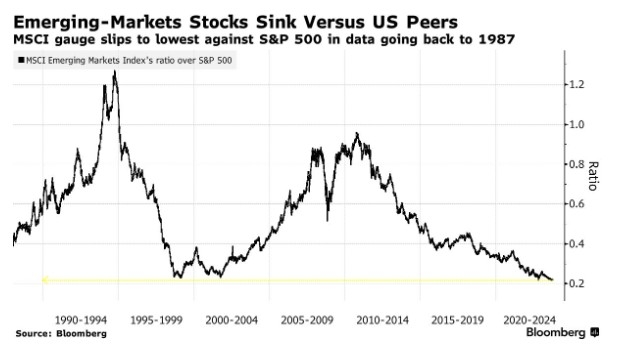

- Market Indices: These are composite indicators that reflect the overall performance of the stock market. Notable indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Investing for International Students

International students can invest in US stocks in several ways, each with its unique advantages and disadvantages:

1. Direct Stock Purchase

Pros:

- Direct ownership of shares

- Potential for higher returns

- Direct exposure to company performance

Cons:

- Requires a brokerage account and knowledge of the stock market

- Higher initial investment

- Potential for higher fees

2. Exchange-Traded Funds (ETFs)

Pros:

- Lower initial investment

- Diversification

- Easy to buy and sell

Cons:

- May have higher management fees

- Limited control over individual stocks

3. Mutual Funds

Pros:

- Professional management

- Diversification

- Easy to buy and sell

Cons:

- Higher management fees

- Potential for underperformance

4. Dividend Reinvestment Plans (DRIPs)

Pros:

- Automatic reinvestment of dividends

- Cost-effective way to accumulate shares

Cons:

- Limited control over investment decisions

- Potential for lower returns

Case Studies

Case 1: An international student invested

Case 2: An international student chose to invest in a diversified ETF tracking the S&P 500 index. By investing

Conclusion

Investing in US stocks can be a valuable way for international students to build wealth and gain financial independence. By understanding the stock market, choosing the right investment vehicles, and maintaining a long-term perspective, students can capitalize on the opportunities presented by the US stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....