Investing in stocks is a popular way to grow wealth, but the decision between international and US stocks can be daunting. This article aims to provide a comprehensive guide to help investors understand the differences and make informed decisions.

Understanding the Basics

Firstly, it's essential to understand the basic differences between international and US stocks. US stocks are shares of companies listed on exchanges in the United States, such as the New York Stock Exchange (NYSE) or the NASDAQ. International stocks, on the other hand, are shares of companies listed on exchanges outside the United States, such as the London Stock Exchange or the Tokyo Stock Exchange.

Diversification

One of the primary reasons investors consider international stocks is for diversification. Investing in a single market can be risky, as economic and political events can significantly impact stock prices. By investing in both international and US stocks, investors can spread their risk and potentially benefit from different market conditions.

Risk and Return

International stocks often come with higher risk due to factors such as political instability, currency fluctuations, and different regulatory environments. However, they can also offer higher returns, especially in emerging markets. US stocks, on the other hand, are generally considered less risky due to a stable political and economic environment, but may offer lower returns compared to international stocks.

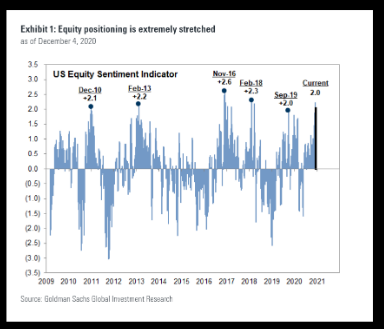

Market Performance

Historically, US stocks have outperformed international stocks. However, this trend is not guaranteed to continue. Over the past few years, some international markets, particularly in Asia, have shown strong growth, making them attractive investment opportunities.

Currency Fluctuations

Investing in international stocks exposes investors to currency risk. If the US dollar strengthens against the local currency of the international stock, the investor's returns in US dollars may be reduced. Conversely, if the US dollar weakens, the investor's returns may increase.

Tax Considerations

Tax implications can vary significantly when investing in international stocks. It's important to understand the tax laws in both the United States and the country where the stock is listed to avoid any surprises.

Case Studies

To illustrate the differences between international and US stocks, let's consider two companies: Apple Inc. (AAPL), a US-based technology company, and Tencent Holdings Limited (TCEHY), a Chinese internet and social media company.

Apple, as a US stock, has a well-established track record and is considered a safe investment. Its products are in high demand globally, and it has a strong presence in the US market. In contrast, Tencent operates in a rapidly growing market with significant potential for growth but also faces regulatory challenges.

Conclusion

In conclusion, the decision between international and US stocks depends on individual investment goals, risk tolerance, and market conditions. Both have their advantages and disadvantages, and it's important to conduct thorough research before making investment decisions. By understanding the basics and considering factors such as diversification, risk, and return, investors can make informed choices and potentially achieve their financial goals.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....