Are you looking to diversify your Tax-Free Savings Account (TFSA) investments? Consider adding US stocks to your portfolio. This article delves into the benefits of investing in US stocks through a TFSA, providing you with valuable insights and strategies to make informed decisions.

Understanding TFSA and US Stocks

A TFSA is a tax-advantaged savings account available to Canadian residents. Contributions are tax-free, and any investment growth or income within the account is also tax-free. Investing in US stocks within your TFSA can offer numerous advantages, including potential higher returns and diversification.

Benefits of Investing in US Stocks Through a TFSA

Higher Returns: The US stock market has historically offered higher returns compared to the Canadian market. By investing in US stocks through your TFSA, you can potentially increase your investment returns.

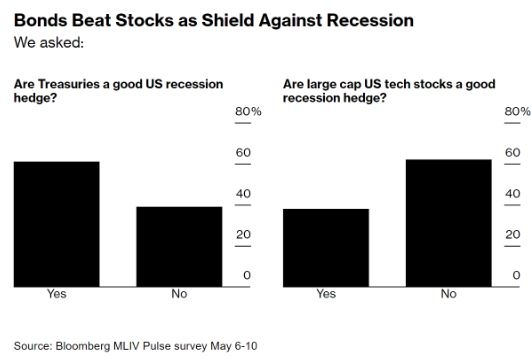

Diversification: Investing in US stocks can help diversify your portfolio, reducing your exposure to market volatility. The US market includes a wide range of industries and sectors, allowing you to spread your investments across various asset classes.

Currency Exposure: Investing in US stocks can provide exposure to the US dollar, which may offer protection against currency fluctuations.

Access to World-Class Companies: The US stock market is home to many of the world's largest and most successful companies, such as Apple, Microsoft, and Amazon. Investing in these companies can provide access to their growth potential.

How to Invest in US Stocks Through a TFSA

Choose a Broker: To invest in US stocks through your TFSA, you'll need a brokerage account that supports international investments. Research and compare brokers to find one that offers competitive fees, a user-friendly platform, and access to a wide range of US stocks.

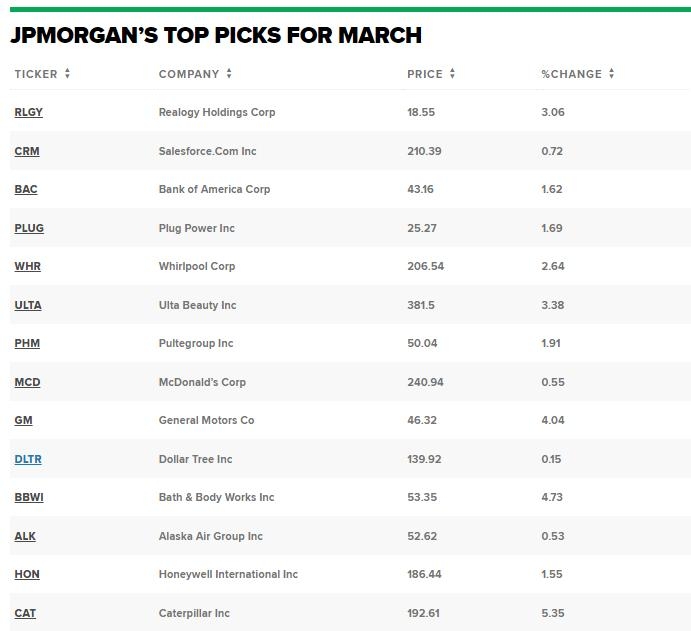

Research and Select Stocks: Conduct thorough research to identify US stocks that align with your investment goals and risk tolerance. Consider factors such as the company's financial health, growth prospects, and market position.

Open a TFSA Account: If you haven't already, open a TFSA account. Ensure you understand the contribution limits and any restrictions on withdrawals.

Transfer Funds: Transfer funds from your TFSA to your brokerage account. This will provide you with the capital needed to purchase US stocks.

Purchase US Stocks: Use your brokerage account to purchase US stocks within your TFSA. Monitor your investments regularly and adjust your portfolio as needed.

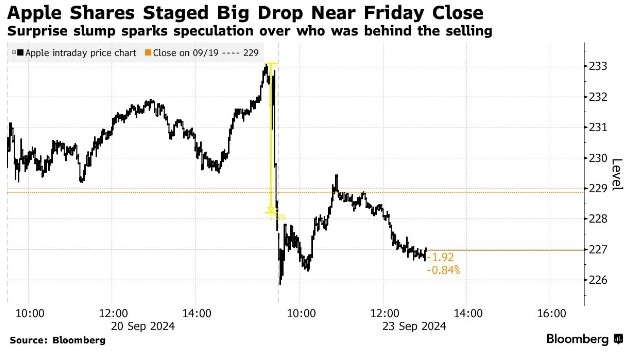

Case Study: Investing in Apple (AAPL) Through a TFSA

Let's consider an example of investing in Apple (AAPL) through a TFSA. Suppose you contributed

Conclusion

Investing in US stocks through a TFSA can be a smart way to diversify your portfolio and potentially increase your investment returns. By carefully selecting stocks and monitoring your investments, you can make informed decisions and maximize the benefits of your TFSA.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....