As we gear up for April 7, 2025, investors are closely watching the US stock market to predict potential trends and opportunities. The stock market's performance can significantly impact investors' portfolios, making it crucial to stay informed about the latest outlook. In this article, we will delve into the key factors influencing the US stock market on this date and provide insights into potential opportunities and risks.

Economic Indicators to Watch

One of the primary factors that can influence the stock market is economic indicators. On April 7, 2025, investors should keep an eye on the following economic reports:

- GDP Growth: The GDP report provides an overview of the overall economic health of the country. A strong GDP growth rate can indicate a robust economy, potentially boosting stock market performance.

- Consumer Spending: Consumer spending is a critical indicator of economic activity. An increase in consumer spending can signal a positive outlook for the stock market.

- Inflation Rates: Inflation rates can impact the stock market in various ways. High inflation can erode purchasing power, while low inflation can indicate a healthy economy.

Sector Performances

Another key factor to consider is sector performances. Certain sectors may outperform others based on various factors, such as economic conditions, technological advancements, and regulatory changes. Here are some sectors to watch on April 7, 2025:

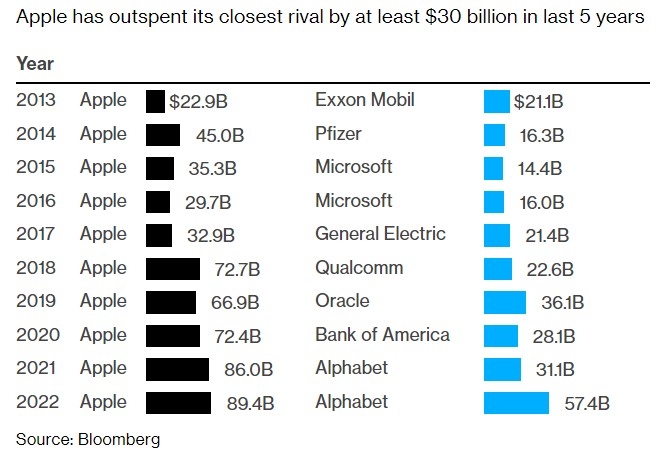

- Technology: The technology sector has been a major driver of stock market growth in recent years. Companies like Apple, Microsoft, and Amazon have consistently delivered strong performances.

- Healthcare: The healthcare sector is expected to grow as the population ages and healthcare needs increase. Companies like Johnson & Johnson and Pfizer could be potential winners in this sector.

- Energy: The energy sector has seen a significant rebound in recent years, driven by increased oil and gas production. Companies like ExxonMobil and Chevron could benefit from rising oil prices.

Market Sentiment

Market sentiment can play a significant role in the stock market's performance. On April 7, 2025, investors should pay attention to market sentiment indicators, such as:

- Stock Market Indices: The S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite are key indices that provide insights into market sentiment.

- Earnings Reports: Companies' earnings reports can impact market sentiment. Positive earnings reports can boost investor confidence, while negative reports can lead to market sell-offs.

Case Studies

To illustrate the potential impact of these factors on the stock market, let's consider a few case studies:

- Tech Giant Outperforms: Suppose a leading technology company, such as Apple, releases a highly anticipated product on April 7, 2025. This could lead to a surge in the company's stock price and potentially boost the overall technology sector.

- Economic Data Disappoints: If the GDP growth rate falls short of expectations on April 7, 2025, it could lead to a sell-off in the stock market, as investors become concerned about the economy's health.

Conclusion

In conclusion, the US stock market outlook for April 7, 2025, hinges on various factors, including economic indicators, sector performances, and market sentiment. By staying informed about these factors and keeping an eye on the latest news and developments, investors can make informed decisions and capitalize on potential opportunities in the stock market.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....