The Brexit referendum in 2016 sent shockwaves through global financial markets, including the US stock market. This decision by the United Kingdom to leave the European Union has had a profound impact on various aspects of the global economy. In this article, we will delve into how Brexit has affected the US stock market and what investors should consider moving forward.

Understanding the Impact of Brexit on the US Stock Market

The primary concern for investors after the Brexit vote was the uncertainty it brought to the global economy. This uncertainty has had several implications for the US stock market:

Currency Fluctuations: The British pound plummeted following the Brexit vote, making UK exports cheaper and potentially boosting the US stock market for companies with significant exposure to the UK market. However, the overall impact of currency fluctuations on the US stock market has been mixed.

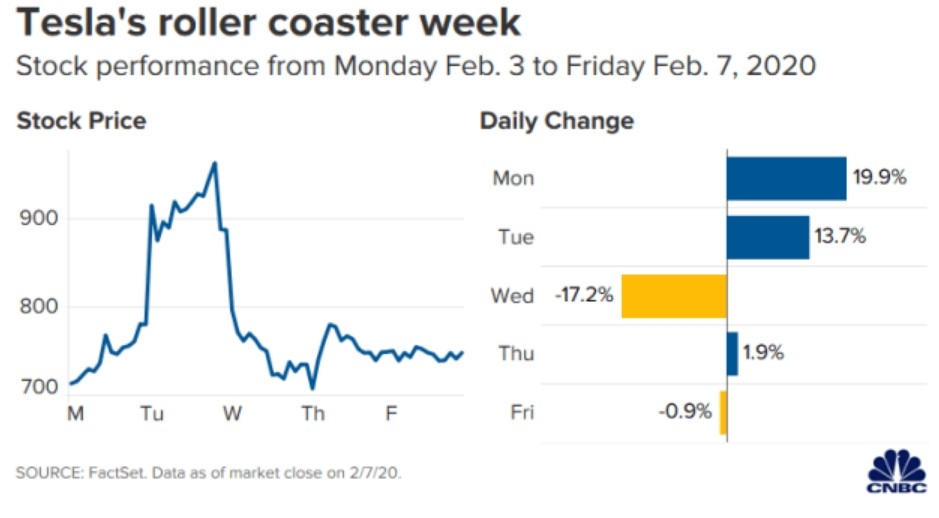

Economic Uncertainty: The uncertainty surrounding the UK's future trade relations with the EU has caused volatility in the US stock market. Companies that rely on trade with the UK have had to reevaluate their business strategies, leading to increased uncertainty and volatility.

Global Economic Growth: The Brexit vote has raised concerns about the potential slowing of global economic growth. This has led to a cautious approach among investors, with many seeking safe haven investments such as gold and US Treasuries, which can have a negative impact on the US stock market.

Case Studies

One of the most notable examples of the impact of Brexit on the US stock market is the decline in the stock prices of companies with significant exposure to the UK market. For instance, pharmaceutical giant GlaxoSmithKline (GSK) saw its stock price fall following the Brexit vote due to concerns about the future of its operations in the UK.

On the other hand, some companies with operations in the UK have seen their stock prices rise. For example, Amazon's UK operations have seen increased growth following the Brexit vote, as the company has expanded its presence in the UK market.

Investor Considerations

As investors navigate the post-Brexit landscape, there are several key considerations to keep in mind:

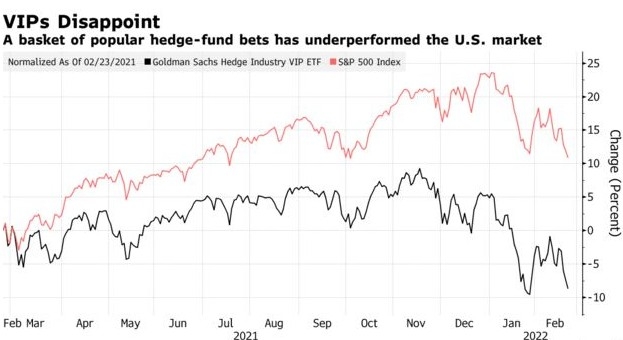

Diversification: Diversifying your portfolio can help mitigate the impact of Brexit on the US stock market. By investing in a variety of sectors and geographical regions, you can reduce your exposure to the risks associated with Brexit.

Market Volatility: Be prepared for increased market volatility in the short term. This volatility can present opportunities for long-term investors, but it also requires a careful approach to risk management.

Economic Indicators: Keep an eye on economic indicators that can provide insight into the potential impact of Brexit on the US stock market. For example, pay attention to UK GDP growth, inflation rates, and employment data.

In conclusion, Brexit has had a significant impact on the US stock market, with uncertainty and volatility being the primary concerns. As investors navigate this landscape, diversification, market volatility, and economic indicators will play a crucial role in making informed investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....