Introduction

The stock market is a crucial component of the global financial landscape, and understanding the differences between major markets is essential for investors. This article aims to provide a detailed comparison between the UK and US stock markets, highlighting key factors such as market structure, major indices, and recent performance. By the end of this article, you'll have a clearer understanding of the unique aspects of each market and how they can impact your investment decisions.

Market Structure

The UK and US stock markets operate under different regulatory frameworks and market structures. The London Stock Exchange (LSE) is the primary stock exchange in the UK, while the New York Stock Exchange (NYSE) and NASDAQ are the most prominent exchanges in the US.

The LSE is known for its focus on traditional blue-chip companies, with a strong presence in sectors such as finance, energy, and utilities. The NYSE, on the other hand, has a more diverse range of companies, including technology, healthcare, and consumer goods.

Major Indices

One of the most significant differences between the UK and US stock markets is the composition of their major indices.

The FTSE 100 index is a benchmark for the UK stock market, consisting of the 100 largest companies by market capitalization. It includes companies from various sectors, with a particular emphasis on financial and industrial firms.

The S&P 500 index is the cornerstone of the US stock market, representing the 500 largest companies by market capitalization across all sectors. It is often considered a proxy for the overall health of the US economy.

Recent Performance

In recent years, both the UK and US stock markets have demonstrated resilience and growth. However, there have been notable differences in their performance.

The UK stock market has faced challenges due to political uncertainty, such as Brexit. While the market has recovered from its initial plunge, it remains somewhat volatile.

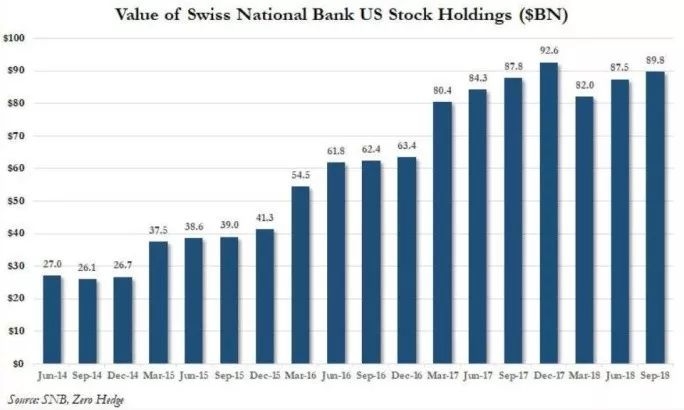

The US stock market, particularly the S&P 500, has been a standout performer, driven by strong corporate earnings and economic growth. This has attracted a significant amount of foreign investment.

Market Dynamics

Several factors contribute to the dynamics of the UK and US stock markets.

1. Regulatory Environment: The UK operates under the Financial Conduct Authority (FCA), while the US has the Securities and Exchange Commission (SEC). Both regulatory bodies aim to maintain fair and efficient markets, but they have different approaches to oversight and enforcement.

2. Economic Factors: The UK and US economies have distinct characteristics that influence their stock markets. For instance, the UK has a larger public sector, while the US has a more robust private sector.

3. Sector Allocation: The UK and US stock markets differ in terms of sector allocation. The UK has a higher concentration of financial and industrial companies, while the US has a more diverse mix of sectors.

Case Study: Tech Giants

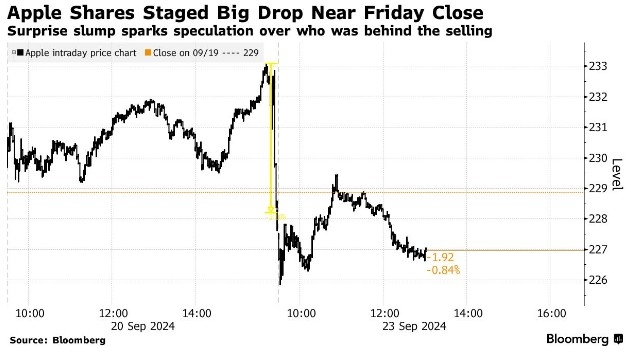

A prime example of the differences between the UK and US stock markets is the performance of tech giants such as Apple and Microsoft.

Apple, a US-based company, has been a significant contributor to the S&P 500 index. Its market capitalization has soared over the years, making it one of the world's most valuable companies.

Microsoft, another US tech giant, has also experienced remarkable growth and is a major component of the S&P 500.

In contrast, the UK does not have a dominant tech company comparable to Apple or Microsoft. This highlights the difference in sector allocation between the two markets.

Conclusion

In conclusion, the UK and US stock markets have distinct characteristics that influence their performance and investment opportunities. Understanding these differences is crucial for investors looking to diversify their portfolios or gain exposure to different sectors.

By analyzing factors such as market structure, major indices, and recent performance, you can make more informed investment decisions. Keep in mind that both markets offer unique opportunities and risks, so it's essential to conduct thorough research before making any investment choices.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....