Introduction

The US stock market is often considered the global benchmark for investor confidence and market trends. Among the plethora of companies listed, some stocks have gained significant momentum, capturing the attention of investors worldwide. This article delves into the top US stocks that are currently experiencing a surge in momentum, offering insights and analysis into what makes them stand out.

Understanding Stock Momentum

Stock momentum refers to the speed at which a stock price moves in either direction. A stock with strong momentum will experience rapid and sustained price gains, while a stock with weak momentum may struggle to maintain gains or could even see price declines. Understanding the factors that drive stock momentum is crucial for investors looking to capitalize on market trends.

Top US Stocks with Strong Momentum

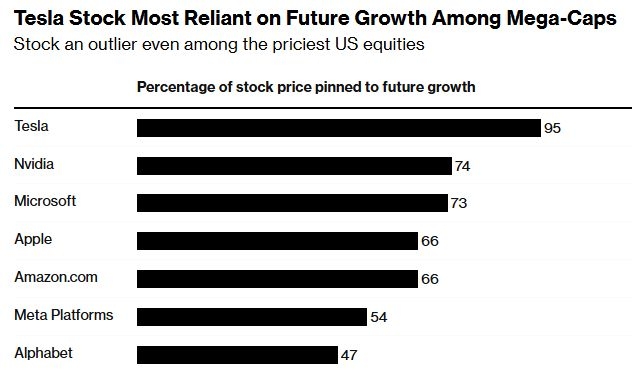

- Tesla (TSLA)

Tesla has long been a leader in the electric vehicle (EV) market, and its momentum continues to grow. With the increasing demand for sustainable transportation, Tesla has been able to maintain a strong position in the market. The company's recent expansion into new markets and its advancements in battery technology have further bolstered its momentum.

- Amazon (AMZN)

Amazon has become synonymous with online retail and cloud computing. As the e-commerce giant continues to expand its offerings and grow its market share, it has experienced a significant surge in momentum. The company's commitment to innovation and its ability to adapt to changing consumer trends have been key factors in its success.

- NVIDIA (NVDA)

NVIDIA is a leader in the graphics processing unit (GPU) market, providing critical components for everything from gaming to data centers. With the rise of artificial intelligence and the increasing demand for high-performance computing, NVIDIA has seen its stock soar. The company's focus on research and development has allowed it to maintain its position as an industry leader.

- Meta Platforms (META)

Meta Platforms (formerly Facebook) has faced challenges in recent years, but its stock has seen a significant rebound. The company's continued investment in virtual reality and its expansion into other markets, such as commerce and financial services, have contributed to its renewed momentum.

- Berkshire Hathaway (BRK.B)

Berkshire Hathaway, led by Warren Buffett, is a conglomerate that owns a diverse range of businesses. Its stock has experienced a surge in momentum, driven by the strong performance of its insurance and investment operations. The company's long-term approach to investing has earned it the reputation as a top US stock.

Case Study: NVIDIA

To illustrate the power of stock momentum, let's look at NVIDIA. In the past year, the company's stock has surged more than 100%, driven by strong earnings reports and a growing demand for its GPUs. This surge can be attributed to several factors:

- Innovation: NVIDIA has continuously innovated in the GPU market, developing new technologies that outpace competitors.

- Market Trends: The rise of artificial intelligence and high-performance computing has created a significant demand for NVIDIA's products.

- Strong Leadership: The company's leadership has demonstrated a clear vision for the future and has been able to execute effectively.

Conclusion

The top US stocks with strong momentum are often those that have a clear competitive advantage, a strong track record of innovation, and a commitment to growth. By understanding the factors that drive stock momentum, investors can identify potential opportunities in the market. As always, it's important to conduct thorough research and consider your own risk tolerance before making any investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....