Investing in the stock market can be a lucrative endeavor for U.S. citizens, but it's important to understand the tax implications. This article delves into the various tax aspects of owning stocks, including capital gains tax, dividends tax, and more. By the end, you'll have a clearer understanding of how much U.S. citizens pay taxes on stocks and how to navigate these complexities.

Capital Gains Tax

When you sell a stock for a profit, you are subject to capital gains tax. The rate at which you are taxed depends on how long you held the stock before selling it. If you held the stock for less than a year, it's considered a short-term capital gain, and you'll be taxed at your ordinary income tax rate. If you held the stock for more than a year, it's considered a long-term capital gain, and you'll be taxed at a lower rate, typically 0%, 15%, or 20%, depending on your taxable income.

Dividends Tax

Dividends are payments made by a company to its shareholders. They can be classified as either qualified or non-qualified dividends. Qualified dividends are taxed at the lower long-term capital gains rates, while non-qualified dividends are taxed at your ordinary income tax rate. The classification of dividends depends on the company paying them and the type of stock you own.

Tax-Deferred Accounts

To mitigate the tax burden on stock investments, many U.S. citizens use tax-deferred accounts like IRAs (Individual Retirement Accounts) and 401(k)s. Contributions to these accounts are made with pre-tax dollars, reducing your taxable income in the year of contribution. Taxes are paid when you withdraw funds from these accounts, typically in retirement.

Taxation of Stock Options

Stock options granted to employees can also be subject to taxes. If you exercise an incentive stock option (ISO), you may not have to pay taxes on the difference between the fair market value of the stock and the exercise price. However, if you exercise a non-qualified stock option (NSO), you'll be taxed on the difference between the exercise price and the fair market value of the stock at the time of exercise.

Case Study: Investing in Stocks

Let's consider a hypothetical scenario to illustrate the tax implications of stock investments. John purchased 100 shares of Company XYZ at

Short-Term Capital Gains Tax:

Since John held the stock for less than a year, the

Long-Term Capital Gains Tax:

If John had held the stock for more than a year, the

Dividends Tax: Let's say Company XYZ paid a $2 per share dividend. If the dividends are classified as qualified, John would pay taxes at the lower long-term capital gains rate. If they are classified as non-qualified, he would pay taxes at his ordinary income tax rate.

Conclusion

Understanding the tax implications of owning stocks is crucial for U.S. citizens. By familiarizing yourself with capital gains tax, dividends tax, and tax-deferred accounts, you can make informed investment decisions and minimize your tax burden. Keep in mind that tax laws can change, so it's always a good idea to consult with a tax professional for personalized advice.

vanguard total stock market et

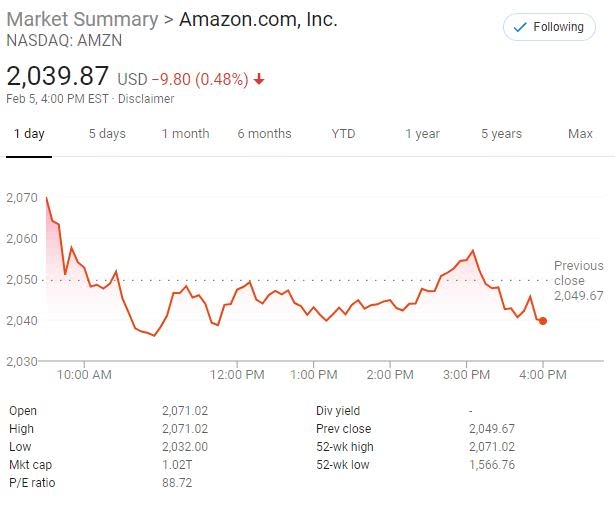

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....