Are you interested in investing in BASF SE, one of the world's leading chemical companies? If so, you're in the right place. This guide will walk you through the process of purchasing BASF stock in the United States, ensuring you understand each step along the way.

Understanding BASF SE

Before diving into the investment process, it's important to have a basic understanding of BASF SE. Based in Ludwigshafen, Germany, BASF is a global chemical company with operations in more than 80 countries. The company is involved in various industries, including agriculture, construction, automotive, and consumer goods.

Why Invest in BASF Stock?

Investing in BASF stock can offer several advantages:

- Strong Market Position: As one of the largest chemical companies in the world, BASF enjoys a strong market position and a diverse portfolio of products and services.

- Consistent Earnings: BASF has a history of consistent earnings, making it an attractive investment for income-focused investors.

- Global Presence: With operations in multiple countries, BASF is well-positioned to benefit from global economic growth.

Steps to Buy BASF Stock in the US

Now that you understand the basics, let's dive into the steps required to purchase BASF stock in the United States:

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online brokerage firm. Many popular brokers, such as TD Ameritrade, E*TRADE, and Charles Schwab, offer access to international stocks, including BASF.

Fund Your Account: Once your brokerage account is open, you'll need to fund it with cash. This can be done through a wire transfer, bank account transfer, or by depositing a physical check.

Research BASF Stock: Before purchasing BASF stock, it's crucial to conduct thorough research. Analyze the company's financial statements, industry trends, and market conditions. This will help you make an informed investment decision.

Place an Order: Once you've completed your research, you can place an order to buy BASF stock. You can do this through your brokerage platform by entering the number of shares you wish to purchase and the maximum price you're willing to pay.

Monitor Your Investment: After purchasing BASF stock, it's important to monitor your investment regularly. Stay updated on the company's financial performance, industry news, and economic indicators that may affect the stock price.

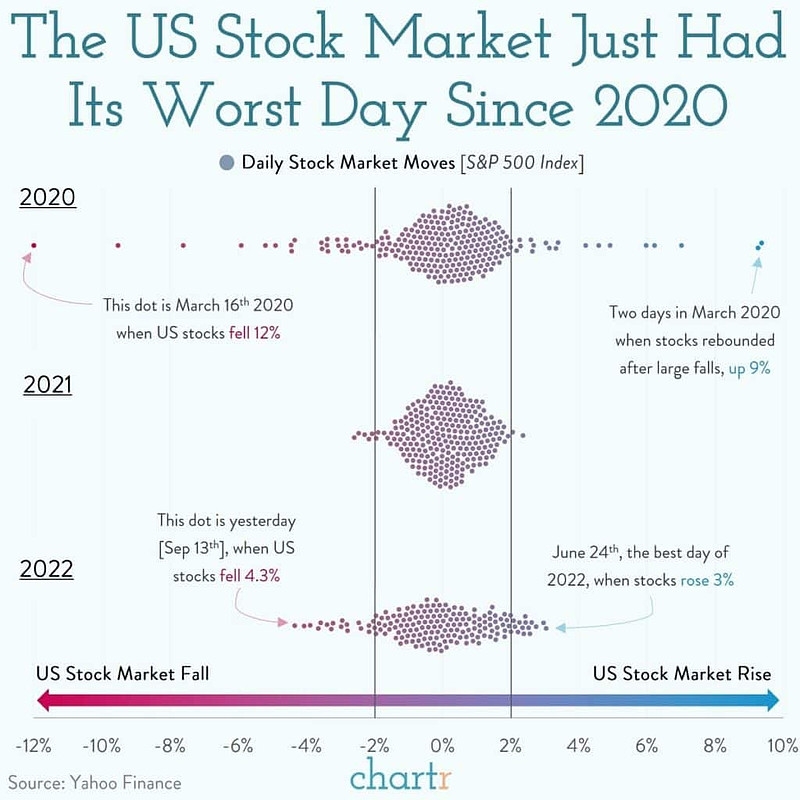

Case Study: BASF's Recent Stock Performance

To illustrate the investment potential of BASF stock, let's consider a recent case study. In 2020, BASF reported a strong performance despite the global pandemic. The company's revenue increased by 6% to €59.2 billion, and its adjusted net income rose by 12% to €5.3 billion.

This positive performance can be attributed to several factors, including strong demand for BASF's products in the construction and consumer goods industries, as well as cost-saving measures implemented by the company.

Conclusion

Investing in BASF stock can be a valuable addition to your portfolio. By following these steps and conducting thorough research, you can successfully purchase and manage BASF stock in the United States. Remember to stay informed and make informed investment decisions to maximize your returns.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....