As we delve into October 2025, the US stock market stands at a pivotal point, shaped by a complex interplay of economic indicators, technological advancements, and geopolitical events. This article aims to highlight the key trends that are likely to dominate the US stock market in October 2025, providing investors with valuable insights to guide their decisions.

Economic Indicators and Growth Projections

The US economy has been on a steady growth trajectory over the past few years, with a robust job market and strong consumer spending. Key economic indicators such as GDP, unemployment rate, and inflation rate will continue to be closely monitored by investors. In October 2025, we expect the following trends:

- Moderate Economic Growth: The US economy is projected to experience moderate growth, with GDP growth rates slightly above 2%. This indicates a stable and sustainable economic environment.

- Low Inflation: Inflation has been on a downward trend, and we anticipate it to remain low in October 2025. This is positive news for the stock market, as lower inflation can lead to higher corporate profits.

- Low Unemployment: The unemployment rate is expected to remain low, around 3.5%, which indicates a healthy labor market. This is beneficial for the stock market, as strong employment data often correlates with higher corporate earnings.

Sector Performance

Different sectors within the US stock market tend to perform differently based on various factors such as economic conditions, technological advancements, and regulatory changes. In October 2025, the following sectors are expected to be the major performers:

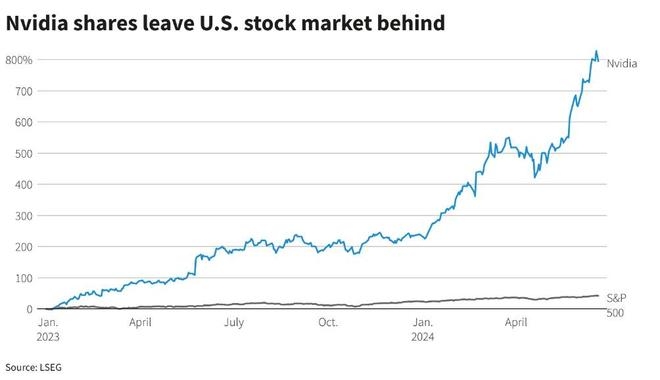

- Technology: The technology sector remains a major driver of the US stock market. With advancements in artificial intelligence, 5G technology, and cloud computing, companies in this sector are likely to continue their strong performance.

- Healthcare: The healthcare sector is expected to see significant growth, driven by an aging population and the increasing demand for medical services and technologies.

- Financials: The financial sector may also perform well, as interest rates remain low and economic growth continues. Banks and insurance companies are likely to benefit from higher earnings and asset valuations.

Geopolitical Events and Risks

Geopolitical events can have a significant impact on the US stock market. In October 2025, investors will be closely monitoring the following developments:

- Trade Wars: The ongoing trade tensions between the US and other countries, particularly China, could affect the stock market. Any significant escalation in trade wars could lead to higher inflation and slower economic growth.

- Global Events: Events such as elections in key countries, political instability, and natural disasters can also impact the US stock market. Investors will be closely monitoring these events to assess their potential impact.

Conclusion

As we approach October 2025, the US stock market stands at a critical juncture, with a mix of economic growth, technological advancements, and geopolitical risks. Investors should remain vigilant and stay informed about the latest trends and developments to make informed decisions. By understanding the key trends and risks, investors can position themselves for success in the US stock market.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....