In today's globalized world, understanding the differences between the stock market versions in the United States and Canada is crucial for investors. This article delves into the key aspects that distinguish these markets, including trading hours, regulatory bodies, and stock exchanges. By the end, you'll have a clearer picture of how these markets operate and how they can impact your investment decisions.

Trading Hours: A Key Difference

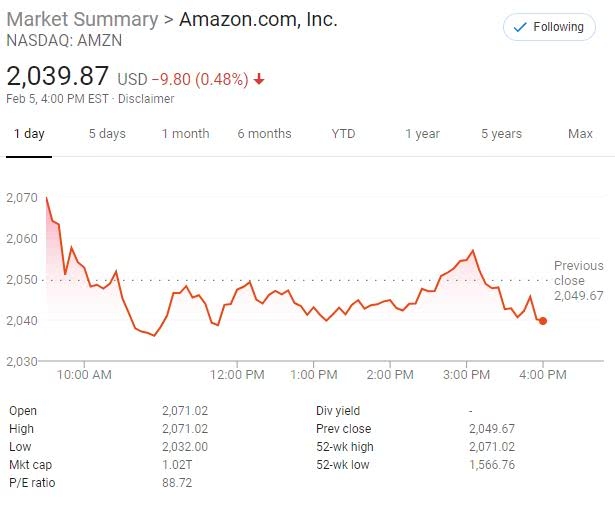

One of the most noticeable differences between the US and Canada stock markets is the trading hours. The New York Stock Exchange (NYSE) and the NASDAQ, which are the two major stock exchanges in the United States, operate from 9:30 AM to 4:00 PM Eastern Time (ET). In contrast, the Toronto Stock Exchange (TSX) and the TSX Venture Exchange (TSXV) have slightly different hours: the TSX operates from 9:30 AM to 4:00 PM ET, while the TSXV operates from 9:30 AM to 4:30 PM ET.

This difference in trading hours can impact the availability of stocks for investors in one country who are trying to trade in the other. For example, if you're in Canada and trying to buy a stock listed on the NYSE, you'll need to be aware of the time difference to ensure that the market is open when you want to make your purchase.

Regulatory Bodies: Protecting Investors

Another crucial difference between the US and Canada stock markets is the regulatory bodies that oversee them. In the United States, the Securities and Exchange Commission (SEC) is the primary regulatory agency responsible for ensuring that the stock market operates fairly and efficiently. The SEC enforces laws and regulations that protect investors, maintain fair and orderly markets, and facilitate capital formation.

In Canada, the responsibility falls on the Canadian Securities Administrators (CSA), a network of provincial and territorial securities regulators. The CSA's primary role is to ensure that the Canadian capital markets are fair and efficient, and that investors are protected from unfair, improper, or fraudulent practices.

Stock Exchanges: A Look at the Major Players

Both the US and Canada have several stock exchanges, each with its own unique offerings. The NYSE is one of the most famous stock exchanges in the world, home to some of the largest and most well-known companies in the United States, such as Apple, Microsoft, and Amazon.

The TSX is the largest stock exchange in Canada, with a diverse range of companies listed, including energy, mining, and financial services. The TSXV, on the other hand, is aimed at smaller and emerging companies, offering a platform for growth-oriented companies to raise capital.

Case Study: Tesla, Inc.

A prime example of the differences between the US and Canada stock markets is the case of Tesla, Inc. When Tesla went public in 2010, it was listed on the NASDAQ in the United States. The company has since grown to become one of the most valuable companies in the world.

In Canada, Tesla is listed on the TSX, which allows Canadian investors to own a piece of this innovative company. However, due to the time difference in trading hours, Canadian investors need to be aware of the timing of their transactions to ensure that the US market is open when they want to buy or sell Tesla stock.

In conclusion, understanding the differences between the US and Canada stock markets is essential for investors who are considering trading in both countries. By being aware of trading hours, regulatory bodies, and stock exchanges, investors can make informed decisions and capitalize on opportunities in both markets.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....