In the vast landscape of investment opportunities, the iShares Total U.S. Stock Market IDX (BKTX) stands out as a robust and diversified choice for investors seeking exposure to the broader U.S. stock market. This review delves into the key features, benefits, and considerations of this popular exchange-traded fund (ETF).

Understanding iShares Total U.S. Stock Market IDX (BKTX)

The iShares Total U.S. Stock Market IDX (BKTX) is designed to track the performance of the S&P 500® Index, which represents the broad market of U.S. stocks. This ETF provides investors with a convenient and cost-effective way to gain exposure to the U.S. equity market without the need to directly purchase individual stocks.

Key Features of BKTX

- Diversification: By tracking the S&P 500, BKTX offers a diversified portfolio of U.S. large-cap stocks, reducing the risk associated with investing in a single stock or sector.

- Low Costs: BKTX is known for its low expense ratio, making it an affordable option for investors seeking to minimize their investment costs.

- Liquidity: As an ETF, BKTX offers high liquidity, allowing investors to buy and sell shares easily during trading hours.

- Tax Efficiency: BKTX is structured as a pass-through entity, which means it does not pay corporate income tax on capital gains. This can be beneficial for investors in terms of tax efficiency.

Benefits of Investing in BKTX

- Access to the U.S. Stock Market: BKTX provides investors with a convenient way to gain exposure to the U.S. stock market, which is often considered a global leader in terms of economic growth and innovation.

- Potential for Long-Term Growth: Historically, the U.S. stock market has provided strong returns over the long term, making BKTX an attractive option for investors seeking long-term growth.

- Risk Management: By tracking the S&P 500, BKTX offers a level of risk management, as the index is diversified across various sectors and industries.

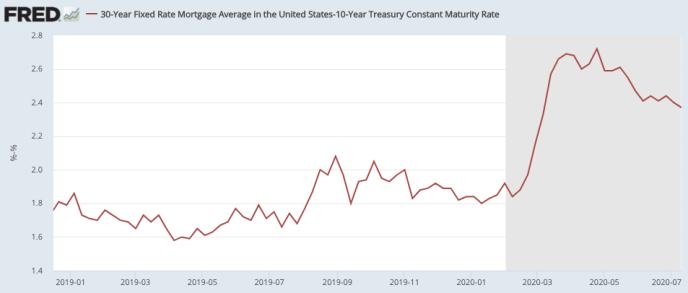

Case Study: Investing in BKTX During the COVID-19 Pandemic

During the COVID-19 pandemic, the stock market experienced significant volatility. However, investors who held BKTX during this period were able to benefit from the diversification and stability offered by the ETF. While the market as a whole experienced a downturn, BKTX's exposure to the S&P 500 helped mitigate some of the losses.

Considerations for Investing in BKTX

- Market Risk: As with any investment in the stock market, there is always the risk of market downturns. Investors should be prepared for potential volatility.

- Sector Concentration: While BKTX provides diversification, it is still concentrated in the U.S. stock market. Investors should consider their overall portfolio allocation and risk tolerance.

- Tax Implications: While BKTX is tax-efficient, investors should be aware of any potential capital gains taxes that may arise from selling shares.

In conclusion, the iShares Total U.S. Stock Market IDX (BKTX) is a compelling investment option for those seeking exposure to the U.S. stock market. With its diversification, low costs, and liquidity, BKTX offers a robust and accessible way to invest in the broader market. As always, investors should conduct their own research and consider their individual investment goals and risk tolerance before making any investment decisions.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....