Introduction: The year 2025 marks a critical juncture in the US stock market. With record-high valuations, investors are increasingly concerned about the possibility of a market bubble. This article delves into the current state of the US stock market, analyzing key indicators and providing insights into whether a bubble is indeed forming.

Market Valuation Metrics

One of the primary indicators of a market bubble is the price-to-earnings (P/E) ratio. As of 2025, the S&P 500's P/E ratio stands at an alarming 35x, significantly higher than its historical average of 16x. This indicates that investors are paying a premium for stocks, which raises concerns about overvaluation.

Sector Analysis

The technology sector, often considered a bellwether for the broader market, has seen particularly rapid growth. Companies like Apple, Amazon, and Google have seen their valuations soar, contributing to the overall market's elevated P/E ratio. However, it's important to note that while technology stocks may be overvalued, other sectors, such as healthcare and energy, are still trading at reasonable valuations.

Economic Indicators

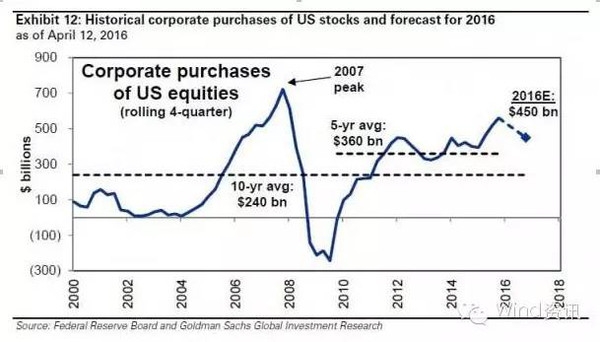

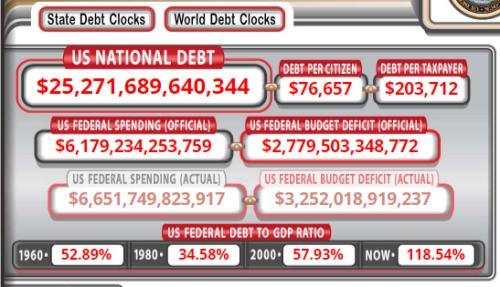

Another crucial factor to consider is the economic environment. The US economy has been experiencing steady growth, with low unemployment and inflation rates. However, some experts argue that these favorable conditions may be masking underlying vulnerabilities, such as rising corporate debt and a potential slowdown in global growth.

Case Studies

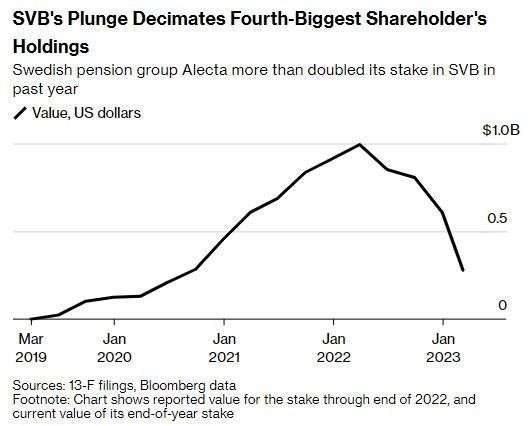

A prime example of a market bubble is the dot-com bubble of the late 1990s. During that period, internet companies were valued at exorbitant levels, with many investors ignoring fundamental valuation metrics. Ultimately, the bubble burst, leading to significant losses for investors. While the current market may not be as extreme as the dot-com bubble, the parallels are striking.

Market Sentiment

Market sentiment plays a crucial role in determining whether a bubble is forming. As of 2025, investor optimism remains high, with many investors believing that the market's growth will continue. However, this sentiment could change rapidly if there is a significant economic downturn or a major geopolitical event.

Conclusion

In conclusion, the US stock market's current valuation levels raise concerns about the possibility of a bubble. While the market may not be as overvalued as it was during the dot-com bubble, the elevated P/E ratio and the optimism of investors suggest that caution is warranted. As investors, it's important to remain vigilant and consider the potential risks associated with the current market environment.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....