In the ever-evolving world of finance, the question of whether the US stock market is efficient has been a topic of debate for decades. Efficiency in the stock market refers to the ability of prices to reflect all available information. This article delves into the concept of market efficiency, examines the arguments for and against, and explores various factors that contribute to the efficiency of the US stock market.

Understanding Market Efficiency

Market efficiency is a cornerstone of financial theory. It suggests that stock prices are always fair and reflect all known information. In an efficient market, it is impossible to consistently achieve above-average returns by trading on public information. This concept is often summarized by the Efficient Market Hypothesis (EMH), which posits that stock prices fully reflect all available information.

Arguments for Market Efficiency

Proponents of market efficiency argue that the US stock market is highly efficient due to several factors:

- Information Availability: The US stock market is one of the most transparent and well-regulated markets in the world. Companies are required to disclose financial information, and this information is readily available to investors.

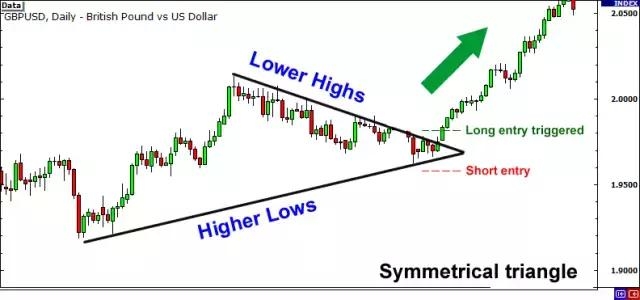

- High Turnover: The US stock market experiences high levels of trading activity, which ensures that prices quickly adjust to new information.

- Herd Behavior: Investors often follow the crowd, leading to rapid price adjustments in response to new information.

Arguments Against Market Efficiency

Despite the arguments for market efficiency, there are several reasons to question its validity:

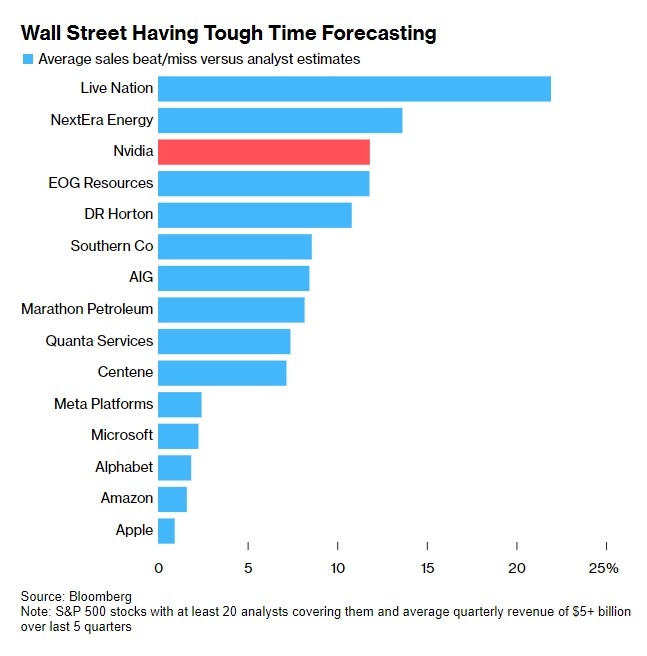

- Information Asymmetry: Some investors may have access to non-public information, giving them an unfair advantage.

- Market Manipulation: Instances of market manipulation can lead to mispriced stocks.

- Behavioral Biases: Investors may be influenced by emotions and biases, leading to irrational decision-making.

Factors Contributing to Market Efficiency

Several factors contribute to the efficiency of the US stock market:

- Regulatory Framework: The Securities and Exchange Commission (SEC) plays a crucial role in ensuring market efficiency by enforcing regulations and overseeing corporate disclosures.

- Technology: Advanced trading platforms and algorithms enable real-time data analysis and facilitate rapid price adjustments.

- Investor Education: Increased investor education and awareness contribute to a more informed and efficient market.

Case Studies

To illustrate the concept of market efficiency, consider the following case studies:

- Facebook IPO: The Facebook IPO in 2012 was widely anticipated and priced at

38 per share. However, the stock opened at 42 and quickly surged to $45, reflecting the market's rapid adjustment to new information. - Tesla's Stock Price: Tesla's stock price has experienced significant volatility over the years, reflecting the market's reaction to the company's performance and news.

Conclusion

In conclusion, the question of whether the US stock market is efficient is complex and multifaceted. While there are arguments for and against market efficiency, it is clear that the market is influenced by various factors. Understanding these factors and their impact on market efficiency is crucial for investors and policymakers alike.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....