Are you ready to dive into the world of investing and grab yourself some stocks? Whether you're a seasoned investor or just starting out, understanding the ins and outs of the stock market is crucial. In this article, we'll explore the key aspects of stock investment, from identifying the right stocks to maximizing your returns. So, let's get started and learn how to grab us stock like a pro!

Understanding the Stock Market

Before you can start grabbing stocks, it's essential to have a solid understanding of the stock market. The stock market is a place where companies sell shares of their ownership to investors, allowing them to become part-owners of the company. These shares are then traded on exchanges, like the New York Stock Exchange (NYSE) or the NASDAQ.

Identifying the Right Stocks

The first step in grabbing us stock is identifying the right stocks to invest in. This involves researching companies and analyzing their financial performance, market position, and growth potential. Here are some tips to help you find the best stocks:

Research the Company: Look for companies with a strong track record of profitability, stable revenue growth, and a solid financial position. Check their annual reports, earnings calls, and other financial statements for insights.

Analyze the Market: Understand the industry trends and competition that affect the company's performance. Look for companies that are leading in their industry and have a competitive edge.

Consider the Dividends: Companies that pay dividends can provide a steady income stream and can be a good sign of financial health.

Investing Strategies

Once you've identified potential stocks, the next step is to decide how to invest. There are several strategies you can consider:

Long-term Investing: Invest in companies you believe will grow over time. This strategy requires patience and a long-term perspective.

Dividend Investing: Invest in companies that pay dividends. This can provide a steady stream of income while your investments grow.

Growth Investing: Look for companies with high growth potential. These companies may not pay dividends but have the potential for significant capital appreciation.

Case Studies

To illustrate the effectiveness of these strategies, let's look at a few case studies:

Apple (AAPL): A long-term investor in Apple would have seen significant returns. Since 2010, Apple's stock has grown by over 700%.

Procter & Gamble (PG): For dividend investors, Procter & Gamble has been a solid choice. The company has increased its dividend for 65 consecutive years.

Amazon (AMZN): As a growth investor, Amazon has delivered exceptional returns. The company's stock has surged since its initial public offering (IPO) in 1997.

Risks and Considerations

While investing in stocks can be profitable, it's important to understand the risks involved:

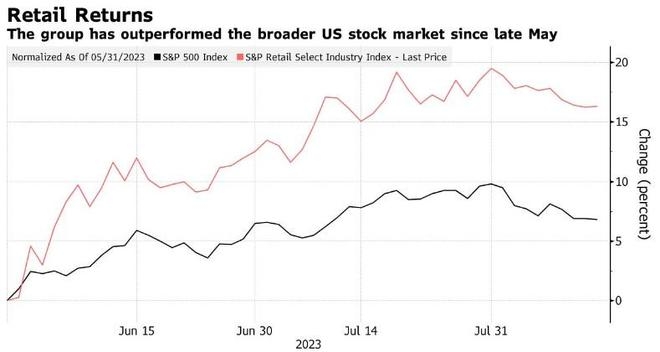

Market Volatility: Stock prices can fluctuate widely, leading to potential losses.

Liquidity: Some stocks may be less liquid, making it harder to buy or sell shares quickly.

Economic Factors: Economic downturns can negatively impact stock prices.

Conclusion

Grabbing us stock requires thorough research, careful analysis, and a clear investment strategy. By understanding the stock market, identifying the right stocks, and choosing the right investing strategy, you can increase your chances of success. So, don't wait—start investing today and grab yourself some stock!

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....