Introduction: The question on everyone's mind lately has been: "Is the US stock market going to crash?" With the recent fluctuations and uncertainties in the market, investors are on edge, trying to predict the future. This article delves into the various factors that could potentially lead to a stock market crash and examines the current market conditions. By understanding these factors, we can better prepare ourselves for whatever the future may hold.

Economic Factors One of the primary concerns regarding a potential stock market crash is the economic factors at play. Economic indicators such as GDP growth, unemployment rates, and inflation can all impact the stock market. Currently, the US economy is experiencing moderate growth, with a low unemployment rate and stable inflation. However, if these factors were to deteriorate significantly, it could lead to a stock market crash.

Political Factors The political landscape also plays a crucial role in the stock market. With the upcoming presidential election, investors are worried about potential policy changes that could affect the market. For instance, changes in trade policies, tax reforms, or healthcare reforms could have a significant impact on the stock market.

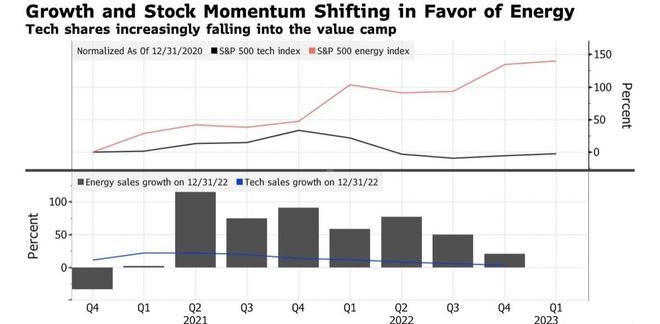

Technological Advancements Technological advancements have been a major driver of the stock market's growth over the past few years. However, rapid technological changes can also lead to market instability. As companies invest in new technologies, their stock prices may fluctuate, creating uncertainty in the market. It is essential to monitor these advancements and assess their potential impact on the stock market.

Market Valuations Another critical factor to consider is market valuations. The stock market has been on an upward trend for several years, leading to high valuations. When market valuations become overly optimistic, it can lead to a bubble, which could burst and cause a stock market crash. Investors should keep an eye on price-to-earnings (P/E) ratios and other valuation metrics to gauge whether the market is overvalued.

Case Study: The Dot-Com Bubble A prime example of a stock market crash is the dot-com bubble in the late 1990s. The market experienced rapid growth, driven by the proliferation of internet companies. However, when investors realized that many of these companies were not profitable, the bubble burst, leading to a significant crash in the stock market.

Conclusion: While predicting a stock market crash is difficult, it is essential to understand the various factors that could contribute to one. By monitoring economic, political, technological, and valuation factors, investors can better prepare themselves for potential market downturns. As we navigate through these uncertain times, it is crucial to remain vigilant and informed about the factors that could impact the US stock market.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....