Investing in the United States through a Canadian RRSP (Registered Retirement Savings Plan) can be a strategic move for many Canadian investors. This article will delve into the intricacies of using a Canadian RRSP to invest in US stocks, highlighting the benefits, risks, and practical steps to get started.

Understanding Canadian RRSPs

A Registered Retirement Savings Plan is a tax-advantaged savings account available to Canadian residents. Contributions to an RRSP are tax-deductible, and any earnings grow tax-deferred until withdrawal. This makes it an attractive vehicle for long-term savings and investment.

Investing in US Stocks through an RRSP

Investing in US stocks through a Canadian RRSP offers several advantages. Firstly, it allows investors to diversify their portfolio internationally, which can help mitigate risk. Secondly, the US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities.

Benefits of Investing in US Stocks through an RRSP

- Tax Advantages: Contributions to an RRSP are tax-deductible, reducing your taxable income in the current year. This can be particularly beneficial if you expect to be in a lower tax bracket during retirement.

- Diversification: Investing in US stocks through an RRSP allows you to diversify your portfolio internationally, which can help reduce risk and potentially increase returns.

- Access to a Wide Range of Investment Opportunities: The US stock market offers a vast array of companies across various sectors and industries, giving you the opportunity to invest in companies you believe in.

Risks to Consider

While investing in US stocks through an RRSP offers numerous benefits, it's important to be aware of the risks involved:

- Currency Risk: Investing in US stocks through an RRSP exposes you to currency fluctuations. If the Canadian dollar strengthens against the US dollar, your investments may be worth less when converted back to Canadian dollars.

- Market Risk: As with any investment, there is always the risk of market volatility and potential losses.

How to Invest in US Stocks through an RRSP

To invest in US stocks through an RRSP, you'll need to follow these steps:

- Open an RRSP Account: If you don't already have an RRSP account, you'll need to open one. You can do this through a bank, credit union, or mutual fund company.

- Choose a Broker: Once you have an RRSP account, you'll need to choose a broker to execute your investments. Many Canadian brokers offer access to US stocks through their platforms.

- Research and Select Stocks: Research and select the US stocks you want to invest in. Consider factors such as the company's financial health, industry, and market trends.

- Place Your Order: Once you've selected your stocks, place your order through your broker.

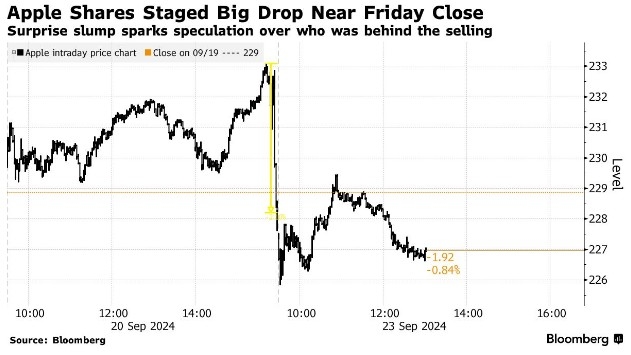

Case Study: Investing in Apple Inc. through an RRSP

Let's say you believe in Apple Inc.'s long-term potential and want to invest in the company through your RRSP. Here's how you could do it:

- Research Apple Inc.: Analyze the company's financial statements, market position, and growth prospects.

- Open an RRSP Account: If you don't already have an RRSP account, open one through a bank, credit union, or mutual fund company.

- Choose a Broker: Select a broker that offers access to US stocks through their platform.

- Place Your Order: Once you've chosen Apple Inc., place your order through your broker. The stock will be purchased and added to your RRSP account.

In conclusion, investing in US stocks through a Canadian RRSP can be a strategic move for many investors. By understanding the benefits, risks, and practical steps involved, you can make informed decisions about your investments. Remember to consult with a financial advisor to ensure that your investment strategy aligns with your financial goals and risk tolerance.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....