In the world of finance, the US stock market holds a special place. Known for its robustness and diversity, the C US stock market is a key indicator of the country's economic health. Whether you're a seasoned investor or just starting out, understanding the intricacies of the C US stock market is crucial. This article delves into the essentials of the US stock market, providing insights into its workings, key players, and potential investment opportunities.

The Basics of the US Stock Market

The US stock market is a vast network of exchanges where shares of publicly-traded companies are bought and sold. The most prominent exchanges include the New York Stock Exchange (NYSE) and the NASDAQ. These platforms facilitate the trading of stocks, bonds, and other financial instruments.

Key Players in the US Stock Market

Several key players shape the US stock market. These include:

- Investors: Individuals and institutions that buy and sell stocks.

- Brokers: Professionals who facilitate stock transactions on behalf of investors.

- Regulators: Agencies like the Securities and Exchange Commission (SEC) that oversee the market and ensure fair practices.

Understanding Stock Market Indices

The performance of the US stock market is often measured using indices. Some of the most well-known indices include:

- Dow Jones Industrial Average (DJIA): A price-weighted average of 30 large publicly-traded companies.

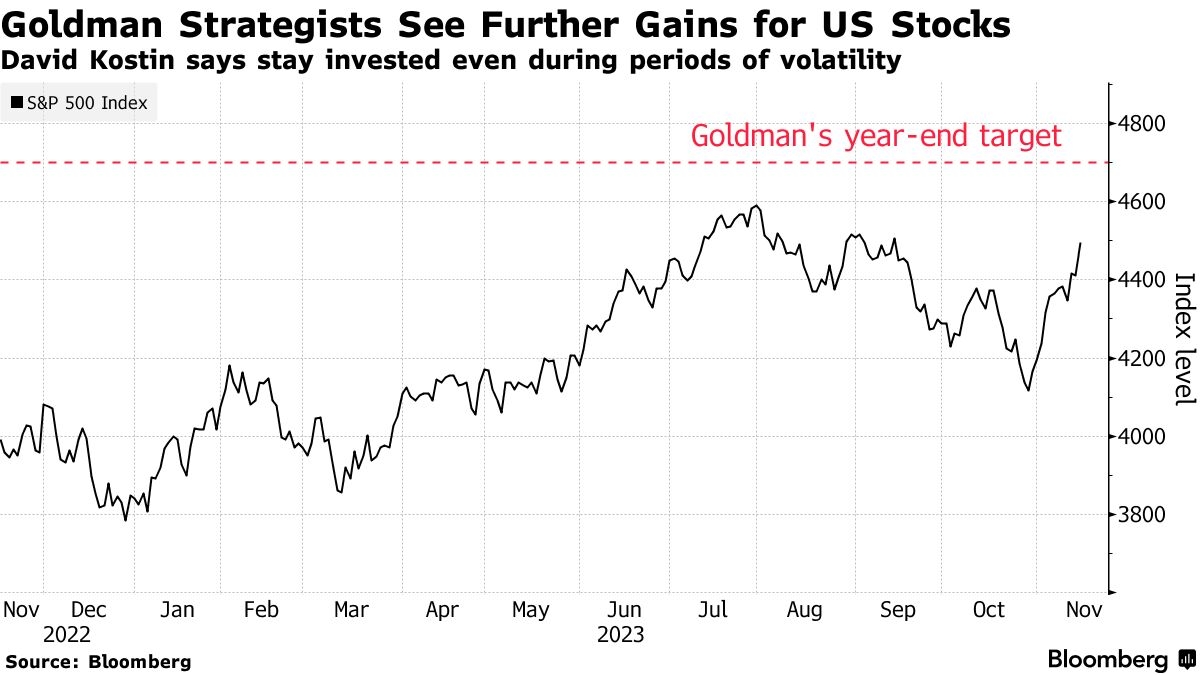

- S&P 500: A broad stock market index that tracks the performance of 500 large companies.

- NASDAQ Composite: An index that includes all domestic and international common stocks listed on the NASDAQ.

Investing in C US Stocks

Investing in C US stocks involves several steps. Here's a brief overview:

- Research: Familiarize yourself with different sectors and companies. Look for companies with strong fundamentals and a solid track record.

- Open a Brokerage Account: Choose a reputable brokerage firm and open an account.

- Choose Stocks: Select stocks that align with your investment goals and risk tolerance.

- Monitor Your Investments: Regularly review your portfolio and make adjustments as needed.

Case Study: Apple Inc.

A prime example of a successful C US stock is Apple Inc. Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world's most valuable companies. Its stock has provided investors with substantial returns over the years, making it a popular choice for long-term investors.

Risks and Rewards

Investing in the US stock market carries both risks and rewards. While the potential for high returns is significant, it's important to be aware of the following risks:

- Market Volatility: Stock prices can fluctuate widely, leading to potential losses.

- Economic Factors: Economic downturns can impact stock prices.

- Company-Specific Risks: Issues within a company, such as poor financial performance or management problems, can negatively impact its stock price.

Conclusion

The C US stock market is a dynamic and complex market that offers numerous opportunities for investors. By understanding its workings, key players, and risks, you can make informed investment decisions. Whether you're looking for long-term growth or short-term gains, the US stock market has something to offer. Always remember to do your research and consult with a financial advisor before making any investment decisions.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....