In today's fast-paced world, the US stock market remains a key indicator of the country's economic health. As investors and traders, it's crucial to understand the current economic environment to make informed decisions. This article delves into the latest trends, challenges, and opportunities in the US stock market.

The Current State of the US Stock Market

The US stock market has experienced a rollercoaster of emotions over the past few years. From the bull market of 2017 to the pandemic-induced downturn in 2020, and now the gradual recovery, the market's performance has been nothing short of fascinating. The S&P 500, a widely followed index, has recovered significantly from its 2020 lows, showcasing the resilience of the US economy.

Trends to Watch

Technology Stocks: Technology companies have been at the forefront of the market's growth. Firms like Apple, Microsoft, and Amazon have continued to dominate the landscape, driving the market upwards. As remote work becomes the new normal, tech stocks are expected to remain a significant force.

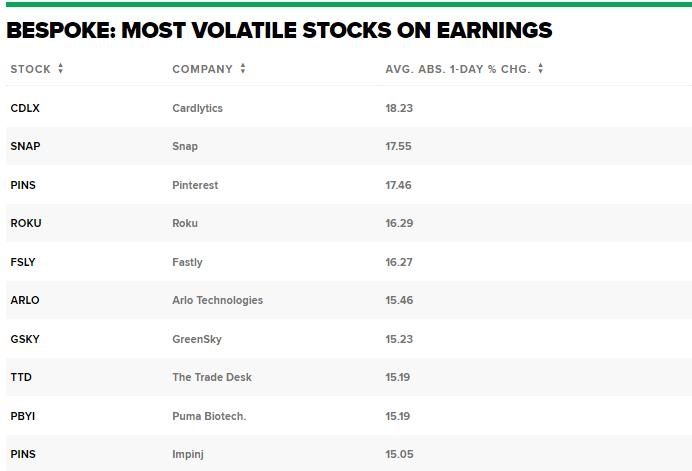

Earnings Reports: Companies have started to release their quarterly earnings reports, and the results have been mixed. While many tech companies have surpassed expectations, traditional sectors like energy and manufacturing have struggled.

Inflation and Interest Rates: The Federal Reserve has been closely monitoring inflation, and recent data suggests that prices are on the rise. The central bank is expected to raise interest rates to control inflation, which could have implications for the stock market.

Challenges and Risks

Political Uncertainty: The upcoming presidential election and potential policy changes could impact the market. Investors need to stay vigilant about political developments and how they might affect various sectors.

Global Economic Recovery: The pace of the global economic recovery remains uncertain. The US stock market is closely tied to the global economy, and any setbacks in other countries could impact US markets.

Market Valuations: The US stock market is currently valued at historic highs, raising concerns about overvaluation. Investors need to be cautious and not solely focus on short-term gains.

Case Studies

Tesla (TSLA): Tesla has been a standout performer in the stock market. Its innovative electric vehicles and aggressive expansion plans have captured investors' attention. Despite facing challenges, such as supply chain issues and regulatory scrutiny, Tesla has managed to maintain its position as a market leader.

Johnson & Johnson (JNJ): Johnson & Johnson has demonstrated resilience in the face of the pandemic. The company's healthcare products and pharmaceuticals have been in high demand, driving its stock price upwards.

Conclusion

The current economic environment in the US stock market is complex and ever-changing. Investors need to stay informed and adaptable to navigate the challenges and opportunities that lie ahead. By focusing on key trends, managing risks, and making informed decisions, investors can achieve long-term success in the stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....