In the ever-evolving world of finance, stock indexes play a crucial role in reflecting the overall performance of the stock market. The United States, being the world's largest economy, boasts a variety of stock indexes that investors closely monitor. This article aims to provide a comprehensive guide to the most significant stock indexes in the US, their history, composition, and how they impact the market.

The S&P 500

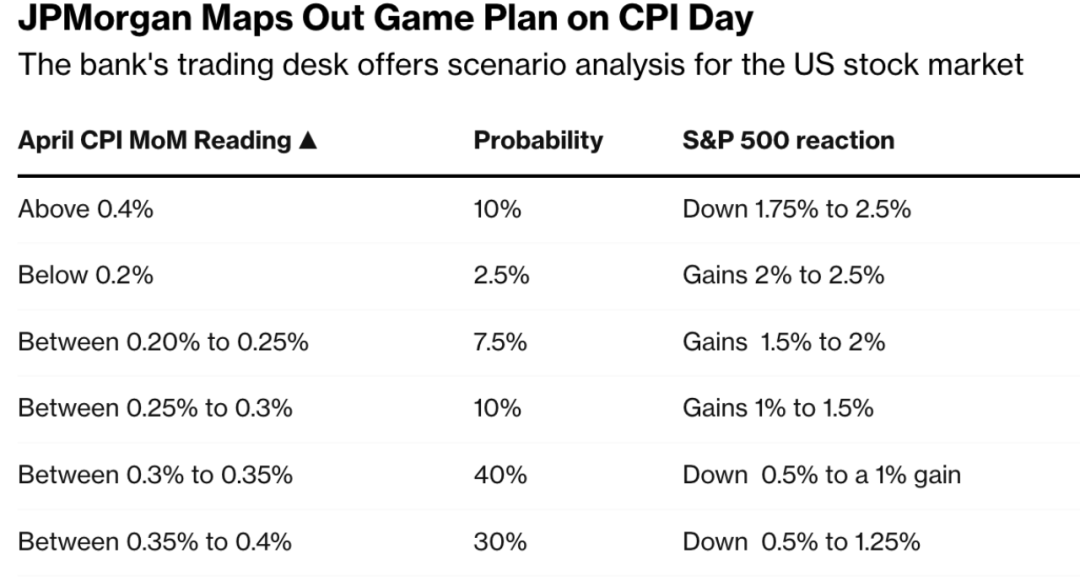

The S&P 500 is perhaps the most well-known stock index in the US. It consists of 500 large-cap companies across various sectors, representing approximately 80% of the total market capitalization of the US stock market. The index was first introduced in 1957 and has since become a benchmark for the performance of the US stock market. Historically, the S&P 500 has provided a good indication of the overall market trend.

The Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is another iconic stock index in the US. It includes 30 large-cap companies across various sectors and is often considered a bellwether for the US economy. The DJIA was first published in 1896 and has been a reliable indicator of market trends over the years. One of the key advantages of the DJIA is its simplicity, as it only includes 30 companies, making it easier for investors to track.

The NASDAQ Composite

The NASDAQ Composite is a broad-based index that includes all domestic and international common stocks listed on the NASDAQ Stock Market. It is particularly known for its technology-heavy composition, with companies like Apple, Microsoft, and Amazon being part of the index. The NASDAQ Composite was first introduced in 1971 and has become a significant benchmark for the technology sector.

The Russell 3000

The Russell 3000 is a comprehensive index that measures the performance of the 3000 largest US companies, representing approximately 98% of the investable US equity market. It is divided into three segments: large, mid, and small-cap companies. The Russell 3000 was created in 1984 and is often used as a benchmark for the US stock market as a whole.

Impact of Stock Indexes on the Market

Stock indexes have a significant impact on the market. They provide investors with a quick and easy way to gauge the overall market trend and make informed investment decisions. When a stock index is rising, it generally indicates a strong market, while a falling index suggests a bearish market.

Case Study: The 2008 Financial Crisis

One of the most significant events in the history of stock indexes was the 2008 financial crisis. The S&P 500 and the DJIA plummeted by more than 50% during the crisis, reflecting the widespread panic and uncertainty in the market. This event highlighted the importance of stock indexes in providing a snapshot of the market's health.

In conclusion, stock indexes in the US are vital tools for investors and market analysts. They offer a comprehensive view of the market and help investors make informed decisions. Whether you are a seasoned investor or just starting out, understanding the different stock indexes and their impact on the market is crucial for success in the stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....