Are you looking to dive into the world of high-potential investments? If so, the US Growth Stocks Index is a fantastic tool to help you identify and capitalize on emerging market trends. This index is designed to track the performance of companies that exhibit strong growth potential and are expected to deliver significant returns over the long term. In this article, we'll explore what the US Growth Stocks Index is, how it can benefit investors, and provide some valuable insights to help you navigate this dynamic market.

Understanding the US Growth Stocks Index

The US Growth Stocks Index is a benchmark that measures the performance of companies with above-average growth prospects. These companies typically operate in industries with strong long-term growth potential and are characterized by consistent revenue and earnings growth. The index is a crucial resource for investors seeking exposure to high-growth sectors, such as technology, healthcare, and consumer discretionary.

Key Features of the US Growth Stocks Index

- Strong Growth Potential: Companies included in the index demonstrate above-average revenue and earnings growth, indicating a high likelihood of long-term success.

- Sector Diversity: The index covers a wide range of sectors, allowing investors to diversify their portfolios and mitigate risk.

- Market Capitalization: Companies listed in the index generally have a significant market capitalization, providing stability and liquidity.

Benefits of Investing in the US Growth Stocks Index

- Potential for High Returns: Investing in high-growth companies can lead to significant returns over the long term, as these companies are poised to capitalize on market trends and expand their market share.

- Diversification: By investing in a diversified basket of companies, investors can reduce their exposure to individual stock risk.

- Access to High-Potential Sectors: The US Growth Stocks Index provides access to promising sectors that may outperform the broader market in the long run.

How to Invest in the US Growth Stocks Index

Investors can gain exposure to the US Growth Stocks Index through a variety of investment vehicles, including:

- Index Funds: These funds track the performance of the index and provide investors with a cost-effective way to invest in a diversified portfolio of high-growth companies.

- ETFs (Exchange-Traded Funds): ETFs are similar to index funds but are traded on exchanges throughout the day, offering liquidity and lower transaction costs.

- Stocks: Individual investors can purchase shares of companies included in the index to gain direct exposure.

Case Studies: Success Stories from the US Growth Stocks Index

To illustrate the potential of the US Growth Stocks Index, let's look at a few successful companies:

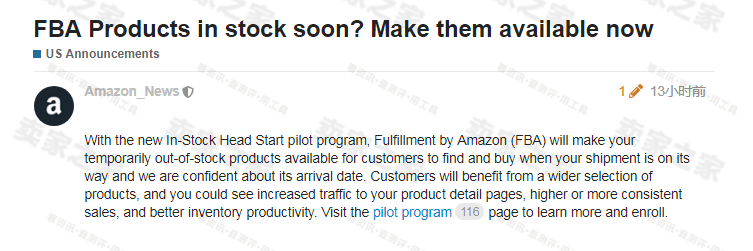

- Amazon: Since its inception, Amazon has been a dominant player in the e-commerce industry, delivering strong revenue and earnings growth. Its inclusion in the US Growth Stocks Index highlights its potential for continued success.

- Apple: As a leader in the technology sector, Apple has consistently delivered impressive growth, making it a prime example of a company that belongs in the US Growth Stocks Index.

- Tesla: Known for its innovative electric vehicles, Tesla has experienced rapid growth in recent years and has become a staple of the US Growth Stocks Index.

In conclusion, the US Growth Stocks Index is an essential tool for investors looking to capitalize on high-potential investments. By understanding its key features, benefits, and investment opportunities, you can navigate this dynamic market and potentially achieve significant returns. Remember to conduct thorough research and consider your risk tolerance before making any investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....