In today's fast-paced world, investing in the right sector can be a game-changer for your portfolio. Among the numerous industries out there, the healthcare sector has always been a safe bet for investors looking for long-term growth. One particular area that has been making waves is "US Med Stock," a term that encompasses medical stocks within the United States. In this article, we will delve into the world of US Med Stock, exploring its potential, benefits, and the key players that you should keep an eye on.

Understanding US Med Stock

To begin with, let's clarify what we mean by "US Med Stock." It refers to publicly-traded companies that are involved in the healthcare industry within the United States. This includes pharmaceutical companies, biotech firms, medical device manufacturers, and healthcare providers. These stocks are often considered to be a bellwether for the broader healthcare sector and are typically seen as a stable investment.

The Benefits of Investing in US Med Stock

Investing in US Med Stock offers several benefits:

Stable Growth: The healthcare industry is essential for any economy, and as the population grows and ages, the demand for healthcare services and products continues to rise. This makes US Med Stock a stable investment with long-term growth potential.

Innovative Products: The healthcare sector is known for its continuous innovation. By investing in US Med Stock, you get a chance to be part of groundbreaking developments in pharmaceuticals, biotechnology, and medical devices.

Diverse Opportunities: The healthcare industry encompasses a wide range of sectors, giving investors diverse opportunities to invest in areas they are passionate about or believe in.

Key Players in US Med Stock

Several companies have made a name for themselves in the US Med Stock market. Here are a few notable ones:

Pfizer Inc. (PFE): As one of the world's largest pharmaceutical companies, Pfizer has a strong pipeline of new drugs and is involved in numerous partnerships and collaborations.

Johnson & Johnson (JNJ): A diversified healthcare giant, Johnson & Johnson has a presence in multiple sectors, including pharmaceuticals, medical devices, and consumer healthcare products.

AbbVie Inc. (ABBV): Known for its innovative therapies, AbbVie has a robust pipeline of drugs and is a leader in the biotech industry.

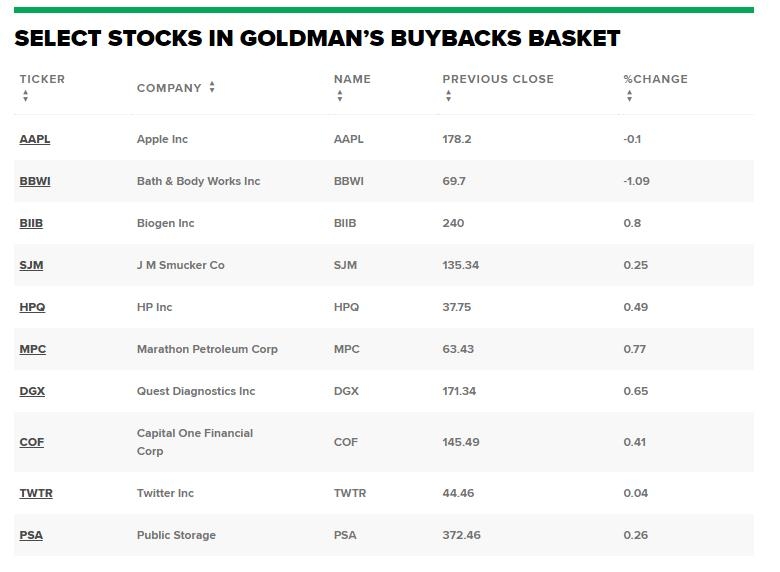

Biogen Inc. (BIIB): A leader in the development of therapies for neurological diseases, Biogen has several successful drugs on the market and a promising pipeline.

Case Studies: Successful US Med Stock Investments

Several investors have reaped the benefits of investing in US Med Stock. One such example is the investment in Amgen Inc. (AMGN), a biotech firm known for its innovative therapies. When Amgen's drug, Enbrel, was approved in 1998, it quickly became a blockbuster drug, propelling the company's stock to new heights. Investors who bought Amgen's stock in the early 1990s and held on to it saw their investment grow significantly over the years.

In conclusion, US Med Stock represents a promising investment opportunity for those looking to capitalize on the healthcare industry's growth. By understanding the benefits, key players, and historical successes, you can make informed decisions about your investments in this exciting sector.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....