Understanding the Significance of US Stock Exchange Indices

The US stock exchange indices are among the most closely watched and influential financial metrics in the world. They offer a snapshot of the overall performance of the stock market, providing investors with valuable insights into market trends and economic conditions. This article delves into the key US stock exchange indices, their history, and their significance in the global financial landscape.

Dow Jones Industrial Average (DJIA)

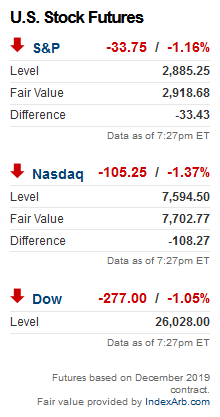

The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," is one of the oldest and most widely followed stock market indices. It consists of 30 large, publicly-owned companies across various sectors of the economy. The DJIA serves as a benchmark for the performance of the US stock market and is often used to gauge the overall health of the American economy.

Standard & Poor's 500 (S&P 500)

The Standard & Poor's 500 (S&P 500) index is a widely recognized measure of the performance of the stock market. It includes the stocks of 500 large companies from across the United States, representing various sectors and industries. The S&P 500 is considered a key indicator of the US economy and is often used to assess market trends and economic conditions.

NASDAQ Composite

The NASDAQ Composite index is a widely followed index that tracks the performance of all companies listed on the NASDAQ exchange. It includes a diverse range of companies, from small startups to large multinational corporations. The NASDAQ Composite is particularly known for its role in the technology sector, with many of the world's leading tech companies, such as Apple, Microsoft, and Amazon, being part of the index.

Case Study: The Impact of the S&P 500 on the Stock Market

One notable example of the impact of the S&P 500 on the stock market is the financial crisis of 2008. As the crisis unfolded, the S&P 500 experienced a significant decline, reflecting the widespread turmoil in the financial sector. This decline was a bellwether for the broader stock market, leading to a widespread sell-off and contributing to the overall economic downturn.

Key Takeaways

Understanding the US stock exchange indices is crucial for investors who want to gain a comprehensive view of the stock market and economic conditions. By analyzing these indices, investors can make informed decisions about their investments and stay ahead of market trends.

- Dow Jones Industrial Average (DJIA): Tracks the performance of 30 large, publicly-owned companies across various sectors.

- Standard & Poor's 500 (S&P 500): Includes the stocks of 500 large companies from across the United States, representing various sectors and industries.

- NASDAQ Composite: Tracks the performance of all companies listed on the NASDAQ exchange, particularly known for its role in the technology sector.

By keeping a close eye on these indices, investors can stay informed about market trends and economic conditions, helping them make better investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....