Introduction

A government shutdown is a scenario that sends ripples through the economy, and the stock market is no exception. In October 2025, if the US government faces a shutdown, investors and market analysts are already bracing for potential impacts. This article delves into the possible consequences of a government shutdown on the stock market, highlighting key areas of concern and providing insights into how investors can navigate such a volatile period.

Understanding the Implications

A government shutdown occurs when the federal government is unable to fund its operations due to a lack of appropriations. This can lead to a halt in government services, including those that directly or indirectly affect the economy. Here are some of the key implications for the stock market:

1. Government Contractors and Employees

Government contractors and employees are among the first to feel the pinch during a shutdown. With reduced or halted operations, their ability to contribute to the economy diminishes. This can lead to a decline in corporate earnings, particularly for companies with significant government contracts. Contractors such as Lockheed Martin and Raytheon could face revenue uncertainty, impacting their stock prices.

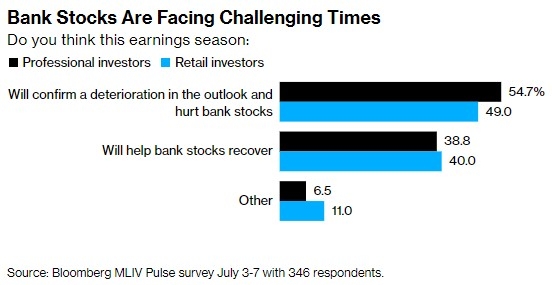

2. Defense and Security Stocks

The defense sector is often considered a bellwether for government shutdowns. With a shutdown, defense spending may be impacted, leading to a potential decline in defense stocks. Companies like Boeing and Northrop Grumman could see their stocks affected as the government's ability to fund military contracts is compromised.

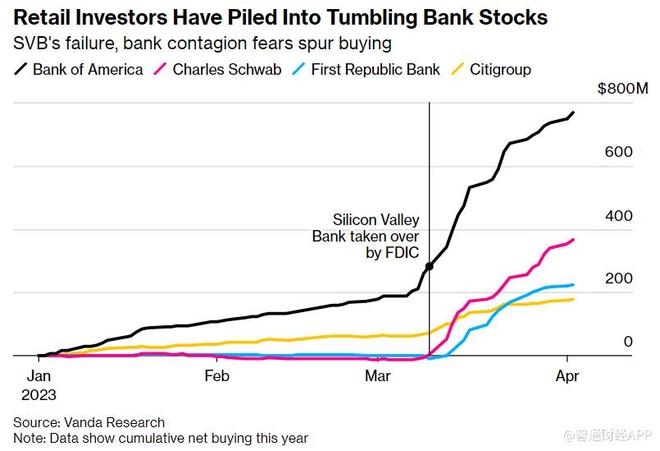

3. Consumer Spending

Government employees, who are often among the middle class, may experience a sudden loss of income during a shutdown. This can lead to a decrease in consumer spending, which in turn can impact companies across various sectors. Retail companies like Walmart and Target could see a decline in sales as consumers tighten their budgets.

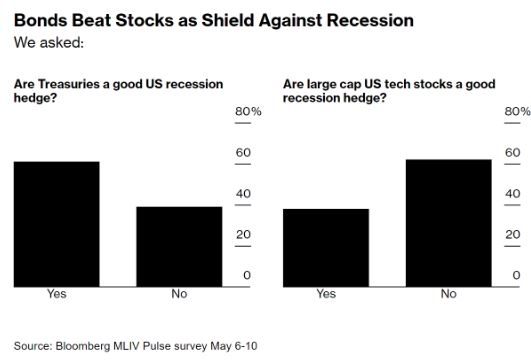

4. Interest Rates and Borrowing Costs

A government shutdown can also impact the bond market, potentially leading to higher interest rates. This is because the government may need to borrow more to cover its expenses during the shutdown. Higher interest rates can have a negative impact on stocks, particularly in sectors sensitive to borrowing costs, such as real estate and utilities.

Case Study: The 2018 Government Shutdown

In 2018, the US government faced a shutdown for 35 days, the longest in history. During this period, the stock market experienced significant volatility. The S&P 500 fell by approximately 6.9% during the shutdown, with the tech sector being the hardest hit. Companies like Amazon and Apple saw their stock prices decline as investors worried about the broader economic impact of the shutdown.

Navigating the Volatility

For investors, navigating the volatility associated with a government shutdown requires a cautious approach. Here are some strategies to consider:

- Diversify Your Portfolio: Diversification can help mitigate the impact of a government shutdown on your investments. Consider allocating your assets across various sectors and asset classes to reduce risk.

- Focus on Companies with Strong Fundamentals: Companies with strong financial health and solid fundamentals are more likely to weather the storm of a government shutdown. Look for companies with low debt levels and strong cash flow.

- Stay Informed: Keep yourself updated with the latest news and developments related to the government shutdown. This will help you make informed decisions about your investments.

Conclusion

A government shutdown in October 2025 could have significant implications for the stock market. By understanding the potential impacts and adopting a cautious approach, investors can navigate the volatility and protect their investments.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....