Are you looking to expand your investment portfolio and include US stocks, but unsure of how to get started from New Zealand? Trading US stocks can be a great way to diversify your investments and potentially earn higher returns. In this article, we will guide you through the process of trading US stocks from New Zealand, including the necessary steps and tips to help you succeed.

Understanding the Basics

Before diving into trading US stocks, it's important to understand the basics. The US stock market is one of the largest and most liquid in the world, with numerous exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. When you trade US stocks, you're essentially buying a share of a company listed on one of these exchanges.

Choosing a Broker

The first step in trading US stocks from New Zealand is to choose a reliable broker. A broker acts as an intermediary between you and the stock market, allowing you to buy and sell stocks. When selecting a broker, consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable financial authority, such as the Financial Markets Authority (FMA) in New Zealand.

- Fees: Compare the fees charged by different brokers, including brokerage fees, transaction fees, and currency conversion fees.

- Platform: Look for a broker with a user-friendly trading platform that offers the tools and resources you need to make informed investment decisions.

Some popular brokers for trading US stocks from New Zealand include Interactive Brokers, Charles Schwab, and TD Ameritrade.

Opening an Account

Once you've chosen a broker, the next step is to open an account. This process typically involves providing personal and financial information, such as your name, address, and tax identification number. You may also need to provide proof of identity and address.

After your account is approved, you can fund it using various methods, such as bank transfers, credit cards, or wire transfers. It's important to note that trading US stocks may incur currency conversion fees, so it's best to choose a broker that offers competitive exchange rates.

Understanding Market Hours

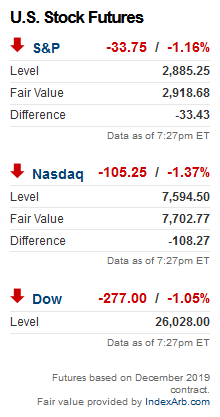

The US stock market operates during specific hours, typically from 9:30 AM to 4:00 PM Eastern Standard Time (EST). However, it's important to note that trading can occur outside of regular market hours, including before the market opens (pre-market) and after the market closes (after-hours).

Placing Orders

Once your account is funded, you can start placing orders to buy or sell US stocks. There are several types of orders you can use, including market orders, limit orders, and stop orders. It's important to understand the differences between these orders and how they can impact your investments.

- Market Orders: These orders are executed immediately at the best available price.

- Limit Orders: These orders are executed at a specified price or better.

- Stop Orders: These orders are triggered when a stock reaches a certain price, either to buy or sell.

Monitoring Your Investments

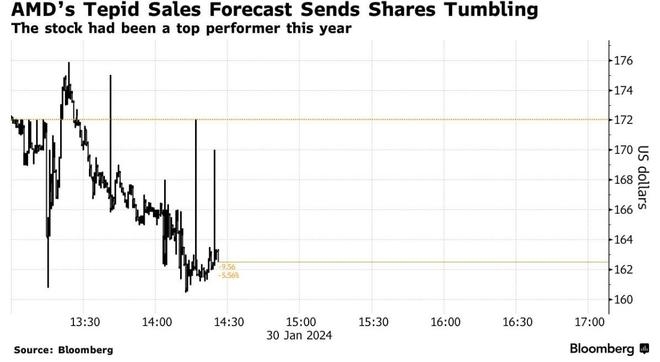

After placing your orders, it's important to monitor your investments regularly. This includes keeping an eye on market news, company earnings reports, and any other relevant information that could impact the value of your stocks.

Case Study: Investing in Apple Inc.

Let's say you want to invest in Apple Inc. (AAPL), one of the most popular companies in the US stock market. After opening an account with a broker and funding it, you can place a market order to buy shares of Apple at the current market price. As an investor, it's important to monitor Apple's performance and stay informed about any news or developments that could impact its stock price.

Conclusion

Trading US stocks from New Zealand can be a great way to diversify your investment portfolio and potentially earn higher returns. By choosing a reliable broker, understanding market hours, and monitoring your investments, you can increase your chances of success. Remember to do your research and stay informed about the market to make the best investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....