On August 7, 2025, the US stock market experienced a day of significant movements, influenced by a mix of economic indicators, corporate earnings reports, and global events. This article provides a comprehensive summary of the key developments and insights from the day.

Economic Indicators

The day began with the release of several important economic indicators. The US Bureau of Labor Statistics reported a lower-than-expected unemployment rate, which fell to 3.6%. This data suggested a strong labor market and supported investor optimism.

Additionally, the Consumer Price Index (CPI) showed a slight decrease in inflation, coming in at 1.9%. This was below the consensus estimate of 2.1%, and it provided further evidence that inflation may be under control.

Corporate Earnings Reports

Several major companies reported their second-quarter earnings on August 7, 2025. The results were mixed, with some companies exceeding expectations while others missed the mark.

Apple Inc. (AAPL): The tech giant reported strong earnings, with revenue and profit growth that beat analyst estimates. This led to a surge in AAPL stock, which closed the day up 3.5%.

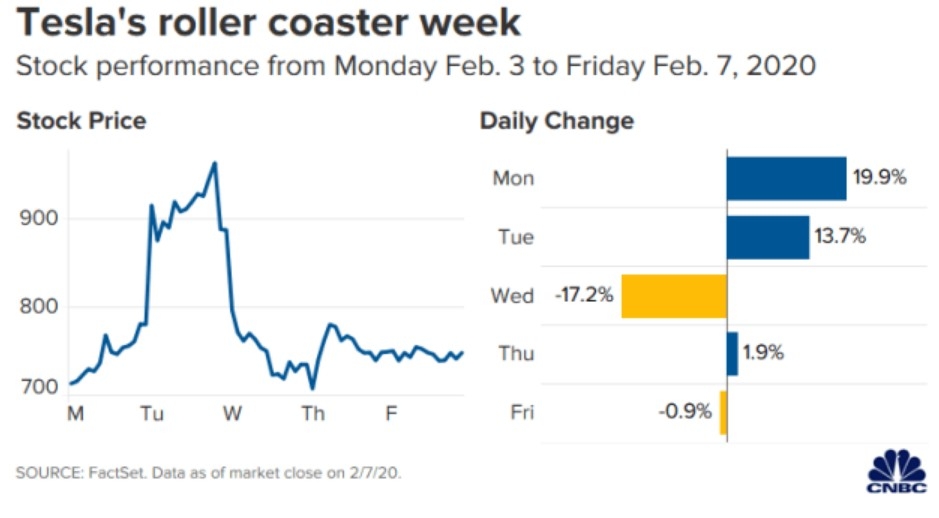

Tesla Inc. (TSLA): The electric vehicle manufacturer reported a slowdown in deliveries, which caused its stock to fall by 2.8%. However, the company also announced plans to expand its production capacity, which helped to limit the decline.

Energy Sector

The energy sector was among the day's biggest winners, driven by rising oil prices. The West Texas Intermediate (WTI) crude oil price closed at

Global Events

Global events also played a significant role in the stock market's movements on August 7, 2025. Tensions between the US and China escalated, leading to concerns about a potential trade war. This caused the S&P 500 to fall by 1.2%.

Sector Performance

Technology: The technology sector was the best-performing sector of the day, with the NASDAQ Composite closing up 1.8%. This was driven by strong earnings reports from major tech companies, including Apple and Microsoft.

Energy: The energy sector was the second-best-performing sector, with the Energy Select Sector SPDR Fund (XLE) closing up 1.5%.

Consumer Discretionary: The consumer discretionary sector was the worst-performing sector of the day, with the Consumer Discretionary Select Sector SPDR Fund (XLY) closing down 0.8%.

Conclusion

The US stock market experienced a day of mixed results on August 7, 2025. While economic indicators and corporate earnings reports provided some optimism, global events and sector performance created uncertainty. Investors will need to closely monitor these factors as they navigate the market in the coming weeks and months.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....