Are you looking to capitalize on the potential of high momentum stocks in the US market? If so, you've come to the right place. High momentum stocks are shares of companies that are currently experiencing rapid growth in their stock prices. In this article, we will delve into what makes a high momentum stock, how to identify them, and why they can be attractive investments.

What is a High Momentum Stock?

A high momentum stock is one that has seen a significant increase in its stock price over a relatively short period. These stocks often exhibit rapid price movements, and they can be highly volatile. Investors who specialize in momentum trading believe that these stocks are likely to continue rising in value.

Identifying High Momentum Stocks

To identify high momentum stocks, investors often look at several key factors:

- Stock Price Performance: Look for companies whose stock prices have seen significant growth in a short period.

- Volume: High trading volumes suggest that there is significant interest in the stock, which can contribute to its momentum.

- Earnings Growth: Companies with strong earnings growth are often seen as high momentum stocks.

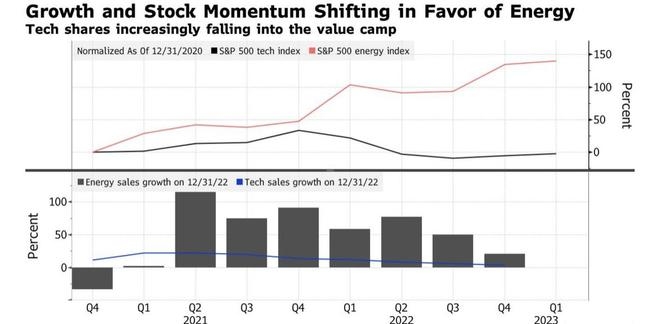

- Sector Trends: Some sectors, like technology or biotechnology, may see increased momentum due to market trends.

Why Invest in High Momentum Stocks?

Investing in high momentum stocks can offer several advantages:

- Potential for High Returns: High momentum stocks have the potential to deliver significant returns in a short period.

- Market Trends: Investing in high momentum stocks can allow investors to capitalize on market trends and consumer demand.

- Diversification: High momentum stocks can be a good addition to a diversified investment portfolio.

Case Studies

Let's look at a few recent examples of high momentum stocks in the US market:

- Tesla (TSLA): Tesla has been a high momentum stock for years, driven by its leadership in electric vehicles and renewable energy technology.

- Shopify (SHOP): Shopify's stock has seen significant growth due to its role in the e-commerce industry and its ability to help businesses go online.

- Snowflake (SNOW): Snowflake's stock has been on the rise as more companies look to move their data to the cloud.

Conclusion

Investing in high momentum stocks can be an exciting way to capitalize on market trends and potential growth. However, it's important to do thorough research and understand the risks associated with these stocks. High momentum stocks can be highly volatile, and their prices can fluctuate rapidly. By keeping an eye on key indicators and staying informed about market trends, you can make more informed decisions about your investments in high momentum stocks in the US market.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....