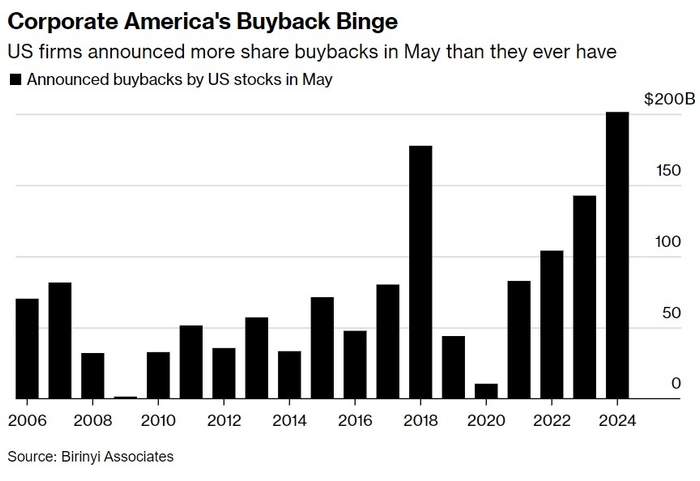

The world of finance is a dynamic landscape, with companies constantly evolving their strategies to maximize shareholder value. One such strategy is stock buybacks, where companies repurchase their own shares from the market. This practice has been a key component of corporate finance for decades, and its impact on the stock market cannot be overstated. In this article, we delve into the trends of US stock buybacks over the years, highlighting the significant changes and insights gained from this analysis.

The Rise of Stock Buybacks

In the early 1980s, stock buybacks were a relatively rare occurrence. However, as the years went by, their popularity skyrocketed. By the late 1990s, the trend had become a mainstream practice, with many companies engaging in large-scale buybacks. This surge in buybacks can be attributed to several factors, including the desire to boost earnings per share (EPS), reduce share dilution, and signal confidence in the company's future prospects.

Buybacks by Year: A Decade-by-Decade Overview

1980s: The nascent era of stock buybacks

In the 1980s, stock buybacks were primarily driven by tax considerations. The Tax Reform Act of 1986 eliminated the ability to deduct interest expenses on corporate debt, making stock buybacks an attractive alternative for companies looking to reduce their tax burden. During this decade, buybacks were relatively small and not a major focus for most companies.

1990s: The buyback boom

The 1990s marked the beginning of the buyback boom. As the economy grew and companies accumulated substantial cash reserves, they began to use these funds for buybacks. The focus shifted from tax considerations to EPS enhancement and signaling. In 1998, for example, the total value of stock buybacks in the US reached

2000s: The tech bubble and aftermath

The early 2000s were characterized by the tech bubble, which led to a surge in stock prices and, consequently, buybacks. However, the bubble's burst in 2000 triggered a downturn in the stock market, leading to a decrease in buybacks. Despite this, companies continued to repurchase shares, although at a slower pace than in the 1990s.

2010s: The era of low interest rates and corporate activism

The 2010s saw a resurgence in stock buybacks, driven by low interest rates and the rise of corporate activism. Companies had ample access to capital, making buybacks an attractive investment option. Moreover, activists pushed companies to increase their buyback programs, arguing that it would boost shareholder value.

2020s: The impact of the COVID-19 pandemic

The COVID-19 pandemic brought unprecedented challenges to the global economy. While some companies paused their buyback programs during the early stages of the pandemic, many resumed them as the economy recovered. The pandemic's impact on stock buybacks varied by industry, with some sectors experiencing a surge in buybacks while others saw a decrease.

Case Studies: Successful and Controversial Buyback Programs

One notable example of a successful stock buyback program is Apple Inc. In 2012, the company announced a

On the other hand, some buyback programs have been controversial. For instance, in 2016, Pfizer's $10 billion buyback program sparked criticism from activists, who argued that the company should instead reinvest in research and development.

Conclusion

The trend of US stock buybacks has evolved significantly over the years, driven by various factors such as tax considerations, EPS enhancement, and corporate activism. As the landscape continues to change, it remains to be seen how companies will utilize this tool to maximize shareholder value. By analyzing the buyback trends by year, we gain valuable insights into the changing dynamics of the stock market and the strategies employed by companies to navigate this complex environment.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....