In the intricate world of finance, the US dollar and the stock market often dance to the same beat, yet their movements can sometimes be at odds. Understanding the interplay between these two powerful forces is crucial for investors looking to navigate the complex financial landscape. This article delves into the relationship between the US dollar and the stock market, highlighting key factors and providing insights into how they influence each other.

Understanding the US Dollar

The US dollar, as the world's reserve currency, plays a pivotal role in global finance. It serves as a benchmark for currency valuation and is used in the majority of international trade transactions. The value of the US dollar is influenced by various factors, including economic indicators, monetary policy, and geopolitical events.

When the US dollar strengthens, it can negatively impact the stock market. This is because a stronger dollar makes US stocks more expensive for foreign investors, who need to exchange their local currency for dollars. As a result, demand for US stocks may decrease, leading to a potential decline in their prices.

Understanding the Stock Market

The stock market, on the other hand, reflects the collective value of publicly traded companies. It serves as a barometer for the overall health of the economy. The stock market's performance is influenced by factors such as corporate earnings, economic indicators, and investor sentiment.

A strong stock market generally indicates a positive outlook for the economy, which can lead to an appreciation of the US dollar. Conversely, a weak stock market may signal economic uncertainty, potentially causing the US dollar to weaken.

The Interplay Between the US Dollar and Stock Market

The relationship between the US dollar and the stock market is complex and often interdependent. Here are a few key factors to consider:

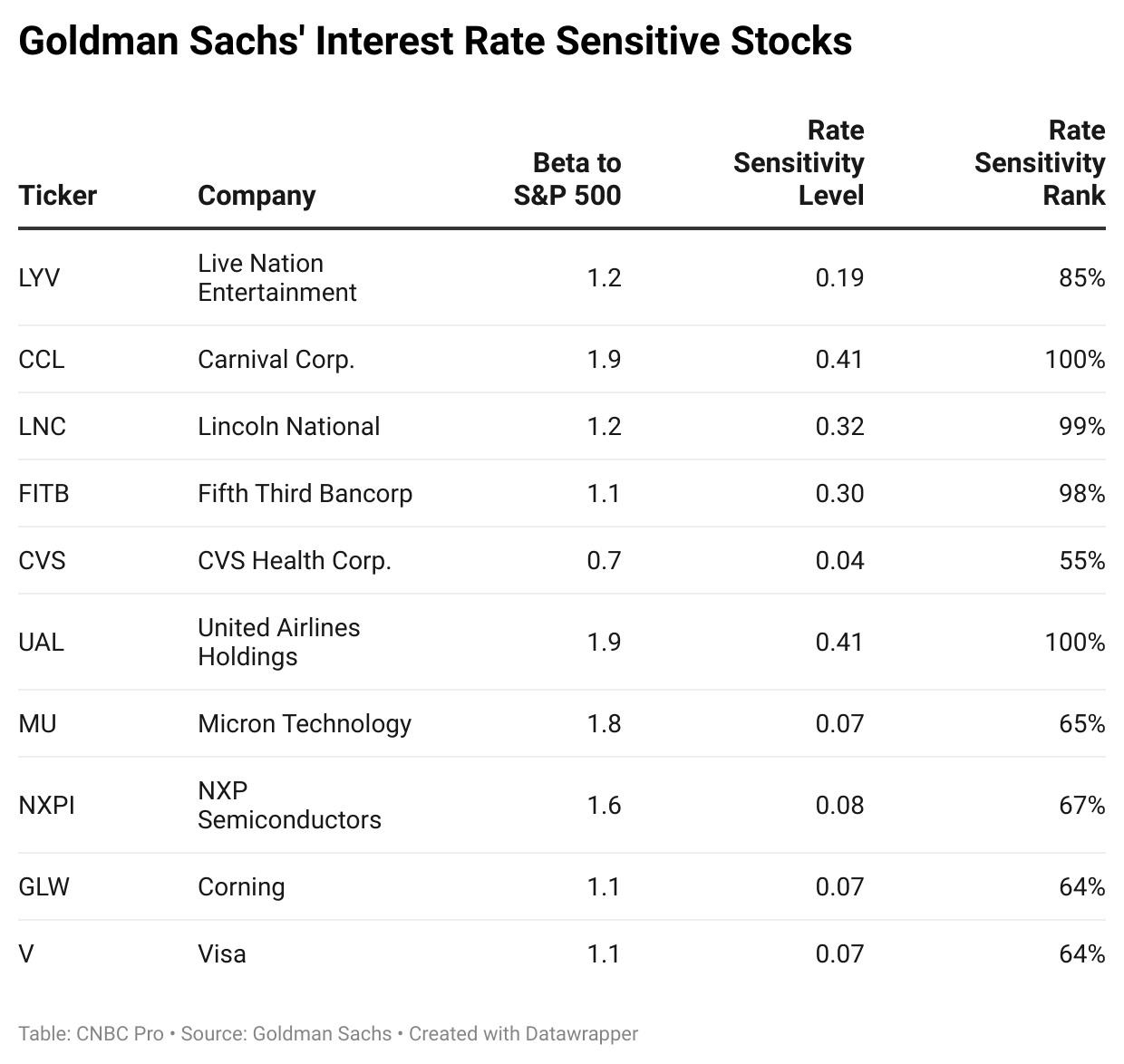

Interest Rates: Central banks, such as the Federal Reserve, use interest rates as a tool to influence the economy. When interest rates rise, the US dollar tends to strengthen, potentially impacting the stock market negatively. Conversely, lower interest rates can weaken the US dollar and boost the stock market.

Economic Indicators: Economic indicators, such as GDP growth, unemployment rates, and inflation, can impact both the US dollar and the stock market. For example, a strong GDP growth rate can boost the stock market and strengthen the US dollar.

Geopolitical Events: Geopolitical events, such as elections or international conflicts, can lead to volatility in both the US dollar and the stock market. In such situations, investors often seek safety in US dollars, leading to a potential increase in its value and a potential decline in the stock market.

Case Studies

To illustrate the relationship between the US dollar and the stock market, let's consider a few recent case studies:

2018: In 2018, the US dollar strengthened significantly as the Federal Reserve raised interest rates. This had a negative impact on the stock market, which experienced a bear market.

2020: In response to the COVID-19 pandemic, the Federal Reserve implemented an aggressive monetary policy, leading to a weakening of the US dollar. The stock market, on the other hand, experienced a strong rally, driven by unprecedented fiscal stimulus measures.

2021: In 2021, the US dollar weakened as investors grew optimistic about the economic recovery. This, coupled with strong corporate earnings, led to a surge in the stock market.

In conclusion, the US dollar and the stock market are interconnected and can influence each other in various ways. By understanding the factors that drive these two financial forces, investors can better navigate the complex financial landscape and make informed decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....