Are you an investor in India looking to expand your portfolio into the United States? Trading US stocks from India can be a lucrative opportunity, but it requires careful planning and understanding of the market. In this comprehensive guide, we'll explore the ins and outs of trading US stocks from India, including the best platforms, strategies, and risks to consider.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. The major exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq, list thousands of companies across various industries, from technology and healthcare to finance and consumer goods.

Best Platforms for Trading US Stocks from India

Several online platforms allow Indian investors to trade US stocks. Here are some of the most popular ones:

- E*TRADE: E*TRADE offers a user-friendly platform with low fees and a wide range of investment options. It also provides research tools and educational resources to help investors make informed decisions.

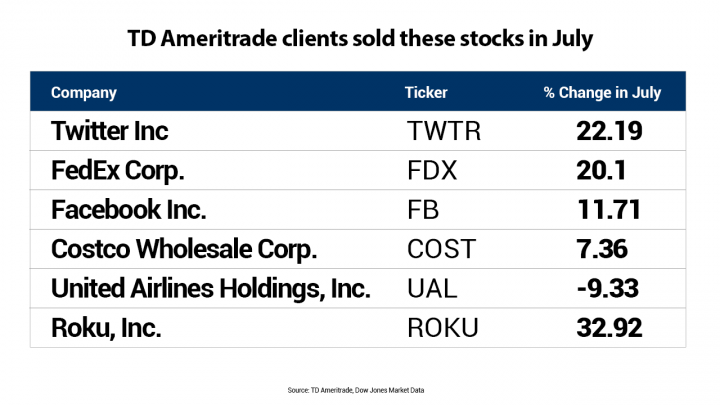

- TD Ameritrade: TD Ameritrade is another popular platform among Indian investors, offering advanced trading tools, research, and educational resources. It also offers a mobile app for convenient trading on the go.

- Fidelity: Fidelity is known for its extensive research and educational resources. It offers a range of investment options, including stocks, bonds, and ETFs, and provides a user-friendly platform with low fees.

Strategies for Trading US Stocks from India

When trading US stocks from India, it's important to have a clear strategy. Here are some common strategies to consider:

- Long-term investing: This involves buying stocks and holding them for the long term, allowing the investor to benefit from the company's growth and dividends.

- Short-term trading: This involves buying and selling stocks within a short period, aiming to profit from price fluctuations.

- Dividend investing: This involves investing in companies that pay regular dividends, providing a steady income stream.

Risks to Consider

While trading US stocks from India can be profitable, it also comes with risks. Here are some of the key risks to consider:

- Currency risk: The value of the Indian rupee can fluctuate against the US dollar, impacting the returns on investments.

- Market risk: The US stock market can be volatile, leading to significant price fluctuations.

- Regulatory risk: Different regulatory frameworks in India and the US can pose challenges for investors.

Case Study: Investing in US Tech Stocks from India

Let's consider a hypothetical scenario where an Indian investor decides to invest in US tech stocks. The investor selects a well-performing tech company, such as Apple Inc., and buys shares at

Conclusion

Trading US stocks from India can be a valuable investment opportunity, but it requires careful planning and understanding of the market. By choosing the right platform, developing a clear strategy, and being aware of the risks, Indian investors can successfully expand their portfolios into the US stock market.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....