In today's rapidly evolving financial landscape, understanding the current valuation of the US stock market is crucial for investors and market analysts alike. This article delves into the key factors influencing the current stock market valuation, offering insights into the trends and potential risks that may impact investors' decisions.

Market Overview

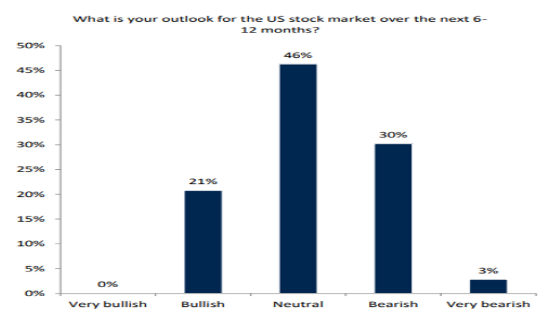

As of the latest data, the US stock market is standing at a significant juncture. With a mix of optimism and caution, investors are closely monitoring various indicators to gauge the market's true value. The S&P 500, a widely followed benchmark index, has been a focal point for many, reflecting the broader market sentiment.

Key Factors Influencing Stock Market Valuation

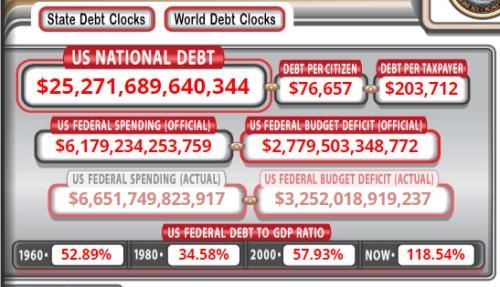

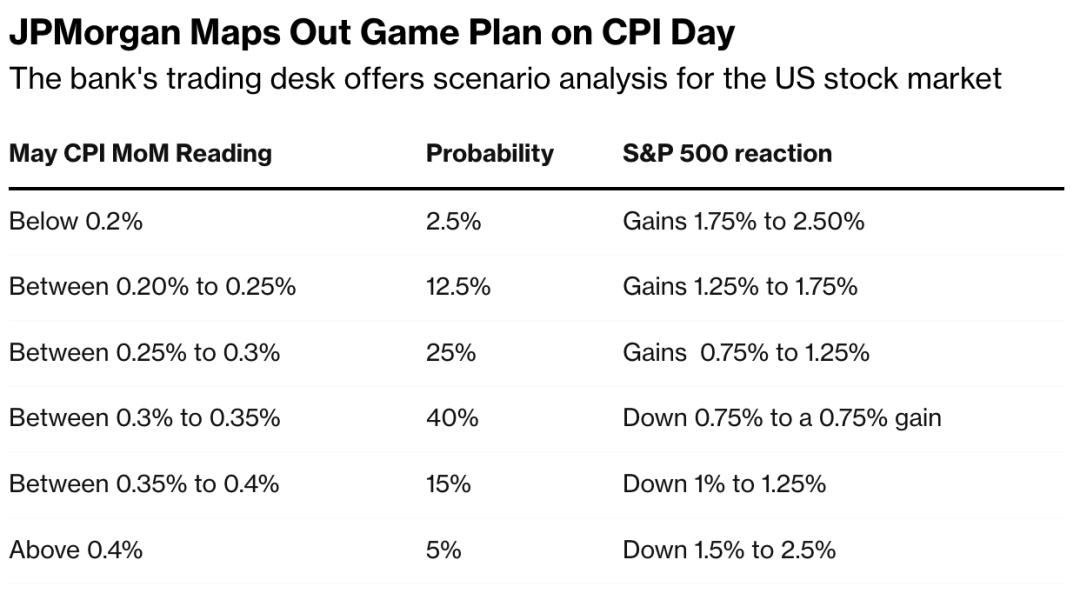

Economic Indicators: Economic data such as GDP growth, unemployment rates, and inflation play a pivotal role in determining stock market valuation. A strong economic backdrop often correlates with higher stock prices, while economic downturns can lead to a decline in market valuation.

Interest Rates: The Federal Reserve's monetary policy, particularly changes in interest rates, significantly impacts stock market valuation. Higher interest rates can lead to increased borrowing costs, affecting corporate earnings and, subsequently, stock prices.

Earnings Reports: Corporate earnings reports are a critical factor in stock market valuation. Strong earnings growth can drive stock prices higher, while disappointing results can lead to a correction.

Market Sentiment: Investor psychology and market sentiment have a profound impact on stock market valuation. Factors such as geopolitical tensions, election outcomes, and technological advancements can sway market sentiment.

Current Trends

Technology Sector: The technology sector, which includes giants like Apple, Microsoft, and Amazon, has been a major driver of stock market growth. However, concerns about valuations and regulatory scrutiny have led to some volatility in this sector.

Energy Sector: The energy sector has seen a resurgence, driven by increased oil prices and a global shift towards renewable energy sources. This trend has contributed to the overall market valuation.

Healthcare Sector: The healthcare sector has also been a significant contributor to the stock market's valuation,受益于人口 aging and advancements in medical technology.

Case Study: Tesla, Inc.

A prime example of stock market valuation dynamics is Tesla, Inc. The electric vehicle manufacturer has seen its stock price skyrocket over the past few years, driven by strong sales growth and investor optimism about the future of the electric vehicle market. However, concerns about valuations and potential competition have led to some volatility in Tesla's stock price.

Conclusion

The current US stock market valuation is influenced by a multitude of factors, ranging from economic indicators to market sentiment. As investors navigate this complex landscape, it's essential to stay informed and consider the risks associated with stock market investing. By understanding the key factors driving the market, investors can make more informed decisions and potentially capitalize on market opportunities.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....