Are you looking to invest in US stocks but reside in the UK? You're not alone. Many investors from the UK are interested in diversifying their portfolios by investing in the US stock market. With its robust economy and numerous opportunities, the US stock market offers a promising investment landscape. In this comprehensive guide, we will explore the process of investing in US stocks from the UK, including the benefits, steps, and potential risks involved.

Benefits of Investing in US Stocks from the UK

- Diversification: Investing in US stocks allows you to diversify your portfolio, reducing your exposure to the UK market's volatility.

- High-Growth Companies: The US stock market is home to many high-growth companies, offering significant potential for capital appreciation.

- Access to Global Opportunities: By investing in US stocks, you gain access to a wide range of industries and sectors, including technology, healthcare, and finance.

- Strong Regulatory Framework: The US has a well-established regulatory framework that ensures investor protection and market integrity.

Steps to Invest in US Stocks from the UK

- Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker that offers access to US stocks. Some popular options for UK investors include Interactive Brokers, TD Ameritrade, and Charles Schwab.

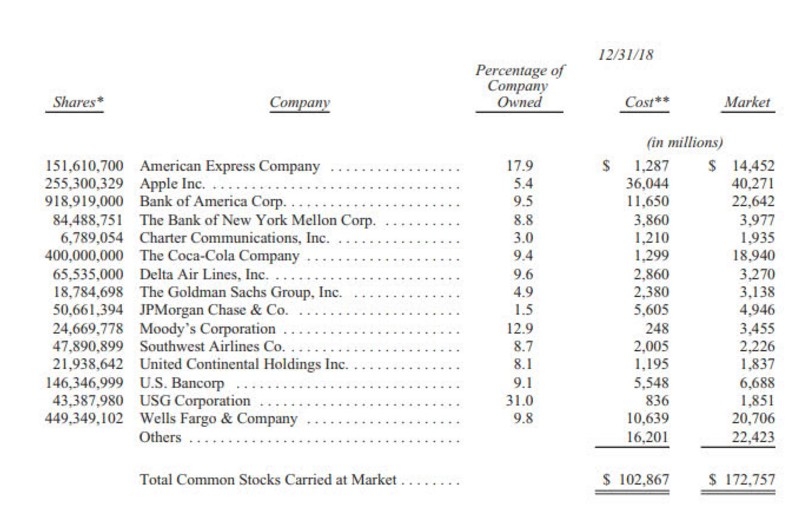

- Research and Select Stocks: Conduct thorough research to identify stocks that align with your investment goals and risk tolerance. Consider factors such as market capitalization, financial health, and growth prospects.

- Familiarize Yourself with the Process: Before placing your first trade, familiarize yourself with the trading process, including order types and execution methods.

- Fund Your Account: Transfer funds from your UK bank account to your brokerage account. Ensure that you have sufficient funds to cover your investment and potential transaction fees.

- Place Your Order: Once your account is funded, place your order to buy US stocks. You can choose to buy individual stocks or invest in a US stock index fund or ETF.

Potential Risks

- Currency Fluctuations: Exchange rate fluctuations can impact the value of your investments. If the GBP strengthens against the USD, your investment returns may be reduced.

- Regulatory Differences: Be aware of the differences in regulatory frameworks between the UK and the US. This may affect your investment decisions and tax obligations.

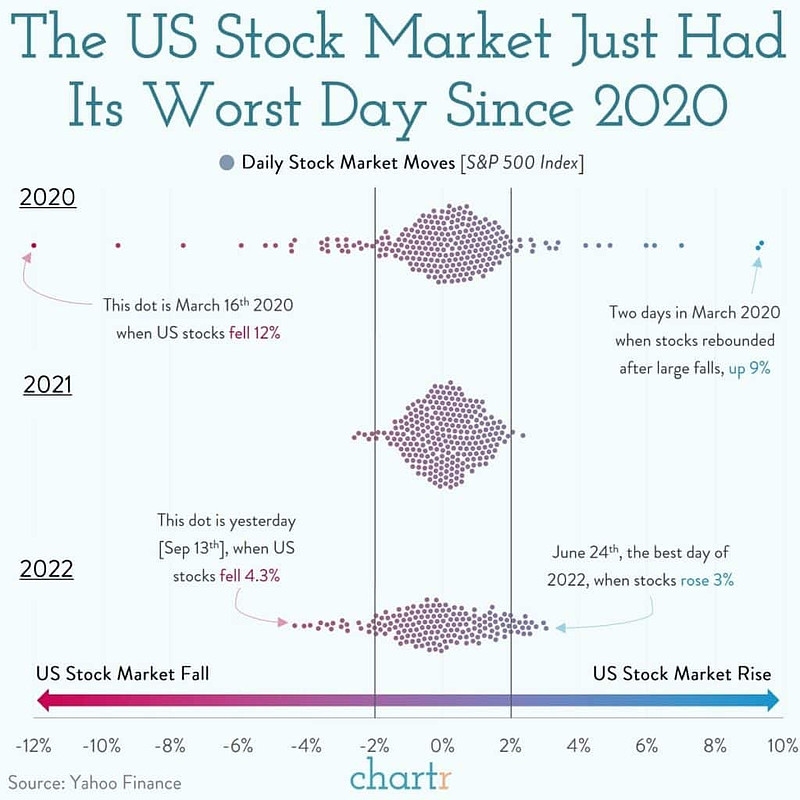

- Market Volatility: The US stock market can be volatile, and your investments may experience significant price fluctuations.

Case Study: Investing in Apple Inc. from the UK

Imagine you are an investor from the UK interested in investing in Apple Inc., a leading technology company. After conducting thorough research, you decide that Apple is a solid investment for your portfolio. You open a brokerage account with a US-based broker, fund your account, and place an order to buy Apple stock. Over time, as Apple's stock price appreciates, your investment grows, providing you with potential capital gains.

In conclusion, investing in US stocks from the UK can be a rewarding experience for investors seeking diversification and access to high-growth companies. By following the steps outlined in this guide and being aware of the potential risks, you can make informed investment decisions and achieve your financial goals.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....