The aviation industry has always been a significant player in the global economy, and the stock prices of major airlines have often mirrored the economic climate. In this article, we'll delve into the trends, predictions, and key influences affecting the stock prices of U.S. airlines. Whether you're an investor, a frequent flyer, or simply curious about the aviation industry, this analysis will provide valuable insights.

Trends in Us Airline Stock Prices

In recent years, the stock prices of U.S. airlines have seen a rollercoaster of ups and downs. One of the most notable trends has been the volatility in the stock prices of airlines following the COVID-19 pandemic. The pandemic caused a significant drop in passenger demand, leading to substantial financial losses for airlines worldwide. However, as the pandemic situation improved, stock prices began to recover.

One of the most notable trends has been the rise in the stock prices of major airlines such as American Airlines, Delta Air Lines, and United Airlines. This increase can be attributed to a combination of factors, including increased passenger demand, improved financial performance, and successful cost-cutting measures.

Predictions for Us Airline Stock Prices

Predicting stock prices is never an exact science, but there are several factors that analysts and investors consider when making predictions. One of the most important factors is the expected demand for air travel. As the global economy continues to recover from the pandemic, there is a general expectation that passenger demand will increase, leading to higher stock prices.

Another key factor is the airline industry's ability to manage costs and improve efficiency. Airlines that can effectively manage their costs and increase their profitability will likely see their stock prices rise. Additionally, the introduction of new technologies and innovations in the aviation industry could also drive stock prices higher.

Key Influences on Us Airline Stock Prices

Several key influences affect the stock prices of U.S. airlines. Here are some of the most important:

Economic Factors: Economic conditions, including GDP growth, inflation rates, and unemployment rates, can significantly impact airline stock prices.

Fuel Prices: Fuel is one of the airline industry's largest expenses. Therefore, fluctuations in fuel prices can have a significant impact on the profitability and stock prices of airlines.

Regulatory Changes: Changes in regulations, such as those affecting airline operations or passenger rights, can have a substantial impact on stock prices.

Competition: Increased competition from other airlines or new entrants into the market can negatively impact the profitability and stock prices of established airlines.

COVID-19 Pandemic: The ongoing impact of the pandemic, including new variants and vaccination rates, remains a significant influence on airline stock prices.

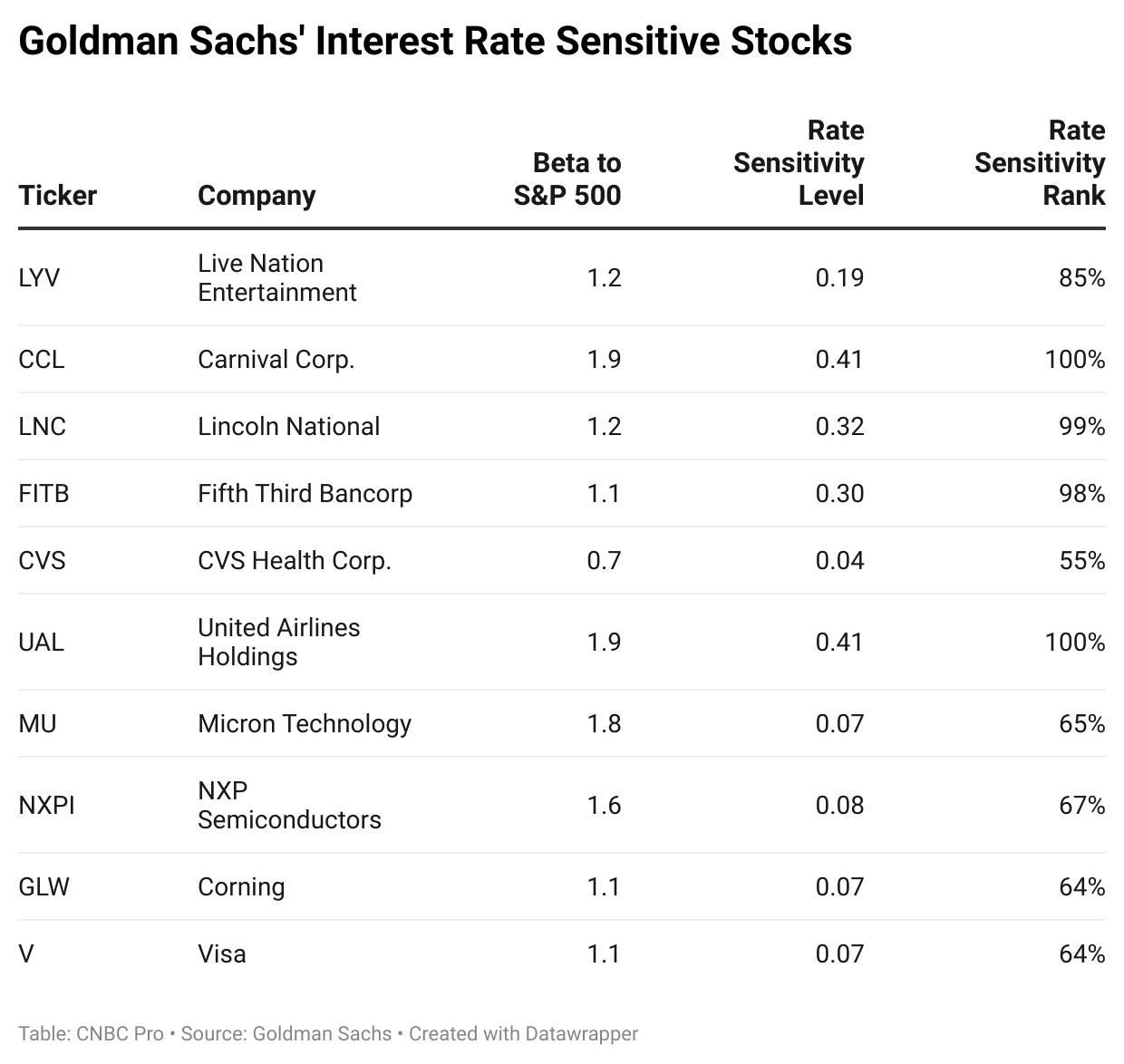

Case Study: United Airlines

One example of how these factors can affect stock prices is the case of United Airlines. Following the COVID-19 pandemic, United Airlines saw a significant drop in its stock price due to the decline in passenger demand. However, as the pandemic situation improved and passenger demand began to recover, United Airlines' stock price started to rise. This demonstrates how various factors can influence the stock prices of airlines.

In conclusion, the stock prices of U.S. airlines are influenced by a wide range of factors, including economic conditions, fuel prices, and competition. While predicting stock prices is never an exact science, understanding these key influences can help investors make informed decisions. As the aviation industry continues to evolve, staying informed about these factors will be crucial for both investors and frequent flyers.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....