In today's dynamic financial landscape, investors are constantly seeking innovative ways to diversify their portfolios. One such investment avenue is preferred stocks, particularly those of US banks. These stocks offer a unique blend of income generation and potential capital appreciation. In this comprehensive guide, we'll delve into the world of US banks preferred stocks, exploring their characteristics, benefits, and potential risks.

Understanding US Banks Preferred Stocks

Preferred stocks are a class of shares that combine features of both common and bond investments. They rank higher in the capital structure than common stocks but lower than bonds. This means that in the event of liquidation, preferred shareholders are entitled to receive payments before common shareholders but after bondholders.

Key Features of US Banks Preferred Stocks

Dividends: One of the primary attractions of preferred stocks is their fixed dividends. Unlike common stocks, where dividends can be variable, preferred stocks offer a consistent stream of income. This makes them an appealing investment for income-focused investors.

Seniority: As mentioned earlier, preferred stocks have a higher claim on assets compared to common stocks. This seniority provides a sense of security to investors, knowing that their investments are protected.

Liquidation Preference: In the event of liquidation, preferred shareholders have a preference over common shareholders for the distribution of assets. This means that they are more likely to recover their investment before common shareholders.

Benefits of Investing in US Banks Preferred Stocks

Income Generation: The fixed dividends offered by preferred stocks can be a significant source of income for investors. This can be particularly beneficial during periods of low interest rates, where other income-generating investments may not be as attractive.

Potential Capital Appreciation: While preferred stocks are known for their income-generating capabilities, they can also appreciate in value over time. This is especially true for bank preferred stocks, which often trade at a premium when the underlying bank is performing well.

Dividend Yields: The dividend yield of preferred stocks can be significantly higher than those of common stocks. This makes them an attractive investment for investors seeking high dividend yields.

Risks of Investing in US Banks Preferred Stocks

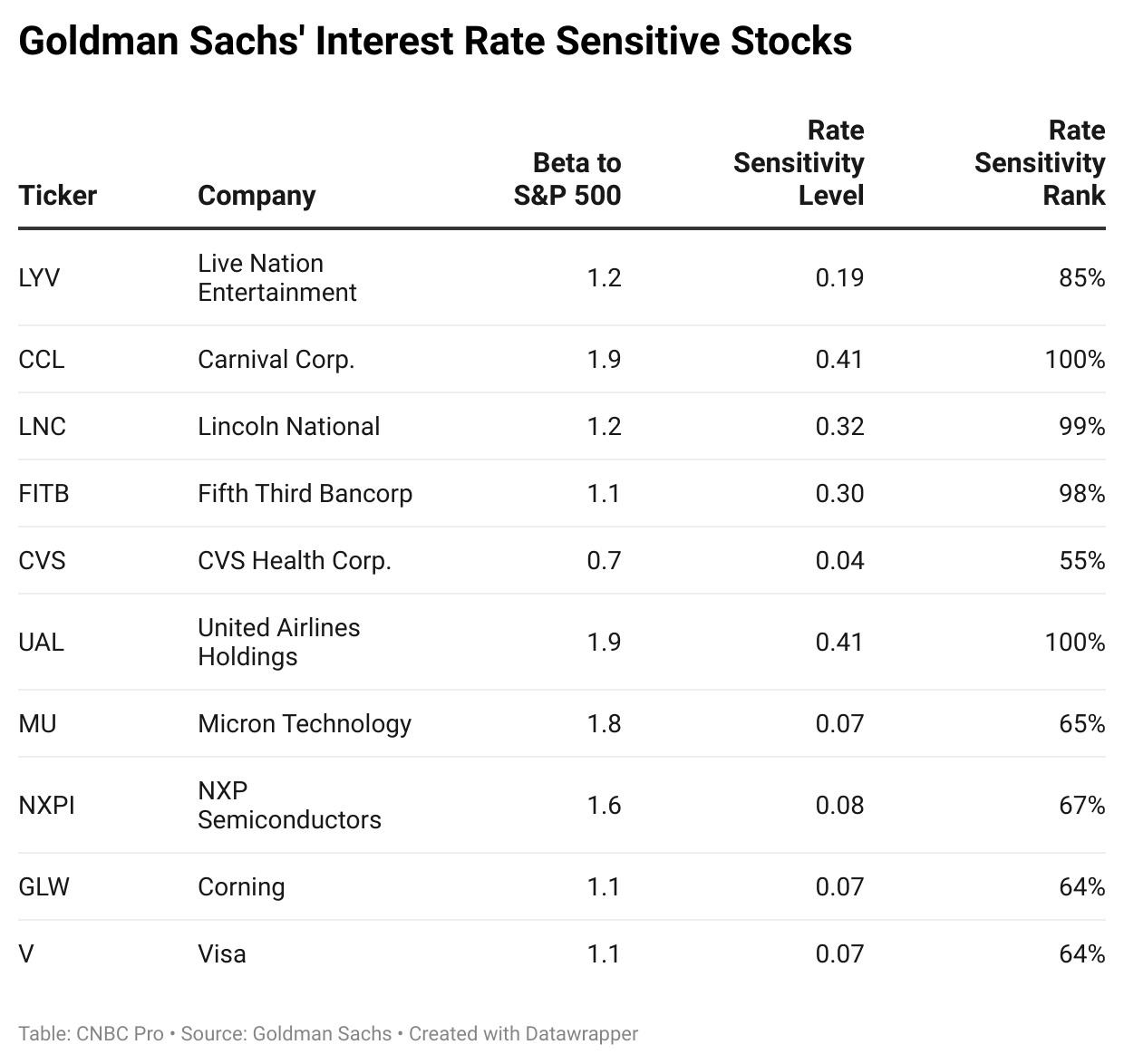

Interest Rate Risk: Preferred stocks are sensitive to changes in interest rates. If interest rates rise, the value of preferred stocks, including those of banks, may decline.

Market Risk: Like all stocks, preferred stocks are subject to market volatility. This means that their value can fluctuate significantly based on market conditions.

Bank-Specific Risks: The performance of a bank's preferred stocks is closely tied to the bank's financial health. Therefore, investors need to conduct thorough research before investing in bank preferred stocks.

Case Study: Bank of America Preferred Stocks

Consider Bank of America's Series A preferred stock (BAC.PA). This stock offers a fixed dividend yield of 6.5% and has a market capitalization of approximately $6 billion. Over the past year, the stock has seen a price increase of 15%, highlighting the potential for capital appreciation.

In conclusion, US banks preferred stocks present a unique opportunity for investors seeking a balance between income generation and potential capital appreciation. While they come with their own set of risks, the potential benefits make them a compelling investment option for many.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....